![Chinese Internet giant Qihoo 360’s three-fold plan to challenge Tencent and Baidu [Interview]](https://img-cdn.tnwcdn.com/image?fit=1280%2C720&url=https%3A%2F%2Fcdn0.tnwcdn.com%2Fwp-content%2Fblogs.dir%2F1%2Ffiles%2F2013%2F04%2Fthree-layers.jpg&signature=0248b69d7c73a932fd3e4f917adfefd7)

With over 450 million users of its PC antivirus software, China’s Qihoo 360 definitely qualifies as an local Internet giant, but it’s a scrappy one. The company is jockeying with rivals Tencent and Baidu to win the hearts of the country’s Internet users as they move mobile, and the competition has at times been less than friendly.

In addition to its security software, Qihoo also operates a browser and now a search engine. While that product lineup may seem a tad random, CFO Alex Xu outlined in an interview the company’s three-part strategy for its business.

“From day one, we’ve been trying to build something we call an ‘Internet platform company,'” Xu said. “We actually built this platform in three different layers, three different steps.”

The foundational layer was the security layer, which hit the market in 2006. The free PC software has reached roughly 95% of the Chinese Internet population, according to Xu.

“On top of that first security layer, we needed to have more influence on those users’ behavior, so the second layer we are building is something we call the access layer,” he continued.

Qihoo viewed the browser as the key access point for Chinese PC users going online, so it built its own. That browser now has 300 million users, or roughly two-thirds penetration.

The final layer is a service layer, where Qihoo is able to introduce and recommend third-party applications and services to its existing user base.

Xu candidly described Qihoo as essentially a “gigantic user generator and traffic redistributor.”

All of Qihoo’s efforts are meant to fit within these three layers. According to Xu, the bottom two layers focus on the stickiness of the company’s users and the depth of influence that it has on them. The upper layer, which includes search, is where Qihoo achieves its monetization.

Compared to its competitors, Qihoo is still at an early stage in its revenue development, but it has been posting strong growth as of late. Xu noted that the company has averaged triple-digit growth for the past few years.

Xu added that Baidu, Tencent, Sina and Sohu have as much as a seven to eight year head start on Qihoo, so its average revenue per active user is not as advanced. Last year, Qihoo achieved about $0.70 in revenue per active user, compared to about $15 for Tencent and $8.50 for Baidu. Meanwhile, Sohu and Sina had an ARPU of around $3.

“The major gap between them and us is time,” Xu said. “If you look at our growth rate, it’s significantly faster than the other guys over the past few years. Over the next few years, you’ll see that gap closing very, very fast and ultimately reaching a relatively healthy level.”

Qihoo’s entrance to the search market last year caused a stir because it represented a new challenger to Baidu’s search monopoly. According to some market research firms, Qihoo managed to achieve 10 percent share by the end of 2012. The company has set an ambitious goal of capturing an additional 10 percent per year, aiming for 40 percent by 2015.

Xu admitted that the “vast majority” of the search market pie is in Baidu’s hands, but, as a smaller company, Qihoo only needs a small piece for it to make a difference. Qihoo’s revenue run rate last year was about $330 million. By comparison, Baidu had over $1 billion in revenue in the fourth quarter of 2012 alone.

“I think we’re pretty much on track to get 20% by the end of the year,” Xu said. “Right now, according to different third party studies, we’re somewhere around the 14% range.”

Competition

Local industry rumors have suggested that Qihoo is notorious among other Internet players as being difficult to get along with. When I asked Xu about the situation, he described three different types of so-called “enemies” it faces.

“One is the traditional antivirus company, particularly domestic ones, such as Kingsoft and Rising,” he said. “When we launched in 2006, we destroyed their business model. Obviously, they hate us. From deep in their minds, they believe we destroyed their business.”

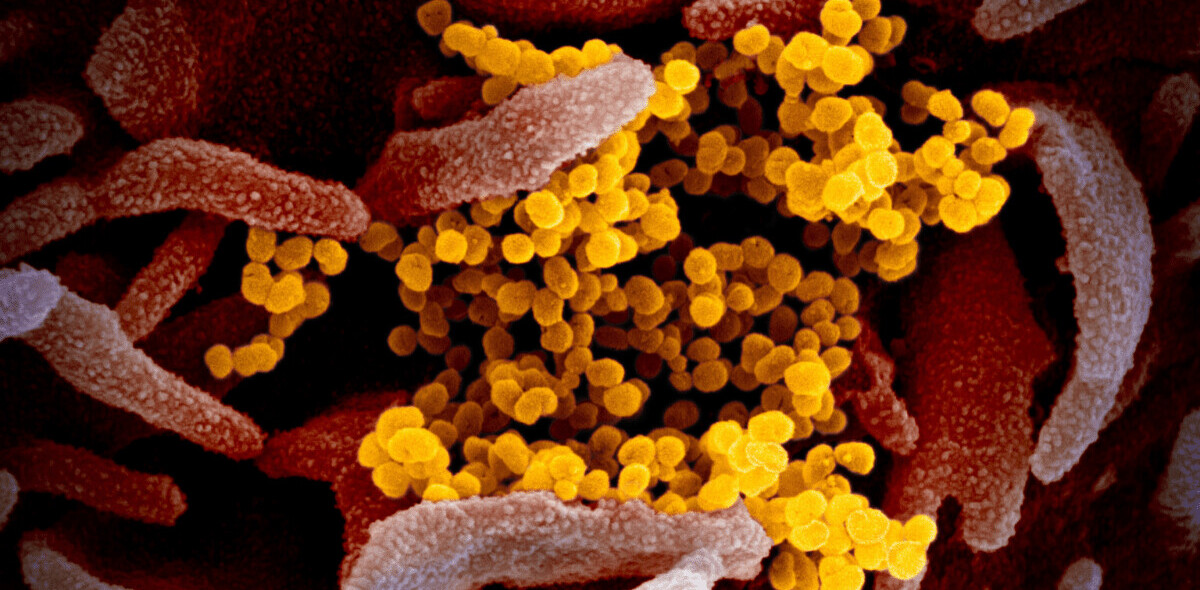

The second group that Qihoo contends with is hackers and cyber criminals: “We made security become a number one priority among all Chinese users, made it available and affordable. That basically blocked those guys’ way to make money off [criminal] activity. Hackers definitely hate us.”

Xu doubted that there was a way to improve Qihoo’s relationship with either of the first two groups.

The third and final group, according to Xu, is rival Internet giants.

“[Qihoo’s] battles with Tencent and Baidu are on different fronts. The battle with Tencent is more about the influence of users. We and Tencent are the only two companies in China that have products on [users’] desktops every day, every minute every second.”

That advantage has been a powerful one in the Chinese market, as it has allowed both companies to recommend services to users without additional marketing and distribution costs.

“Before we launched free security, Tencent was the only one to have [that kind of influence]. As we built up our platform, they felt we were a threat. It’s about who has the final last mile access to users. They certainly want to stop us. That’s where the fight is.”

And fight they did. In 2010, Qihoo and Tencent got involved in a public spat that resulted in the government stepping in to mediate. Earlier this month, Qihoo lost an antitrust suit against Tencent over its instant messaging dominance.

Meanwhile, Qihoo’s competition with Baidu is on the service layer. Xu asserted that Baidu doesn’t have the same kind of power as Tencent on the bottom layers of the pyramid.

“Baidu got used to its dominant monopoly position. All of a sudden there’s a credible challenger,” Xu said.

Last year, the government called the major search players together in an attempt to mediate a dispute that was largely between Baidu and Qihoo. The two companies have been also involved in legal action against each other.

“Because both [Tencent and Baidu] feel a very serious threat from us, I don’t think they want to leave us alone. The fight will continue,” Xu said.

Outside of those three groups of “enemies”, the executive described the majority of the rest of China’s Internet space as “actually pretty friendly.”

“We team up with Sina, Renren, Taobao, 360buy. Basically every single vertical Internet company, unless you’re controlled by Tencent or Baidu, you are our partner because you need our users. We happen to be one of the largest traffic generators in the Chinese Internet,” he said.

“A lot of Internet companies are not so happy with Tencent and Baidu’s position. They need to find an alternative to get traffic and get users; we happen to be that very powerful alternative.”

Developing markets

Though Qihoo has expressed some interest in overseas markets, it’s steering clear of developed countries for now. Xu pointed out that replicating its three-part business model in North America or Europe wouldn’t be feasible. While it could always offer its free security service, it would have a difficult time breaking into the service layer.

“Without the upper layer structure, there’s no way you can make money in those kinds of markets,” he said.

Qihoo is instead likely to focus on other developing markets. However, it would need to find local partners in new markets in order to tailor its approach.

“Each market has very unique characteristics, and if you don’t understand the market you’re jumping in there, it’s very risky,” Xu said. “We’re looking at it and will probably try something in certain developing countries.”

The fourth layer

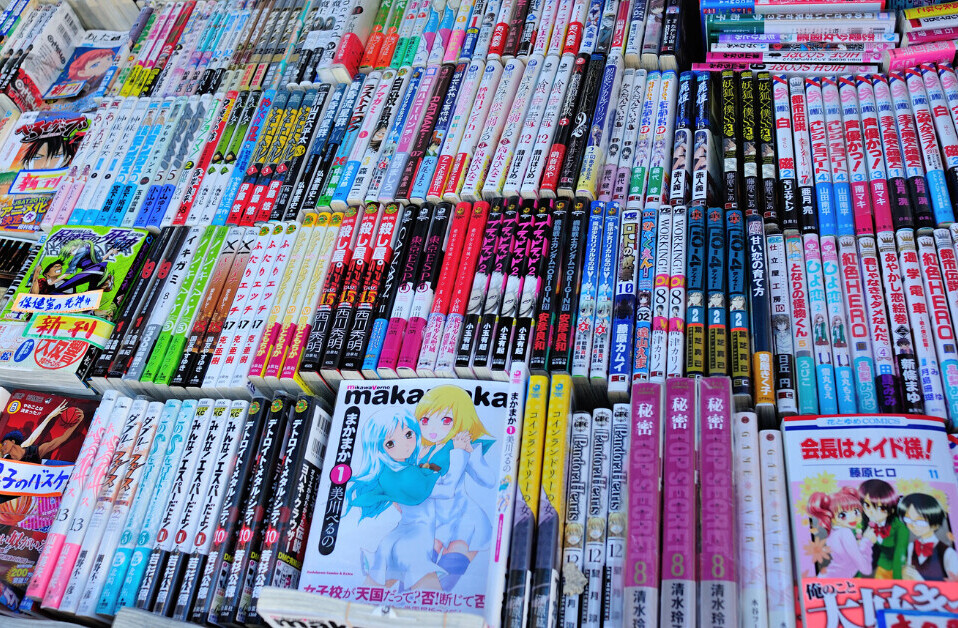

The mobile market is the latest battleground in the Chinese Internet space, and Qihoo isn’t sitting this one out. The company boasts the largest Android application store in China. That’s a pretty handy position to be in, considering that Xu estimates Android has 80 percent of the smartphone market and expects it to continue to grow throughout 2013.

Mobile monetization, however, remains elusive. Qihoo is still building its user base and plans to tackle revenue next.

Xu characterized China’s mobile Internet space as being in an early phase, estimating smartphone penetration at just 25 percent.

“We certainly want to keep pace, extend our market share in those areas, and build one of the largest mobile platforms in China,” he added.

At least for now, Qihoo is living out the common proverb that good things come in threes. Friction with other companies its size is inevitable, but its huge user base and stratified influence on its customers should set it up well for the coming mobile showdown.

Get the TNW newsletter

Get the most important tech news in your inbox each week.