We’ve already talked at length about the division between the Chinese Internet and the rest of the world. It’s a schism that has broad-reaching effects on censorship and culture, and it also has a heavy impact on the development of the Chinese cloud industry.

That industry, like its nebulous namesake, is itself vague and undefined. These days it has become such a buzzword that almost anything related to the Internet will have the label slapped onto it. As such, in our survey of the Chinese cloud industry, we’re going to look at several different cross-sections, from back-end computing infrastructure to personal storage.

Cirrus Clouds

To get the forecast for the current state of the cloud in China, I spoke with several members of the industry at companies ranging in size from startups to Internet giants. Everyone agreed that the country’s infrastructure is still a few year’s behind its counterparts in the west.

Alibaba Group, which has established itself as one of the leaders in the move to the cloud with its Aliyun platform, put it this way:

“The cloud computing industry in China is in early developmental stages at this time, adoption of cloud computing services and technology has taken off in recent years and is serving more and more customers; however, user familiarity and understanding of the technology is still underdeveloped as the cloud has only been introduced in the past few years, and applicability still has room to diversify in the Chinese market.”

It may feel like a broken record to talk about yet another growth-story industry in China, but the evidence points to the cloud as being one of those industries. Figures compiled by Cloud Times suggest that the country currently represents just 3 percent of the global cloud market, with Gartner projecting 40 percent annual growth. In terms of money, the Chinese cloud industry is projected to reach $18.6 billion in revenue next year.

In its recent Global Cloud Index report, Cisco forecast that the Asia region will generate the most cloud traffic and workloads around the world by 2016. China is expected to be among the countries that “will contribute heavily” to that trend.

The Chinese market is currently led by domestic companies, since multinational cloud giants have yet to gain a foothold there. Amazon does not offer its Amazon Web Services to China, while Microsoft is only now beginning to enter the local market with its Azure service and it has established an accelerator to promote it.

According to Alibaba, the main challenges that China faces for growth in its cloud industry lie in “the Internet infrastructure, policy and operational areas. On the other hand, it views “high reliability, scalability, cost effectiveness and easy deployment” as benefits existing in the Chinese market.

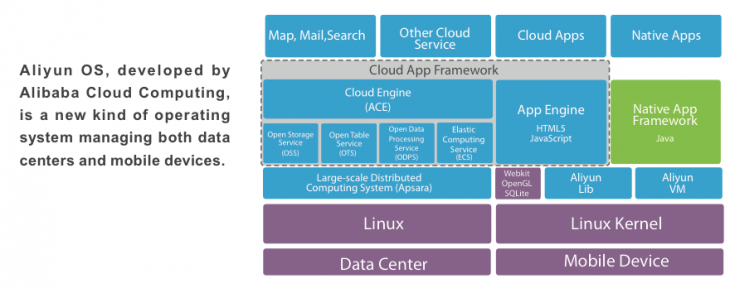

The company’s strategy isn’t just based on providing cloud infrastructure. The company is also working with small and medium-sized businesses to provide free market information and statistical data as part of its cloud operations, and it has partnered with the YunFen Fund on an RMB 1 billion ($161 million) fund for developers using Aliyun’s cloud engine. Meanwhile, Alibaba has developed the Aliyun mobile operating system to take advantage on the front end. After butting heads with Google over whether the OS counts as an incompatible fork of Android, the company recently spun off Aliyun.

“Alibaba Group and Alibaba Cloud Computing have also recognized the strength and value of the mobile Internet in the greater Internet industry and seen its phenomenal growth and traction over the years; the mobile OS is one of these platforms that will help to create an enhanced user experience for consumers,” the company said.

Corporate-level clients on Alibaba’s cloud platform include Japanese gaming giant DeNA, HMeili, Jandan and 51Com. However, one industry insider I talked to suggested that some companies in China have been hesitant to switch to Aliyun since Alibaba, which runs the Alibaba.com, Tmall and Taobao sites, is their chief competitor in the e-commerce business.

Personal Storage

But, Alibaba isn’t the only Chinese Internet titan interested in the cloud. Both Tencent and Baidu have claimed that their own cloud networks are the largest in China, though the specific metrics they use aren’t exactly clear. The two are also actively investing in personal storage solutions. Tencent’s Weiyun is being positioned as the third component of a themed digital lifestyle that also includes its Weibo and WeiXin (WeChat) services.

Meanwhile, Baidu is investing heavily in cloud computing, putting $1.6 billion alone into a new data center. On the consumer side, it recently announced a deal to provide free personal cloud storage to Android phones powered by select Qualcomm chips.

The underdog in the personal storage space is Yunio, a startup that’s looking to compete with its larger rivals. The company says its solution has differentiated itself from alternative options by providing a syncing service that should appeal to professionals, similar to Dropbox or Box in the US.

The underdog in the personal storage space is Yunio, a startup that’s looking to compete with its larger rivals. The company says its solution has differentiated itself from alternative options by providing a syncing service that should appeal to professionals, similar to Dropbox or Box in the US.

Yunio CEO Chris Mathews told The Next Web that his company’s service will surpass 5 million users in the first quarter of next year. The startup is currently angel funded.

It’s certainly an exciting time to be working on a cloud startup in China, but the task brings with it unique difficulties. Mathews noted that the Internet infrastructure in China is fractured according to region and ISP, making it more difficult to set up a reliable nationwide service.

“In China, you have eight bandwidth providers nationwide and none of them play well with each other. This is human implemented, it’s not a technical problem,” he said.

While salary costs are lower in China, Mathews believes that any savings on engineering staff are offset by additional bandwidth and server costs.

It’s natural that the executives I spoke to believe that everything is moving into the cloud, since they’re in the industry.

“Cloud is going to be something that everyone needs to have, kind of like a cell phone. Why would you not? Cloud frees you from your location, you don’t have to be at a certain place or having a certain device to get at your files,” Mathews said.

Early days

One of China’s earliest cloud players is ChinaNetCloud. Co-founder and CEO Steve Mushero said his company got into the game several years ago because it needed reliable cloud infrastructure and “nobody else was here doing that”. Since then, it has developed its main business of outsourcing operations and consulting on cloud projects.

Mushero said that his company has partnered with CloudX and Shanda over the years, but it currently prefers to work with Aliyun. By his estimate, the Chinese cloud industry is about five years behind the US.

“Aliyun is by far the biggest and most advanced and it still has a long way to go,” he said. “Right now Aliyun is the only big provider.”

So far, the cloud industry has been good to ChinaNetCloud, which is backed by angel investors and VC firms. The company has doubled in size every year, and Mushero believes it could grow five fold next year.

Though stringent government regulations for the cloud have been a problem for some companies in China, ChinaNetCloud hasn’t had much of an issue. Mushero says his company has made it a point to very carefully abide by the rules and keep its customers informed of the regulations.

Mushero said he’s looking forward to the day that Amazon’s cloud services arrive in China.

“The more players the better for everybody,” he said. “The more low-cost highly flexible resources you can apply to a market helps it.”

MadeiraCloud

Much of the cloud industry in China is inward focused, an expected result given the gap between the domestic and the foreign Internet. However, not everybody is tailoring their business for just the Chinese market.

For instance, MadeiraCloud is based in Beijing, but the visual management platform it has created is marketed toward foreign companies, since it’s built on top of AWS. The product helps cloud administrators manage their resources with an easy to use Visio-like interface that eliminates some of the complicated technical aspects.MadeiraCloud CEO Daniel O’Prey came to China interested in launching a cloud startup, eventually linking up with co-founder and CTO Zhao Peng, who had previously lead wireless operator China Mobile’s Big Cloud IaaS project.

The startup launched in beta last June to 2,000 users and has surpassed the founders’ expectations. So far, MadeiraCloud hasn’t run up against any major problems operating an international-focused cloud company from within China, but O’Prey does expect the time difference to be a problem as the company builds out its customer support division and so will open a US office next year.

Benefits for MadeiraCloud from being based in China have mostly been financial. O’Prey said operations have been cheaper, and the company has even gotten support from the local government to operate free of rent in an office park.

Developers especially can be found for a lower salary, though the hiring pool can be on the small side because bigger companies like Baidu and Tencent actively recruit lots of engineers straight out of university. Some employees also appear to be more interested in job security and stability than balancing the potential risks and rewards that come with working for a startup.

“There doesn’t tend to be as much of a risk taking culture here,” O’Prey said. “There are a lot less people looking to take that jump.”

While O’Prey acknowledges that Aliyun is the biggest cloud player at present, he expects another company to emerge at the front, probably a telecom or in partnership with a telecom. Huawei is readying its public cloud for early next year, and could offer strong competition to Alibaba. Huawei has risen to become one of the world’s top telecommunications equipment makers, but it has encountered problems in the US because lawmakers are suspicious of its ties to the Chinese government and military.

Microsoft recently partnered with Nasdaq-listed 21Vianet to offer their Azure cloud services from Shanghai. O’Prey said “IBM [SmartCloud] and Microsoft are both here, and I’m sure Amazon will be doing everything they can to have a mainland offering as soon as possible. It’s still very early days for cloud in China, but it’s predicted there will be 12x growth over the next 10 years.”

“There’ll be quite a lot of disruption to come [in the cloud space]. One of the winners or several of the winners might not even be in the market at the moment,” O’Prey said.

After having worked for both a large telecom cloud project and his own startup, Peng Zhao has noticed that the industry in China is more focused on the private cloud market than the public cloud right now.

Peng sees the public cloud as offering the most possible disruption of cloud computing, but he thinks it will take some time for China to get used to the option as Chinese firms are even more concerned about multi-tenancy than their Western counterparts.

“Big Chinese Internet companies like Alibaba and Shanda, they have an open cloud. They are the leading services right now for public cloud services, but there isn’t really a big revenue,” he said, adding that China Telecom, China Mobile and Huawei will likely join in in the long-term.

Peng is also optimistic about the state of the Chinese market. He says that gap between China and the west is “not too big” in areas like software because open source solutions, such as OpenStack, help Chinese players get the latest technology.

“Right now is a very good time for Chinese Internet or technology startups, compared with several years ago. It’s a good time for new startups because…it has more mature developers. From a capital side, the market is very active.”

Cloud Formations

Based on our conversations with industry leaders, China’s cloud industry is puffing along quite well, but it’s also susceptible to storms. Alibaba is on the top stratus of the market, but it’s still anyone’s game. Foreign players like Microsoft and Amazon are lining up for their chance, while China Mobile and Huawei are well set up to build out their own infrastructure. I’m not a good enough metereologist to give firm predictions on the future, but there does seem to be a high chance of growth.

Header image credit: MARK RALSTON / AFP / Getty Images

Get the TNW newsletter

Get the most important tech news in your inbox each week.