Markets reacted positively to Disney’s newly-found laser focus on streaming, pushing the company’s stock price up nearly 5%.

Disney announced a restructure of its media and entertainment arms in a Monday press release. The move centralizes those businesses into one entity that will oversee all distribution and monetization of Disney content, including its streaming platform Disney+. This will mean a significant boost in funding for original content.

Disney’s pivot comes at the tail end of a tough year for the entertainment giant. Rolling COVID lockdowns in March obliterated its Parks, Experiences, and Products department, forcing the company to report a profit loss of 91% in 2020’s first quarter, and a $4.72 billion net loss the following quarter.

By August, park closures and canceled cruises meant a $3.5 billion hit for Disney’s parks and experiences wing.

Disney stock struggled before COVID

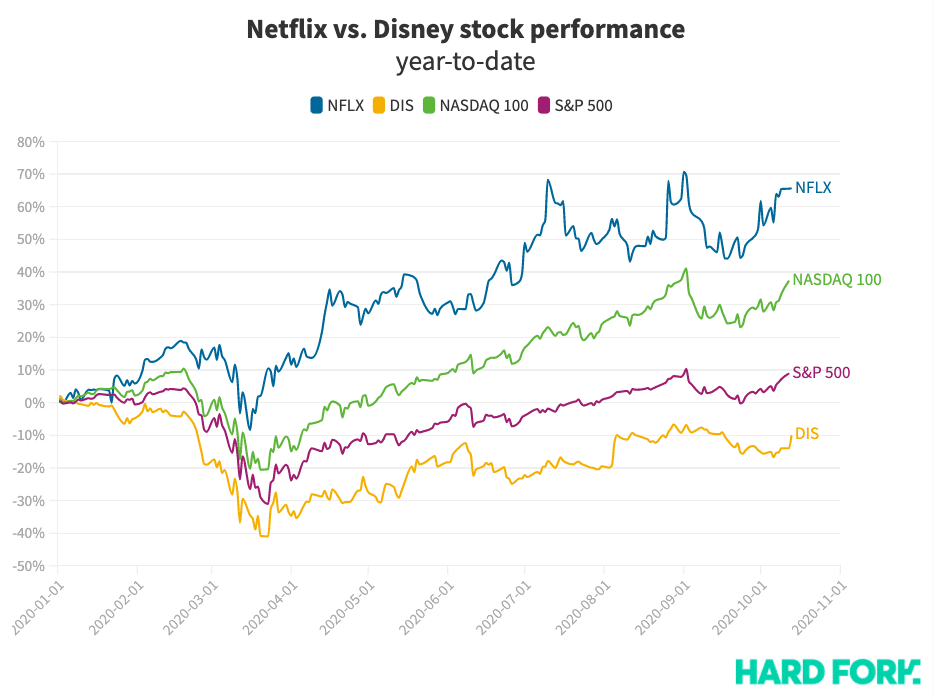

Disney stock has underperformed severely this year, down 10% while the tech-heavy NASDAQ 100 is up more than 37%. Even the broader S&P 500 index, which includes struggling airlines and banks, has risen 9% this year.

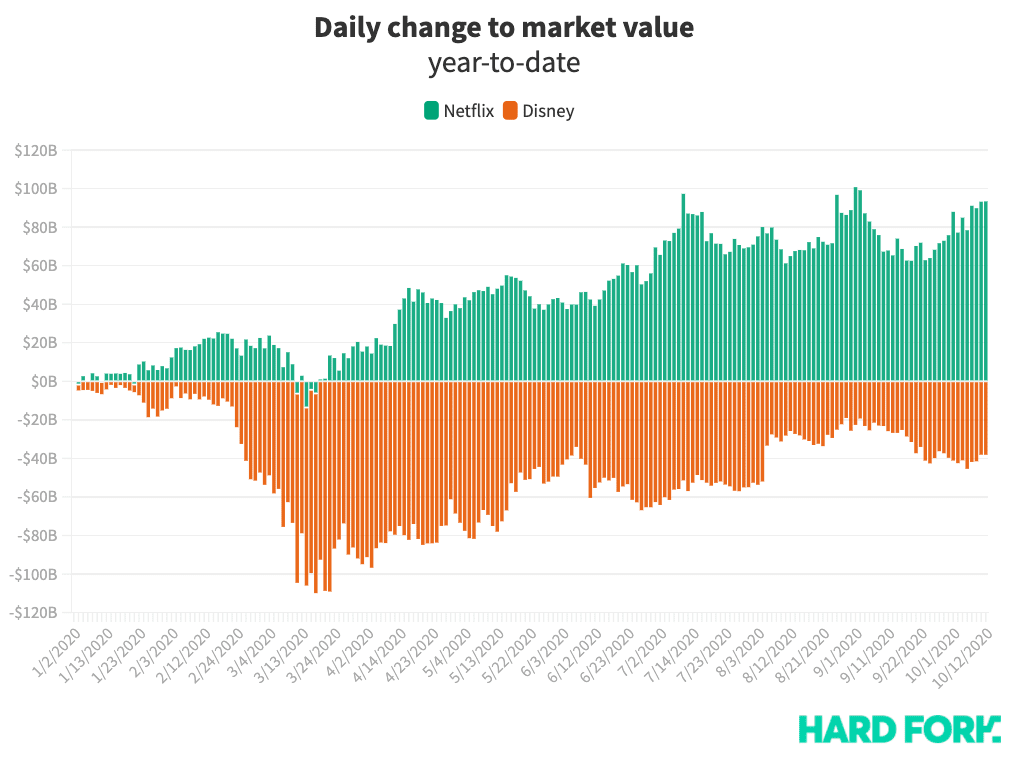

In fact, Disney has spent practically the entire year in the red, having traded evenly for the first few days but sinking ever since. Disney’s market value is currently $225 billon, having shrunk $38 billion this year.

On the other hand, Disney’s new arch nemesis Netflix has seen its share price explode from $326 to $540, representing 65% growth. This has sent Netflix’s market value beyond $238 billion — more than $84 billion added since the start of 2020.

[Read: ‘Mysterious’ billionaire cashes in $127M worth of Gates-backed pharma stock]

Interestingly, just as Disney formally redirects all of its might to growing its streaming business, the markets value Netflix and Disney pretty well equally, just $38 billion separating the two content powerhouses.

For what it’s worth, a raft of Wall Street analysts are sold on the idea, with finance portal The Street reporting bullish sentiment among analysts from the likes of JP Morgan and Rosenblatt Securities.

Get the TNW newsletter

Get the most important tech news in your inbox each week.