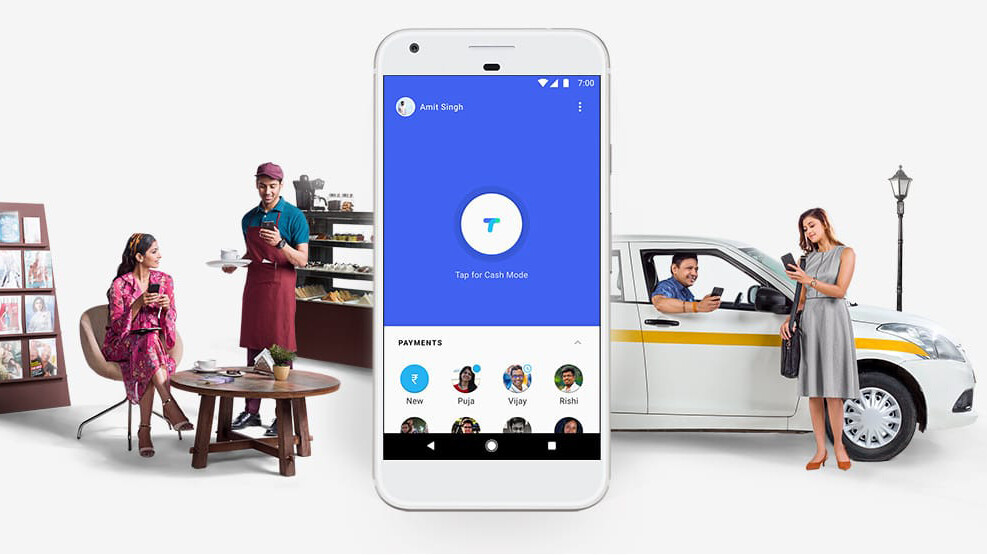

Following reports from last week, Google has launched Tez, a payments app designed for Android and iOS users in India to send money to each other, as well as pay for purchases at businesses that allow digital transactions.

The app (whose name translates from Hindi to ‘fast’) is built on top of the country’s inter-bank Unified Payments Interface (UPI), which allows for instant money transfers at no charge.

Your UPI ID (which looks like ‘yourname@bankname’, but can be edited) is automatically generated if you don’t have one already, and is linked to your bank accounts and phone number. You can send someone money simply by entering their UPI ID, or selecting their phone number from your contacts list if they’re also using Tez.

There’s also an interesting ‘Cash Mode’ feature that lets you pay and receive money with people near you, simply by using audio. Both users will need to have the Tez app installed – but they won’t need to share numbers or bank account details with other to make it happen.

In addition to protecting privacy, this might also be Google’s attempt at simplifying payments for people who are using smartphones for the first time in their lives, and may not entirely comfortable finding and filling out payment details. Tez also supports numerous Indian languages

You can also pay for purchases and services by scanning a business’ QR code. If a business has an online presence, they can also sign up to the Tez commercial program, where they’ll get a channel with which they can communicate with customers on the app via text messages, and allow for streamlined payments.

As with other UPI-based apps, Tez lets you transfer upto Rs. 100,000 ($1,560) and make up to 20 transactions per day.

At launch, we noted a couple of issues with Tez: it requires you to use a Google account and doesn’t support G Suite accounts. We also weren’t able to calibrate the audio setup, which uses your phone’s mic. It isn’t yet clear if that drastically affects the Cash Mode transaction system; we’ll update this post with more information soon.

So what’s the game plan for Google here? While UPI transactions are free, the company might look to earn revenue by charging businesses for additional functionality, such as promoting offers through the aforementioned channels system in the app. It’s already roped in the likes of Dominos, PVR Cinemas, RedBus, and Jet Airways to support its service.

Presently, Tez doesn’t compete directly with digital wallets like those offered by Paytm and Mobikwik, as it only works with your bank accounts.

With that, Google is getting in on the fast-growing digital payments space in India. The company estimates that digital payments in the country will hit $500 billion by 2020; India is a massive market with hundreds of millions of people set to adopt mobile devices and this new wave of digital services over the next few years, so it’s no surprise that Google wants in on the ground floor.

If you’re in India, you can try Tez right now by grabbing the app for Android or iOS.

Get the TNW newsletter

Get the most important tech news in your inbox each week.