Connotate today announced that it had completed a $7 million series B round, claiming advancing momentum, and touting its recent acquisition of Fetch Technologies. According to Crunchbase, the company had raised $5.25 million in its series A, bringing the total funding for the company to $12.25 million as of today.

Participants in the round were Castile Ventures, Prism VentureWorks and .406 Ventures.

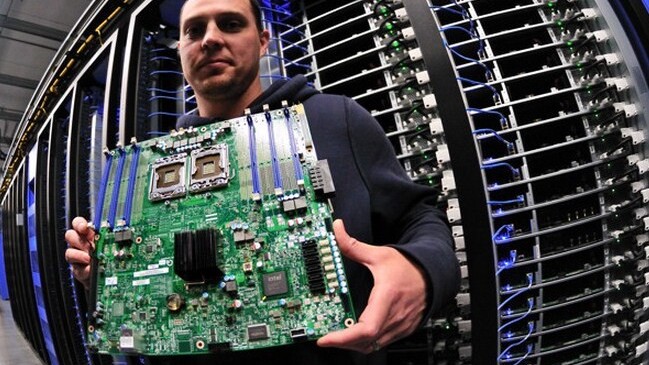

Connotate is a company in a very interesting market space: big data. Its product focus around huge amounts of data, and its actions in real-time. Essentially, Connotate provides tools that allow you to monitor large amounts of data, and stay on top of it as it changes.

That may sound mundane, but as companies increasingly deal with cloud solutions to help grant them sufficient power to deal with their information, companies such as Connotate are often the unsung heroes behind the companies and services that we use on a daily basis. Highlighting this trend is Microsoft’s recent investments in both Hadoop, and its Azure cloud product. Hadoop is a framework that works with large amounts of structured and unstructured data.

In its press release, Connotate’s investors highlighted its market reception as one reason they put more money into the company; “Since our initial investment in Connotate, [.406 Ventures has] been continuously impressed with the company’s execution and traction in the market.” That sounds like we’re talking dollars and revenues, if you ask me.

Given that this is a series B, Connotate is likely a bit more mature as an organization than we usually cover from a funding perspective but fret not, its important to have a good baramoter of the entire capital marketplace, and not just the sliver that is consumer-facing and seed-stage.

Get the TNW newsletter

Get the most important tech news in your inbox each week.