Climate-focused venture capital funds have already raised $6.9bn since the beginning of 2024, up from $5.2bn for the entirety of 2023, according to a new report from Venture Capital Journal.

While climate VCs have closed less funds overall — 24 compared to 26 last year — the average pot size has swelled from $202mn to $267mn so far in 2024.

This climate tech cash boost is largely reflective of a new fund from billionaire Bill Gates’ Breakthrough Energy Ventures (BEV). The American climate tech funding vehicle recently closed its third fund at more than $839mn. BEV also closed a smaller, but still significant, $555m fund in January.

Bill Gates founded BEV in 2015 alongside some of the world’s richest people (men), including Jeff Bezos, Michael Bloomberg, and Richard Branson. The investment thesis was clear: back technologies that have the potential to decarbonise all facets of the world economy.

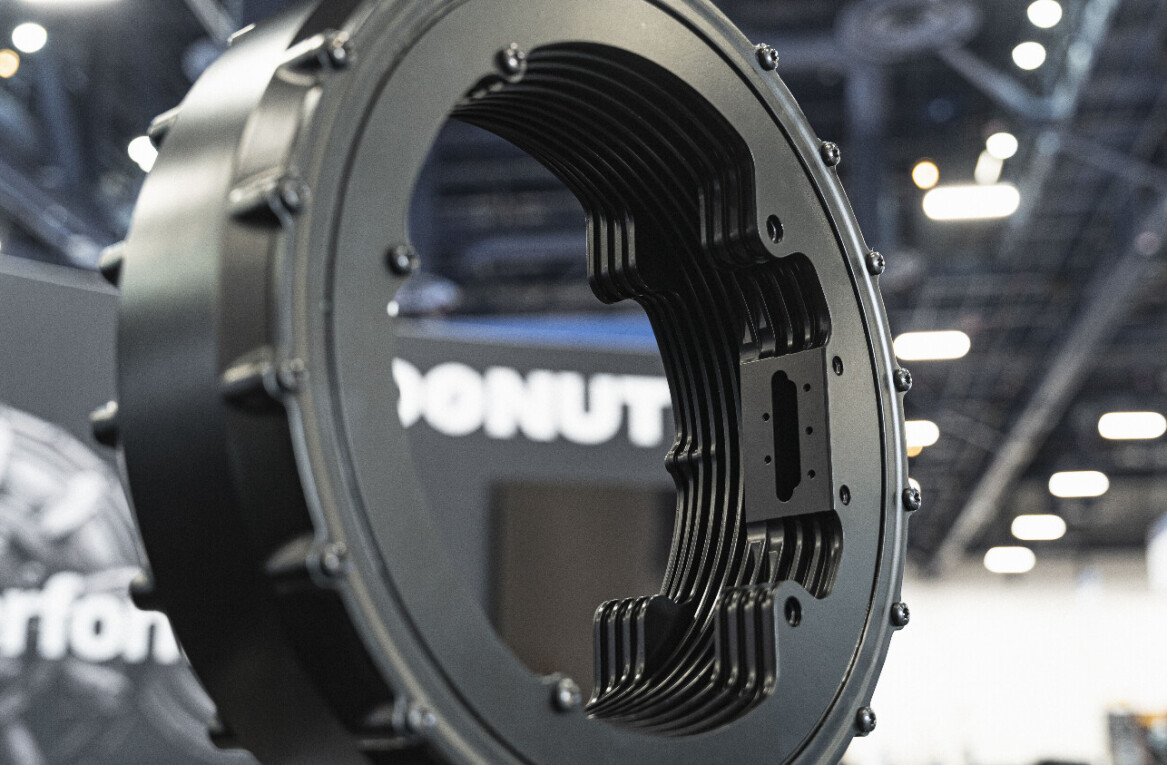

While the VC is based across the pond, it has made dozens of major investments in European startups. These include UK-based Mission Zero, which is developing modular carbon capture machines, and Sweden’s Heart Aerospace, which is building a hybrid-electric regional passenger plane.

While Bill Gates’ deep-pocketed firm is funneling big figures in Europe, a number of homegrown climate tech funds are raising substantial amounts of money as well.

This year, Sweden’s Norrsken raised $346mn and Berlin-based World Fund closed its first fund at $325mn. Spain’s Seaya Ventures also secured $325mn to invest in climate tech startups, becoming Southern Europe’s largest climate tech VC in the process.

The $6.9bn raised since the start of this year represents funds specifically set up to finance technologies designed to tackle climate change. Total private investment in climate tech, however, is much higher.

In 2023, VCs globally invested just over $50bn in climate tech startups, according to Dealroom data. This surpassed all other previous years apart from 2021 ($76bn), which saw record-high venture capital activity across industries. Promisingly, 2023 saw Europe surpass the US for climate tech VC funding.

While we’ll only get the full picture at the end of the year, heightened climate tech VC activity shows promising signs for the sector as a whole. As the globe pushes to decarbonise, climate tech has remained remarkably resilient despite an overall downturn in tech investment.

Get the TNW newsletter

Get the most important tech news in your inbox each week.