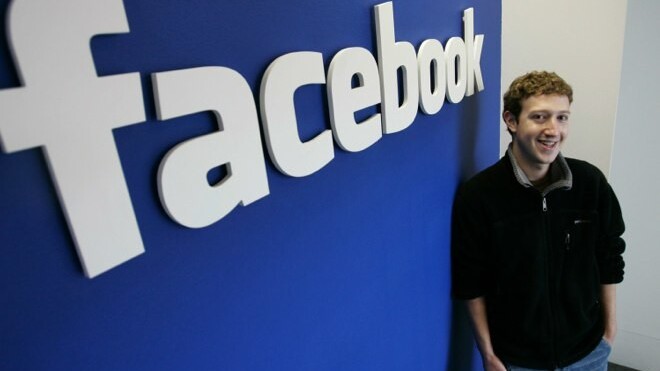

It’s well known that Facebook has more than 800 million users — which would make it the world’s second largest country — but less is known about its financial figures, until now perhaps.

Gawker has published a list of insightful, and quite frankly outrageous, statistics which it was passed by “a source with knowledge of Facebook’s finances”.

The data shows that this year, between January and September, the social network saw its revenue hit $2.5 billion, of which a very healthy $714 million is net income. With still three months to add to the figures, it looks possible that it could pass $1 billion in net by the end of 2011.

Other data reveals that the company has no debt whatsoever, and its assets are valued at a whopping $5.6 billion.

Here is the full list of figures:

Facebook By The Numbers, Jan. 2011 – Sept. 2011

Assets: $5.6 billion

Cash/cash equivalents: $3.5 billion

Debt: $0

Shareholder equity: $4.5 billionOperating cashflow: $1 billion

Revenue: $2.5 billion

Operating income: $1.2 billion

Net income: $714 million

Additionally, the source revealed details of the company’s ownership and stakeholders, which are as follows:

Employees 30%, Mark Zuckerberg 24%, Digital Sky Technologies 10%, Accel Partners 8% (had 10% but sold 2%), Dustin Moskowitz 6%, Eduardo Saverin 5%, Sean Parker 4%, Goldman Sachs clients 3%, Microsoft 1.3%, Peter Thiel and/or Clarium Capital 3%, Greylock Partners 1.4%, Meritech Capital Partners 1.6%, Chris Hughes 1 %, Li Ka-shing 0.75%, Interpublic Group 0.5%, Goldman Sachs 0.8%.

It’s clear that Facebook has a cash pile war chest with which it likely to continue to acquire promising companies, technologies and talent — as it recently did when it bought Gowalla — to keep its service relevant and at the forefront of technology.

Facebook’s success is all the more remarkable when you consider how it places amongst the top ten cash rich tech firms on the planet. While it doesn’t yet have the cash hoards of those giants, the fact that is is set to crown the year with $1 billion in net income, means this 7 year old will soon be eding close to gatecrashing the tech establishment’s table.

An IPO is long-rumoured and on the cards for next year, and Gawker’s insider confirms figures that have been bound around for the last few months:

Our source echoed prior reports that Facebook is considering raising $10 billion at a $100 billion valuation in an initial public offering. That IPO is widely expected to come at some point next year.

Despite all the grief and bitching many people give it, Facebook is a rare example of a company that backed high user numbers with equally impressive financial stats. It has made the social networking space its owning, killing off a number of heavy hitting rivals (in their day), like MySpace, Friendster, and preventing countless other companies that we never heard about get anywhere close to being successful.

A spin-off from Facebook’s swashing buckling financial success, and likely IPO, will be a flood of newly-minted Facebookers whose company equity will become piles of cash which could be invested back into the industry or ploughed into new ventures.

The potential creation of, what Reuters estimates could be,”at least a thousand [new] millionaires” isn’t being heralded by everyone, The Next Web‘s own Alex Wilhelm calls it ‘dumb money’, but, as they say, a kilo of feathers weighs the same as a kilo of bricks.

Update: we reached out to Facebook, but the company has declined to comment on the report.

Get the TNW newsletter

Get the most important tech news in your inbox each week.