This article was written by Marc Amblard, Founder & Managing Director, Orsay Consulting on The Urban Mobility Daily, the content site of the Urban Mobility Company, a Paris-based company which is moving the business of mobility forward through physical and virtual events and services. Join their community of 10K+ global mobility professionals by signing up for the Urban Mobility Weekly newsletter. Read the original article here and follow them on Linkedin and Twitter.

Autonomous Vehicles (AV) hit the bottom of Gartner Hype Cycle’s trough of disillusionment in 2019-2020. Since the middle of last year, we have observed an acceleration in funding and valuation which has led to a few acquisitions. More importantly, this is further singling out a few major players which accelerate their technology development and the deployment of pilots. In addition, these select companies are aggregating an increasing number of OEMs, both light vehicles and heavy trucks, around them — the latter are shifting more of their focus to EVs and software development.

AD system majors have raised billions in the last few months

In the past 9 months, five of the main autonomous driving system (ADS) developers have raised over $4B in total. Cruise benefited from the largest round with $2.75B raised largely from Microsoft and retail giant Walmart at a $30B valuation! Likewise, Aurora, Pony.ai, WeRide and Didi’s AV entity each raised $300M to $400M in the last few months.

We can also suspect that the OEMs that have engaged in partnerships with these companies (see below) have committed to making hefty financial contributions for the right to access the tech for pilots in the mid-term and for production in the longer term.

Another path to raising funds is to go public. Sino-American autonomous trucking startup TuSimple was just introduced on the US stock market, raising about $1.1B at an $8.5B valuation. Similarly, Argo AI, in which Ford and Volkswagen each own 40%, is considering doing the same later this year. This could reduce the pressure on the two OEMs as Argo AI needs to secure its financial runway.

Elsewhere in the AV space, Lidar companies have been very active on the financial front as well. At least six of them have gone public, reverse merging with SPACs and raising over $2B cumulatively over the last 9 months. They have taken advantage of the SPAC wave and of renewed hype in the AV space, managing to hike their valuation to between $1.4B and $3.4B.

The above valuations benefit from a boom in financial markets but are difficult to justify, especially for Lidar startups which have a narrow value proposition and overlapping market ambitions. Nevertheless, these valuation enable significant cash injections (with limited dilution), which will accelerate the development of AV solutions for passengers and goods transportation.

AD system majors are integrating vertically

The large fund raising rounds also provide developers with the means to better master key components of their solutions. Whereas Waymo developed their own Lidars, radars and cameras in-house and specify their compute hardware, other have progressively integrated sensor startups. Last year, Cruise acquired Astyx (radar), complementing Strobe (Lidar) which was purchased in 2017. Similarly, Aurora gained control of Lidar-startups Blackmore (2019) and Ours (2020).

ADS majors have also all developed their own simulation and mapping solutions and are specifying their compute platform in order to ensure optimal overall integration. Pure ADS players such as Waymo, Argo AI or WeRide will provide reference designs for the combination of sensors, compute and mapping tech to their vehicle OEM customers.

For a few players, vertical integration goes beyond AD technology to include vehicles. On the passenger side, Cruise (with GM and Honda) and Zoox have presented their robotaxis and intend to operate the mobility business. Likewise Navya, Easymile and others launched their own autonomous shuttles years ago. On the goods transportation side, Nuro and Neolix have started operating their own last mile delivery vehicles.

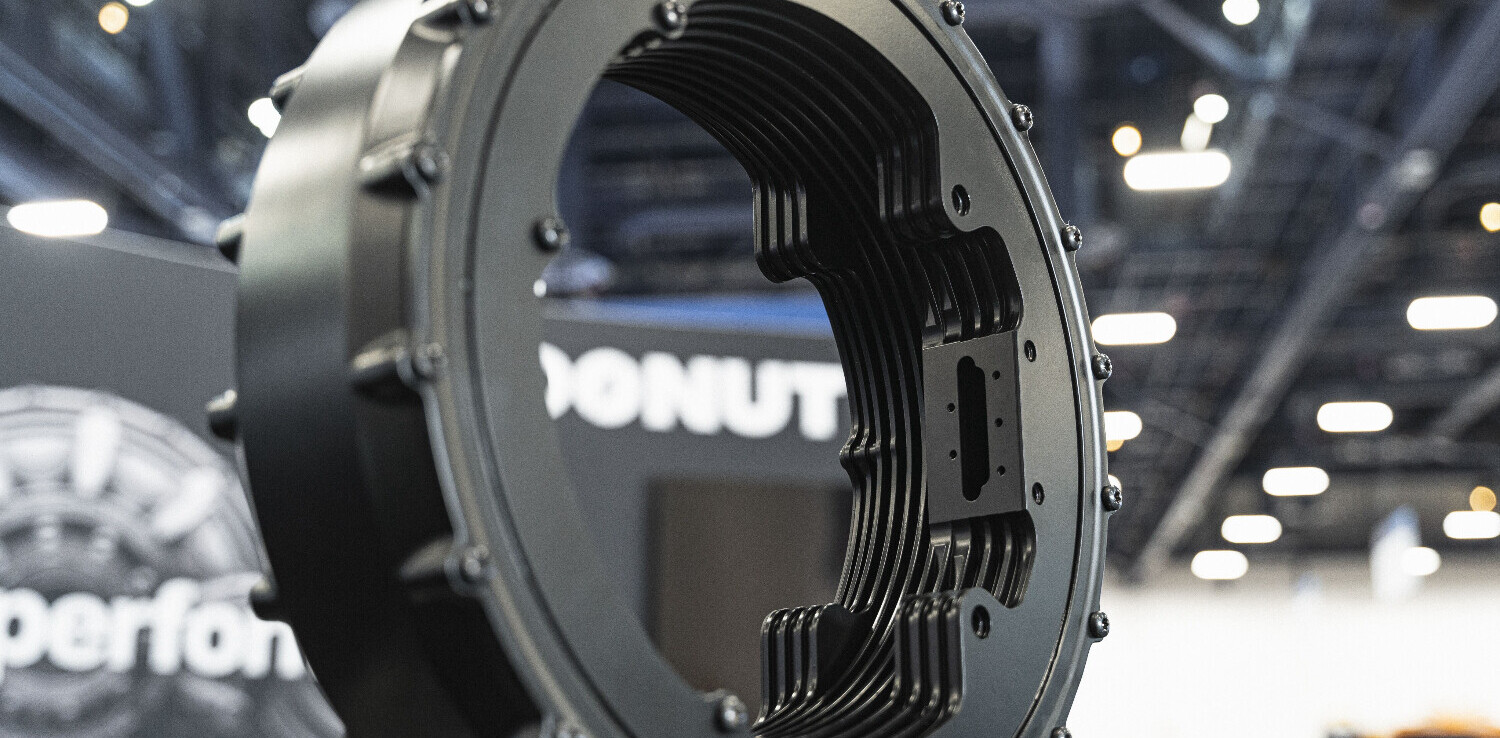

Earlier this year, Cruise made an interesting move with the acquisition of Silicon Valley-based Voyage, which can be considered downstream vertical integration. This cannot be justified by the latter’s AD tech but rather by its market access — Voyage is operating autonomous shuttles in retirement villages in the USA. These locations will likely be used as test beds for Cruise’s Origin robotaxi (above).

Aggregation around a select group of AD system majors

OEMs have partially reallocated their AV R&D budget to accelerate EV development, a must-have given CO2 regulations and market trends, as well as to build-up their software capabilities, another critical move. Given the sums and duration required to bring robust AV tech to market — ADS majors reportedly spend $500M to $1B per year — OEMs are better off joining expert teams for their ADS tech.

As a result, we have observed the aggregation of OEMs around major ADS developers in the past months (diagram below). Most ADS majors partner with either passenger vehicle or truck OEMs depending on their focus. However, Waymo and Aurora have managed to sign collaborations with both types of OEMs to match their dual objectives.

While OEMs are by and large putting their AV future in the hands of ADS majors, they continue to advance their driving assistance game on a parallel, incremental path. Most are deploying Level 2 solutions, and a couple are venturing into Level 3, namely Honda and Mercedes after Audi’s attempt was constrained by regulations. But the longer term goal of reaching Level 4 will involve some sort of partnership with ADS developers.

In summary, it is becoming clear that the capital-intensive development of ADS and AV technology will be handled by a handful of companies which will either offer ADS to OEMs or will develop and operate fleets of autonomous vehicles.

Do EVs excite your electrons? Do ebikes get your wheels spinning? Do self-driving cars get you all charged up?

Then you need the weekly SHIFT newsletter in your life. Click here to sign up.

Get the TNW newsletter

Get the most important tech news in your inbox each week.