You and I probably don’t see eye to eye on everything. You may not agree with my taste in music, or my politics, or my positions on the Oxford comma and tucking in of collared shirts (pro, and only when worn with a tie). But regardless of your race, creed, religion, or stance on the iPad, my guess is we can agree on one fundamental axiom of modern life: banking sucks. Simple is poised to change that.

Yes, banking sucks. And not just a little. Banking sucks a lot. What’s worse, when it sucks, not only does it drive you insane, it costs you money. Lots of money.

An overdraft at my current bank, PNC, costs upwards of $30. Earlier this week, the bank settled a class-action lawsuit for $90M after customers accused it of reordering transactions from largest to smallest in order to increase overdraft fees. In essence, they would use the large charges to make the balance fall to zero as quickly as possible, then hammer the account with the small charges to rack up overdraft fees. I personally had my account decimated by these charges in the past, with sub-$1 transactions costing me a hundred times their value in fees. And to add insult to injury, some services, like Paypal, will repeatedly ping your account with new transactions when the previous ones are rejected, each resulting in a new fee. [A representative from PNC declined to comment for this article, saying only that the bank does not discuss individual customer accounts.]

When I spoke with the manager at the Grand Central PNC branch last year about the bank’s abusive fees and seeming inability to block fraudulent charges from hitting my account — even after being notified multiple times — he was apologetic but unable to offer much help. When I told him about my hope to eventually move my money to Simple, and the company’s stated goal of removing abusive fees, he chuckled and told me he had never heard of it.

My problems with PNC were legion. The bank’s phone support was a nightmare, with long hold times and reps often giving incorrect information. Despite repeated attempts, I was unable to get them to change my address when I moved to New York until a month ago. And while the branch staff was courteous and tried their best to help out, they were often unable to solve even seemingly basic problems, like blocking the aforementioned fraudulent transactions.

The bank’s website and app were, predictably, atrocious. Depositing checks through the app seemed promising until I learned there was a limit of $1000 per day, $3000 per month, which rendered it mostly useless for me. And the website’s user experience, while not a complete train wreck, is far from ideal.

Simple (formerly known as BankSimple) is working to change the way banks interact with their customers. I signed up for the beta list shortly after Alex Payne, Twitter’s former API lead, left the company to help start Simple in May 2010 [Payne announced this week he had left the company]. I received my invitation a little less than two weeks ago, and was fortunate enough to chat briefly with Josh Reich, Simple’s CEO, about the intricacies of setting up a financial company, as well as Simple’s upcoming plans.

Josh Reich, CEO of Simple.

The renaming of Simple from BankSimple is subtle but important; as the company stated in a blog post about the name change, “Simple replaces your bank, but we are not a bank.” The company is a front-end built on top of a FDIC-insured partner bank: The Bancorp Bank.

This distinction is important because as the company quickly found out, opening a bank, or even just a front-end to other banks, is not a process that works on Internet time. The company had difficulties finding a partner at first, and has been in private beta since late November of last year. According to Reich, “We entertained the thought of [opening a bank]. We spoke to a few different people who at the time were trying to buy a bank. And from our perspective we wanted to solve the user experience problem.”

Reich emphasized that the lack of a balance sheet, and the corresponding business models that encourage nickel-and-dime fees, is Simple’s greatest strength. “We don’t have a balance sheet right now,” he said, adding that this frees up the company to focus on more pressing matters, like mobile banking. “Even if we were the best balance sheet managers, that wouldn’t fundamentally solve the user experience problem.”

The iPhone app launched in May, but invitations had been trickling out until this week, when the company opened the floodgates.

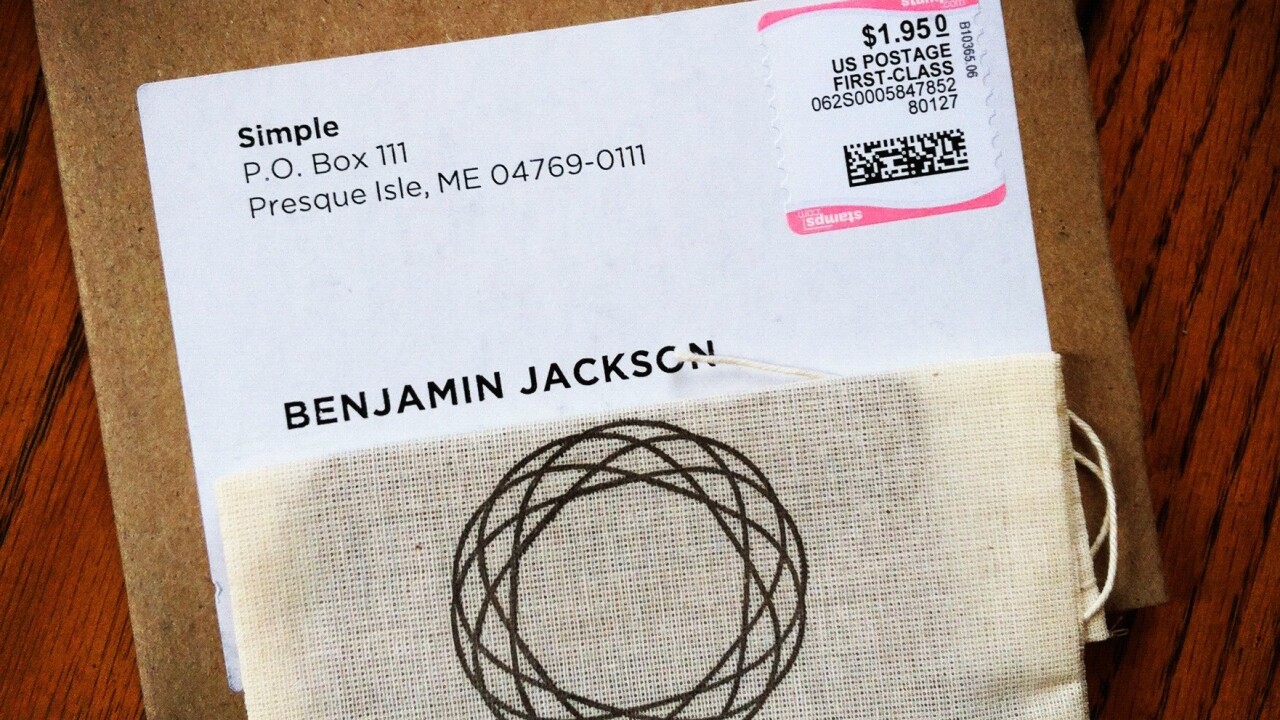

The card came in about a week, and I’ve been using it exclusively for personal expenses for most of this week. Unfortunately, small business accounts are not yet available. It’s also worth noting that signup is not open to everyone yet, even if you do get an invitation; one friend of a friend who is not a U.S. citizen — though authorized to work here — had his application rejected.

The card came in about a week, and I’ve been using it exclusively for personal expenses for most of this week. Unfortunately, small business accounts are not yet available. It’s also worth noting that signup is not open to everyone yet, even if you do get an invitation; one friend of a friend who is not a U.S. citizen — though authorized to work here — had his application rejected.

Reich assured me that opening up Simple to small businesses is one of the company’s top priorities. “A bunch of people have been asking for it… The big difference from a compliance perspective is that you want a small business account to be titled in the name of the business. And so the difference is that when you sign up we want the sign up process to be as quick as possible. And during that process we go out and check that you are who you say you are… Getting that exact same process done for small businesses is a little trickier.” The company is still looking for a partner with less than a 24-hour turnaround for business verification.

The most striking thing about banking with Simple at first is the refreshingly minimal design. My PNC debit card is a flaming, orange and white monstrosity, made illegible with a watermark of the logo overlapping the numbers, complete with a poorly-printed drop shadow and an equally cluttered verso. My Simple card is white, with the company’s name and logo in one corner and the Visa logo in the opposite one. More than once while paying with the debit card it’s gotten remarks from cashiers and bartenders; amazingly (at least in a post-iPod era), no other bank seems to have done a plain white card before. Unsurprisingly, the card has elicited moans of envy when used in the company of my more tech-savvy peers, and to be honest using it right now kind of feels like whipping out a business card set in Silian Rail.

The comparison to Apple above is no accident. In fact, after using the service for a few days, I found myself struck by not only Simple’s aesthetic similarities to Apple, but also its philosophical ones.

The name says it all. The company’s drive for simplicity permeates everything from the packaging that the card is shipped in, to the massive “Call Customer Service” button in the app, all the way to its promise to never punish its customers with hidden fees; yes, the overdraft fees that decimated my PNC account a few years back are gone. Kaput. Same goes for ATM fees at Allpoint ATMs (Allpoint is the largest network in the country with over 43,000 ATMs), though unlike some other online banks the fees the machines charge on top are not reimbursable. Allpoint ATMs can be found through the iPhone app, but remember: different networks use the same ATM models, so an identical ATM might charge you a fee somewhere else. Somewhat predictably, Simple is not putting an end to all fees; still, the fees schedule is comparably short. At the same time, some of the items on that list, like the $5 per month “inactivity fee”, struck me as odd even if they weren’t downright shameless.

When I asked about the international balance check and withdrawal fees, Reich told me that the inactivity fee was being removed from their fee schedule, and explained: “Our stated mission is that we don’t profit from fees. We get charged by the card network and we just pass that around. We don’t have enough leverage to change Visa and Mastercard fees.” In addition, he added, “We plan on revising a lot of them. Our customer relations team has a lot of discretion, and [referring to the inactivity fee] so far we haven’t charged any fees of that sort.” One area of particular leniency is the $2 card reissue fee; Reich confessed, “Every now and then someone posts a photo with a card number.”

He also noted that on some Allpoint ATMs, older versions of the software may incorrectly report a fee, or even actually charge one. If this happens, he urged, “call us and we’ll fix it.” When asked why all ATM fees are not reimbursed even though some competitors offer full reimbursements, he countered, “If you look at the accounts which do reimburse, they usually make that up elsewhere. Because we’re not profiting from fees, we don’t have the money to reimburse it.”

The account is an interest-bearing checking account known as a Negotiable Order of Withdrawal account. Think of it as a savings account with all of the benefits of a checking account. Before you get excited, however, be warned that the interest is a pittance: the current rate is 0.01% annual percentage yield.

Even the copywriting reminds me a bit of a younger, slightly more flippant Apple. Here’s one gem from the Policies & Agreements page: “Just in case you didn’t read the legal documents closely when you applied for a Simple account, here you go. You should. It’s important stuff.”

Much like Apple did with the iPhone and iPad, Simple is working on getting the basics right and making some hard choices (like the aforementioned international restriction) up front. Consider the release schedule. The company has been in private beta for eight months, and the iPhone app is currently at version 1.3.3. The bank does not yet support outgoing transfers, small business accounts, or any deposits other than incoming transfers (though Dwolla, Paypal, and Square are available as backup options). Luckily, direct deposit is available. Simple is taking it slowly, learning from their customers, and not releasing anything until it’s ready. And from what I can tell, for the vast majority of people currently using a checking account, it’s ready.

Signup was painless, as was transferring money from my current bank. One nice touch in the signup process: when prompting you for a password, rather than requiring an obnoxious format (e.g. P@ssw0rd), they ask for a short phrase, which is infinitely more difficult to crack. The card works like any other debit card, and transactions appear in the app quickly (not within minutes, but not more than an hour or two). This helps if you’re trying to keep tabs on how much you spend and when.

The Simple iPhone app is extremely bare-bones, but functional. I had one crash after adding a contact from the address book, but otherwise have had no complaints other than a small visual quirk with the search bar in the Activity tab. The app allows you to set a passcode, which is required for use whenever you open the app or launch it from the background.

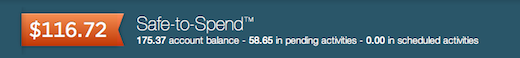

One of Simple’s most touted features was the Safe-to-Spend feature. In theory, it’s not that different from the “available” balance on your bank’s website, though it takes into account scheduled transactions. Soon, however, the company will launch Goals, a feature that allows users to mark a certain amount of money for saving each month which is reflected in the Safe-to-Spend balance. Reich says Goals will launch “in the next six weeks. It’s been available to staff and a small group of beta testers for a couple of months now.”

Transactions can be tagged as in Quickbooks or Mint, but unlike those services Simple can (optionally) map those transactions for you. The mapping was useful but imperfect; some locations had their addresses cut off, confusing me to no end, and others had corporate addresses that were far from the places I swiped the card. Transaction search is done locally rather than on the server, and while I imagine they can fit quite a few transactions in the local database, I wonder how this will hold up over time, especially for frequent spenders.

Transactions can be tagged as in Quickbooks or Mint, but unlike those services Simple can (optionally) map those transactions for you. The mapping was useful but imperfect; some locations had their addresses cut off, confusing me to no end, and others had corporate addresses that were far from the places I swiped the card. Transaction search is done locally rather than on the server, and while I imagine they can fit quite a few transactions in the local database, I wonder how this will hold up over time, especially for frequent spenders.

Where Simple really shined for me, however, is with the ability to pay anyone directly from the app or site. Add a contact, and you’re two taps away from typing in the amount and sending a check by mail. While I can’t wait until this expands to include bank transfers, I can sit tight with Venmo for now. Hopefully I’ll be able use it to pay what few recurring bills I have that still require physical checks (I’m looking at you, Empire Blue).

The web site, while equally well designed, doesn’t do much that the app doesn’t do, so I don’t see myself using it much. Still, it has one killer feature that I may end up using once I have more data in Simple: users can export their transactions as JSON or as a CSV. While Mint generally does the trick, I might someday want to dig deeper into the data myself. And of course, it’s incredibly reassuring to know that I can take my personal finance data with me if I choose to leave.

Who will benefit from Simple? At this point, if you have a checking account, get paid mostly via incoming wires or direct deposit, and are a U.S. citizen, it’s worth signing up. I plan on using Simple for all of my personal banking for the time being, and for the first time in my life I can say not only that I feel good about my bank’s mission, but that I actually enjoy using it.

The company has plenty of plans for improvements to the app and service as well. In-app check deposits will be coming soon, with “the highest deposit limit available now”, according to Reich. They’ll also be doing peer-to-peer payments, much like Venmo or Dwolla, between Simple account holders.

At the end of our conversation, Reich asked me what I thought of the app. I told him my candid opinion, and mentioned the incredulous look I got from the branch manager at my bank when I told him about Simple. His response? Speaking to me over the phone from the top of a hill moments after completing a three-hour hike, he quipped in a wry Australian accent, “You should have seen the look on my branch manager’s face when I told him about it.”

Get the TNW newsletter

Get the most important tech news in your inbox each week.