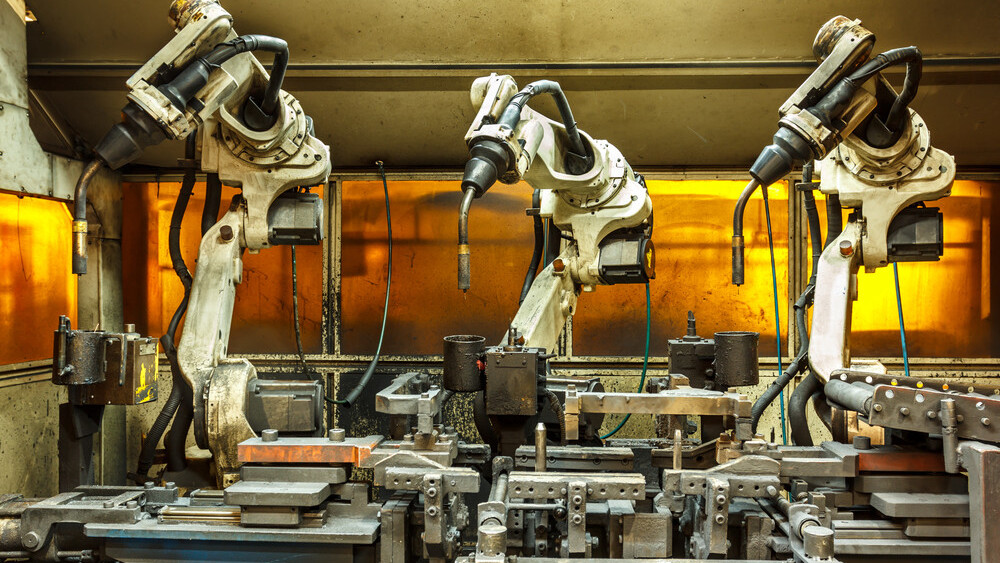

Automation now threatens as much as 40 percent of the job market. And unfortunately for many of us, we’re on track to hit this target by 2030. But maybe it won’t be that bad.

The Wall Street Journal today delivered an engaging look at the history of other major disruptions throughout history. From the industrial revolution, to the 1500s, where Queen Elizabeth I refused to grant a patent for a mechanical knitting machine that threatened skilled laborers, the fear surrounding tech stealing our jobs has been, mostly, overstated.

Automation will be disruptive, but maybe we’re taking too narrow a view.

It’s a near-certainty that automation will cost workers thousands, maybe even millions of jobs over the next 20 to 30 years. It’s also clear that those displaced aren’t always the ones who benefit from the new industries automation makes possible.

But, historically speaking, the net result is generally positive.

Job loss will occur, that we understand. We have a much more limited comprehension over what positives could come from this level of disruption, although we’re beginning to get a glimpse as companies like Amazon hire thousands of these displaced workers.

During a single day job fair last month, Amazon accepted over 100,000 applications from potential employees. It offered 40,000 of them jobs.

Belinda Duperre was devastated when, in early 2016, the Sam’s Club in Fall River, Mass., closed. She later signed on to work at an Amazon fulfillment center — having never worked in a factory — and now earns $2 more per hour than she did at Sam’s: with better benefits to boot.

Duperre isn’t alone, but she joins a growing number of people just like her who, after years working in one industry, were suddenly forced to switch jobs. And she, at 54, is the prime example of the job loss we fear most: people who worked in one industry for decades, and then are suddenly forced to switch careers later in life.

What I found particularly interesting was this example, again taken from The Wall Street Journal:

After the first automated tellers were installed in the 1970s, an executive at Wells, Fargo & Co. predicted ATMs would lead to fewer branches with even fewer staff. And indeed, the average branch used one-third fewer workers in 2004 than in 1988.

As you can see, the ATM was highly disruptive. You’d be tempted to equate this disruption with job loss, as fewer employees at bank branches meant thousands were suddenly without jobs.

But you’d be wrong.

Since ATMs made it much cheaper for banks to operate, it led to a boom, of sorts, in building new branches. From 1989 to 2004, banks opened 43 percent more physical locations than it did in the period before ATMs — leading to more jobs in banking, consequently.

And that’s not even considering the additional skilled laborers needed to install, configure, and maintain over 400,000 ATMs installed nationwide since the 70s. Or, there’s the drivers and guards needed to fill them. There’s those who work in customer service, laborers who man the assembly lines, parts companies responsible for the pieces within them, ISPs (and their employees) who keep them online, security experts who lock down the network from hackers, and so on.

Job creation is a funny thing. But when you start looking at how industries are interconnected, and how a slowdown in one often leads to a boom in another, maybe we really are overblowing the potential negatives of our new automated future.

Or maybe this was written by a robot who doesn’t want you to be scared anymore.

Get the TNW newsletter

Get the most important tech news in your inbox each week.