Here’s an extraordinary fact about the 2018 bear market: business for Bitcoin-lawyers is booming.

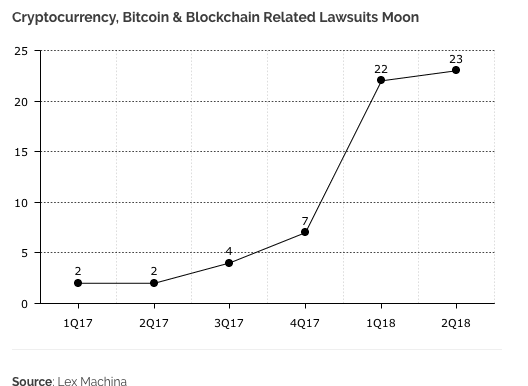

Forty-five lawsuits involving cryptocurrency were filed in the first half of this year, reports blockchain research unit Diar.

That’s triple the amount of all the lawsuits filed last year. This is not the moon we were looking for.

Diar emphasizes the US Securities and Exchange Commission (SEC) as a primary contributor to this trend. It notes the SEC is responsible for 30 percent of the cases filed, and recent moves have indicated there are to be loads more.

Last week, it revealed a veritable hard-on for cryptocurrency startups that fail to register their tokens as securities with the SEC.

Paragon and Airfox, who respectively raised $12 and $15 million after launching initial coin offerings (ICO) last year, were ordered to return all funds to investors, register their tokens as securities, and pay $250,000 in fines.

It also set precedent by shutting down seminal ‘decentralized’ digital asset trading platform EtherDelta for managing an unregistered securities exchange. The SEC further ordered its owner to pay $300,000 in fines.

While this newly-found penchant for prosecuting cryptocurrency-related securities fraud is certainly welcome (and a tad overdue), Diar keenly pointed out these fines seem a little light compared to what the SEC usually dishes for this type of fraud.

In March, the SEC demanded Merrill Lynch, the ‘wealth management’ division of Bank of America, pay $1.25 million in fines for the sale of unregistered securities that raised $38 million from investors.

Get the TNW newsletter

Get the most important tech news in your inbox each week.