Andrej Kiska is an Associate at Credo Ventures.

In the past five years, seed-stage investing has experienced a boom. In North America, seed funds now represent 67 percent of all VC funds, up from 33 percent in 2008.

The CEE region is no different: according to European Private Equity and Venture Capital Association, the number of seed deals has increased 19x over the past four years. Even considering the fact that EVCA’s data is not fully comprehensive, since many investments are not announced at all or are not made by EVCA’s members, it still illustrates my point.

Hand-in-hand with the rise in seed funding naturally comes an increasing number of issued term sheets to all sorts of startups in the earliest stages. Most of these, especially in the CEE, are issued to first-time founders who might not have seen a term sheet before.

If you’re interested in learning more, here’s my term sheet guide to help founders in Europe navigate the funding process.

What is a term sheet?

A term sheet is a non-binding summary of key terms of the proposed transaction. There are typically just two binding provisions: exclusivity and confidentiality.

Confidentiality limits the amount of information an entrepreneur can share with anyone besides the investors who have proposed the term sheet. Basically, once you sign a term sheet, you should not discuss the terms with anyone who has not signed it.

While this clause only becomes valid after the term sheet has been signed (just like exclusivity), it is important to treat the information sensitively even before a term sheet is signed. You will not make your potential investor too happy if you forward his term sheet to other investors to solicit a better offer.

Exclusivity prevents the entrepreneur from negotiating with other investors for some finite period of time. The goal of the exclusivity provision, similarly to confidentiality, is to ensure that the entrepreneur doesn’t use the signed term sheet as a negotiation tool to attract more investors/better terms.

If the transaction does not occur within the specified time frame, the entrepreneur can resume negotiations with other investors.

Why focusing too much on valuation can damage your startup

Valuation is quite important. At the same time, I would argue that many entrepreneurs (especially the first-timers) overemphasize its importance, which entails quite a few risks.

First, you might not get a deal done with the fund you prefer. Sticking with a fund that provides the best valuation can have short-term gains but can cost you in the long run.

A fund that competes only on valuation is indirectly saying that such a fund can’t add much value. Choosing the right partner whom you trust can really boost your startup; even if it means a cut to today’s valuation, it can result in a much more valuable startup later on. I have seen too many startups get killed because they chose the wrong investor.

Second, a high seed valuation sets a high hurdle for subsequent rounds as well. Say you want to raise your seed round at EUR 3 MM valuation, and you expect that valuation to triple or quadruple by Series A to make it an attractive proposition for your investors. Do you know how many companies raised a Series A at EUR 10 MM valuations or higher in the CEE? A handful.

Would you not prefer to raise your Series A at EUR 5 MM, if you were much more likely to raise such a round? The numbers I’ve used are just for illustration, even though I do strongly believe that you are much more likely to raise cash in subsequent rounds (i.e. once you achieve your product/market fit) if you don’t push too hard on valuation in the earlier stages.

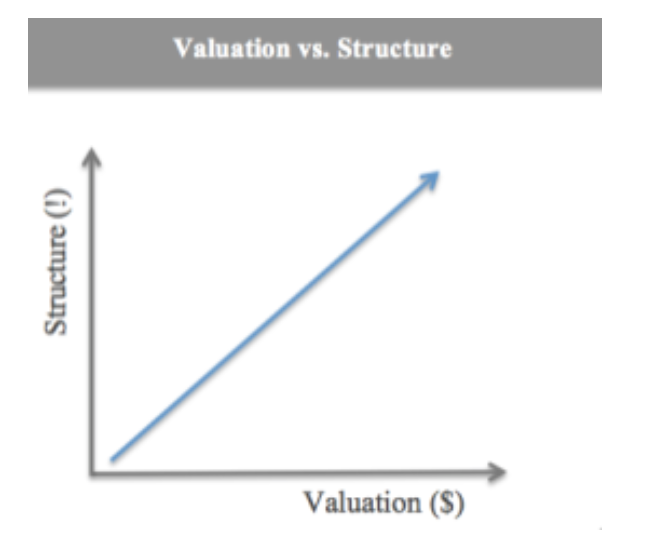

The third and the most important point I want to mention is the structure: the more you focus on valuation, the more incentivized the investor is to include other harsher terms in the term sheet in order to protect its downside. I have borrowed this simple diagram from Jamie McGurk to illustrate the point.

Next: Part 2: What’s a convertible loan?

It is important to distinguish between the two most common methods of investing: convertible loans and equity investments.

In an equity investment, an investor receives a stake in the company in exchange for cash. Plain and simple. If the investor provides a convertible loan instead, he will provide a loan with a maturity date, interest and a special twist: the right to convert the loan into an equity stake in the company at some point in the future.

Convertible loans are, in general, less common. Nonetheless, it typically contains just a few terms that can help you through the funding process.

Definition of a convertible loan

Convertible loan is short-term debt that converts into equity. Usually it converts at the next investment round. Example: if you receive your seed investment in a form of convertible loan, it will convert to equity when you raise your Series A investment.

The advantage from the perspective of an entrepreneur is that a convertible loan before its conversion behaves very much like a standard loan: the investor typically does not have many of the rights of a preferential shareholder (board seats, liquidation preferences, etc.).

Since it is a fairly short and simple document, it also gets executed faster (that’s why convertible loan investment can be processed faster than an equity investment, typically by a couple of weeks). Additionally, a standard convertible loan does not require an immediate payment of interest. Instead, it gets accrued and converted to equity, as explained below.

The disadvantage also comes from the very nature of the loan: until the loan gets converted to equity, the investor has a priority right at maturity date to claim any assets (i.e. cash and hardware for most startups) in order to get the loan and interest repaid.

Needless to say, most startups don’t have enough cash to repay the loan at maturity and thus are forced to liquidate all assets and close down the business.

Why and when to use a convertible loan

There are a couple of scenarios when a convertible loan can be used. First, it may serve as a source of “bridge financing” before an anticipated large financing round.

Say you raised a EUR 200,000 seed round and are now in the process of raising EUR 2 MM Series A, but still need a few more months to complete the round. So you take a EUR 100,000 convertible loan as an extra cushion for the fundraising process.

Since convertible loans are faster to execute from a legal perspective, the whole transaction can get processed in a matter of few weeks.

Bridge financing can be tricky, though: if investors are not 100 percent convinced that things are going well, asking for a quick convertible loan may give rise to major concerns regarding performance and outlook (i.e. the question: why would you need more cash in order to fundraise?). Losing existing investors’ confidence is a very bad way to start the fundraising process.

Second, the convertible loan is used at times when investors and entrepreneurs can’t agree on valuation, especially when they define a conversion discount but not necessarily the valuation cap (explained below). I am not a big fan of this use case: instead of facing a major issue straightaway, both parties decide to shift its resolution to some later point in time.

Such a strategy can very easily backfire, creating nasty arguments between investors and entrepreneurs, which can block further fundraising and thus kill a startup.

Convertible loans are also increasingly being used at the seed stage. There is plenty of criticism against this practice from VCs, especially if the notes are overused and include harsh terms. I recommend reading this piece by Mark Suster on the topic.

Terms you can find in a convertible loan

Maturity date: This is the time by which the loan matures.

First thing to understand: the investor can require the repayment of the loan at the maturity date. This is used to protect his downside: if the startup is not doing well, the investor can still recoup his investment and interest at the loan’s maturity date (and kill the startup if it doesn’t have enough money to repay the loan).

Interest rate: The interest the startup shall pay on the loan. It is typically a PIK (payment in kind) interest, i.e. startup doesn’t actually pay the cash. Instead, interest gets accrued to the principal of the loan. In such case the accumulated interest gets converted into equity together with the principal of the loan.

Example: if you raise a EUR 100,000 convertible loan with an 8 percent interest that gets converted into equity in 12 months, the actual amount that gets converted is EUR 108,000. The most common rates we have seen hover between 6 to 8 percent.

Conversion: An important clause that describes the conditions under which the loan is converted to equity. The most typical mandatory conversion scenario is upon “qualifying financing”: once a startup raises more than EUR XX (i.e. raises a “qualifying financing” round), the loan under gets automatically converted into equity.

The most investor-friendly alternative for conversion is at any time the investor chooses, but this scenario is very rare if the startup has raised additional capital. Typically, if the startup doesn’t raise any new capital before maturity date, the investor has a right to decide whether he wants to convert or not.

Qualifying financing: The minimum amount a startup has to raise in the next financing round in order for the convertible loan to be automatically converted to equity. The amount varies widely depending on whether the startup is raising seed, Series A or more later-stage capital.

Conversion discount: The investor typically converts his loan to equity with a conversion discount in valuation compared to new investors to compensate him for the additional risk of having entered the startup earlier than the new investors.

Example: Say new investors are entering the startup at EUR 5,000,000 valuation. If the note has a 20 percentvaluation discount, the holder of such a loan can convert the entire amount of the loan (and interest as explained above) to equity at 5,000,000 * 80 percent = EUR 4,000,000. A standard discount we typically see on a convertible loan is between 10 to 30 percent, with 20 percent being the most common.

Valuation cap: In addition to a conversion discount, investor can also set a valuation cap, i.e. the maximum valuation at which the loan will convert.

Let’s use the example above, but say that the terms also included a valuation cap of EUR 3,500,000. Without the cap, the investor would convert at EUR 4,000,000 valuation, but with the cap, the investor can convert at EUR 3,500,000.

These are the most common terms an entrepreneur can find in a convertible loan, at least based on what we at Credo Ventures have experienced.

Nevertheless, we tend to prefer equity rounds: rather than hiding/avoiding terms or valuations, we agree on the whole structure at the beginning so we can focus on what is important: creating value for the startup. More on how we set the structure and how we think a fair equity round term sheet should look in the next post.

Read next: Stock up: How to structure employee equity in Europe

Get the TNW newsletter

Get the most important tech news in your inbox each week.