In the eyes of “experts,” when it comes to blockchain, there is often no middle ground — it will either be boom or bust, nothing in between.

I for one have become a big proponent of blockchain technology, especially the crypto-economics used to jumpstart powerful network effects.

But with so many opinions and noise floating around, I thought it would be beneficial to take a deep dive into the ramifications of blockchain technology as it relates to today’s top tech companies.

Will blockchain based alternatives unseat Google, Amazon, Facebook, and Apple? After in-depth research into the business models, here is what I found…

A quick explanation

For those new to the space, blockchains are immutable (unchangeable), often trustless ledgers — creating digital scarcity and the possibility for much more.

Due to their decentralized nature (run by a community vs a single entity) and their economic incentive models (tokens), they potentially represent a major threat to the status quo — at least that is what enthusiasts would have us believe (more on this later in this article).

Basically, this means that anything that was once done/stored on paper can now be accomplished and recorded on the blockchain, creating an infinite and unchangeable “paper” trail of ownership records, programmable contracts, financial information, personal data and much more.

And at least in theory, it would be owned by the users — something unheard of today.

The GAFA tech gods

As we enter 2018, we are entering into an era of unparalleled tech dominance. Companies like Google, Amazon, Facebook, and Apple control more and more of our everyday lives — owning our data and everything around it.

The inherent network effects and flywheels these companies built are unprecedented — both in their scope and ability to stave off competition.

In this connected world where things are constantly changing, I thought it could be beneficial to analyze/theorize blockchain based competitors to combat the tech giants of today — specifically to focus on what it would take to win.

Google is one of the most complicated companies today, with dozens of divisions and products that dominate our daily life.

We will skip most of these areas and instead focus on their primary business model — advertising.

1. Google Search

Google is the dominant search engine with over 77% of global searches going through Google (Source: NetMarketShare.com).

Despite the fact that 1.3B people (there are only 7.6B people globally) live behind China’s Firewall, Google still owns over ¾ of the search engine market. This dominance has fueled Google’s historic rise.

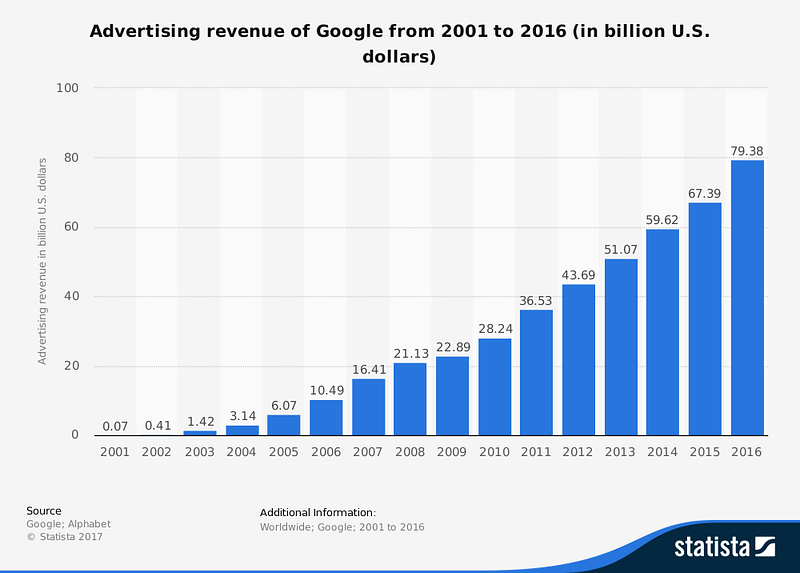

86.5% of Alphabet’s revenue comes from advertising, primarily search ads (Source: Statista).

2. Youtube

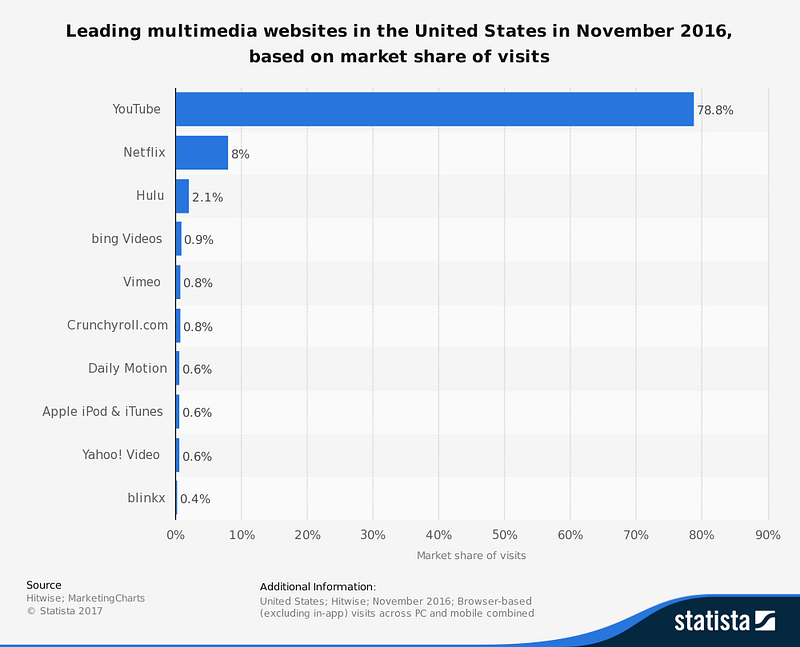

Youtube is the second largest search engine in the world, and easily the largest user-generated video platform. Users upload an impossible 100 hours of content to Youtube every minute.

And Credit Suisse believes that in 2015, Youtube and Google Play accounted for ~15% of Google’s revenue (up from 4% in 2010), and forecasted to reach 24% by 2020.

Considering Google only paid $1.65B to acquire them in 2006, that is one hell of a deal.

3. AdSense — display advertising

The other piece of Google’s advertising supremacy is their partner network, AdSense. AdSense allows sites to monetize through Google’s advertising platform without worrying about the backend or finding advertisers.

Instead, Google handles everything and takes a between 32 and 49 percent of ad revenue generate (the rest going to publishers).

According to Investopedia, AdSense revenues accounted for $15.5B, ie 23% of Google’s total revenue in 2016.

Unfortunately, advertising as a business focuses on eyeballs over quality, leading to much of the degradation and clickbaity titles of today.

I don’t see the advertising model changing drastically anytime soon, meaning Google’s great success with AdSense is likely to continue (and grow).

How blockchain beats Google

Google’s business is all about eyeballs, attention and “supposed transparency.”

Their slogan of “don’t be evil” and mission to openly share information with the world are notably at odds.

This creates a scenario where Google’s platform is god and only those that play by his/her rules are allowed in the garden of Google.

But, crypto complicates things for Google.

Google’s dominance is primarily driven by the network effects of big data and AI combined with the force of habit — a near perfect storm.

At the same time, however, many in the tech community are worried about the role tech giants play in our lives, especially as it relates to selling our personal data.

And as we have seen, the tech community is taking some shots from politicians and users over their role in the recent US election.

1. Search

A blockchain based browser/search engine could solve the problem of misaligned incentives.

I have started using DuckDuckGo (a privacy-focused search engine) after my research for the book (The Big Four — How Today’s Tech Companies Monopolize the Future) revealed the extent of Google’s power and control over my life.

Rather than collecting my personal information to sell better ads, DuckDuckGo (DDG) only occasionally shows ads — and solely based on the actual search query. Imagine that.

NOTE: DuckDuckGo has only a 0.20% market share worldwide (Source — NetMarketShare)

DDG’s approach has major advantages for users, namely disintermediating value with personal data — but there are issues as well.

The reason Google dominates is their data and AI expertise. They know us better than we know ourselves and are able to deliver better experiences as a result.

It is the reason Antitrust action will almost never occur in the US — our definition of monopoly is based on consumer price gouging and poor experiences — the opposite of what today’s top tech companies deliver.

You want the best results for you, and you want them now. Google delivers this.

A blockchain based search engine (BBSE) could theoretically win here. Combined with an identity coin like Citizen, a BBSE could use consumer data and preferences (without ever owning/controlling them) to display better, more personalized search results for users.

And if advertising was added, BBSE users would benefit as well, earning tokenized “commissions” in exchange for seeing the ads — removing the adversarial relationship that exists today.

Unfortunately, I foresee this as being a long ways off. To change user behavior, you need a 5–10x better solution than the existing product.

To get to the point where a BBSE which surpasses Google’s market share (currently 77–80%) will take years.

Most people too freely give up their data and information without reading the terms of service (myself included).

2. Video

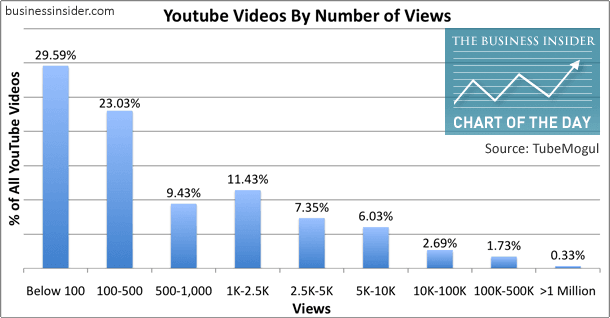

Competing with Youtube presents many of the same challenges as tackling search. There is one major advantage however, the creators create the platform and value.

And because Youtube advertising isn’t effective for the vast majority of creators, this could be interesting.

According to our analysis, the average CPM that can be expected from YouTube videos is between $0.50 and $5.00. That means that for every 1 million views of your videos, you can expect to make between $500 and $5,000. — Monetize Pros

That is pretty horrible, especially considering podcast ads earns 5–20x higher CPMs (cost per 1000 impressions).

Because Youtube is so competitive and the ability to earn is limited, it makes logical sense that creators would cross-populate content. On a new blockchain based video platform (BBVP), there would be less competition and thus a greater percentage of attention.

If incentives were added for creators to create content and onboard audiences, the rewards suddenly get more interesting.

The first mover advantages create inherent network effects and time urgency — bring over your subscribers before some other Youtuber does.

That said it would still take time, especially to bring sufficient eyeballs to make good money.

But with strong enough token incentives and quality content, it seems safe to say that news would spread.

The question is how fast. Odds are a BBVP would take several years to mature. Youtube has over 100 hours of video uploaded every minute — that is a lot of evergreen, SEO rich content.

And because Google favors Youtube, it would be hard to steal search traffic.

NOTE: Steemit/Dtube is currently working on building a Youtube killer but has a long long way to go to create a credible threat.

That said Steemit is one of the most active blockchain projects/cryptocurrencies with a market cap of $1.49B and processes over 1M transactions per day (820k/day as of July 2017) — things are happening!

3. Adsense

Advertising ruined the internet and journalism. When the world switched from subscriptions to display ads, quality started to slide.

Today clickbait is king.

More eyeballs and pageviews (hence those annoying freaking slideshows) have created a world where artificial attention is rewarded.

We have seen the quality of journalism and content degrade — prioritizing provocative headlines, flashy thumbnails and accidentally promoting an asshole like Trump.

NOTE: Trump won because he created controversy, driving eyeballs (ie ad dollars) and thus rankings/ratings around the globe. Our disgust forced us to read and forced his image and message everywhere like an inescapable evil billboard.

A blockchain based publication model (BBPM) could, in theory, solve this.

Medium does a decent job of illustrating the point (although not profitable), by allowing users to upvote/Clap for articles they enjoy (up to 50 Claps). A similar model could redistribute dollars to the sites and publications we appreciate most.

And there are companies/organizations trying to do just that, both with and without blockchains. This is a hard proposition though because the majority don’t understand the power/risk of personal information.

Most people are fine with “being the product” and profiting (receiving free content/access) for their contribution to the system.

In my opinion, the one and only way a blockchain based answer to Adsense could succeed would be tokenized incentives for early adopters (users and publishers) to the system where Adsense ads had an if/then statement attached. If a user is BBPM member, no ads. If not then display ads.

In order to participate in the BBPM, publishers could jointly collude to “monopolize” the market, creating a linearly sliding scale of advertising intrusiveness across all web properties to encourage laggards to convert (ie overtime sites across the internet become less and less usable and more and more ads/spammy until readers joined the BBPM)

That said, I don’t see a “mafia-like” approach like this being adopted or believe change can happen in under a generation (hard to go from free to paid and be okay with it).

Hopefully, it will help kill clickbait…

Amazon

The company Bezos built to sell books online is now arguably the most dominant and diversified company on earth, and the odds-on favorite to crack the $1T market cap first.

This seems to be the consensus, at least among technologists. But the majority are often very wrong, so let’s dive deeper.

Understanding the empire

Amazon’s business is made up of five primary divisions: Amazon.com, AWS, Alexa, Whole Foods Market and Amazon Prime.

Each on its own would be an impressive business. Combined they create the world’s largest flywheel.

I don’t believe Alexa, Whole Foods or Amazon Prime have any risk of blockchain based disruption (at least in the foreseeable future). The nature of these business models isn’t easily decentralized.

And while decentralized AI could be an interesting component to building an Alexa killer, I believe the bulk of the effort to be merging multiple technologies and disciplines (voice, AI, APIs, hardware) which seem highly unlikely in the foreseeable future

1. Amazon.com

Amazon’s is the most monopolistic and well-positioned marketplace the Western world has ever seen. Last year they did $136B in revenue with double-digit growth every year.

2017 estimates show a staggering 44% of US e-commerce occurred on Amazon.com (Source: Recode). And Amazon has been growing at least 13% YoY (year-over-year) for each of the last 5 years.

It isn’t just a monopoly, it is accelerating.

But there is another layer to unpack — Amazon Basics, where Amazon analyzes 3rd party seller data and copies the best performing products.

Ultimately Amazon wants to replace ALL 3rd party sellers/products with Amazon Basics versions. Amazon wants to (and will) own the customer and every ounce of margin that comes with it.

Marketplaces die when the creator becomes the competitor.

2. Amazon Web Services (AWS)

(NOTE: I think Amazon should spinout AWS before regulators start antitrust actions)

Amazon built AWS for their marketplace. They needed the ability to host images and information for Amazon.com and Bezos being Bezos, built the product in a modular fashion.

As AWS grew, Amazon constantly cut prices to crush competition, making AWS the easy choice.

Your margin is my opportunity. — Jeff Bezos

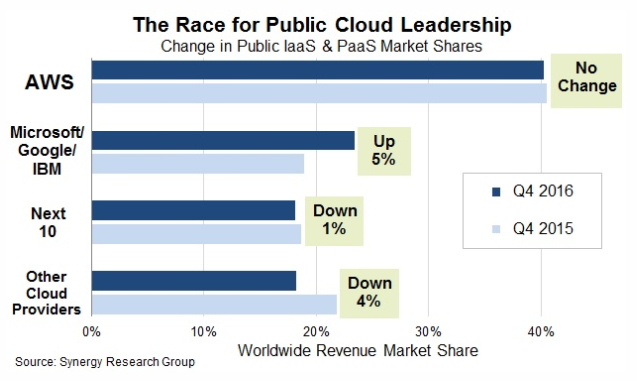

Today ~42% of the web is powered by AWS. That is more than double Microsoft, Google and IBM (combined). Yet given the easy-to-use system and affordable pricing, it makes sense.

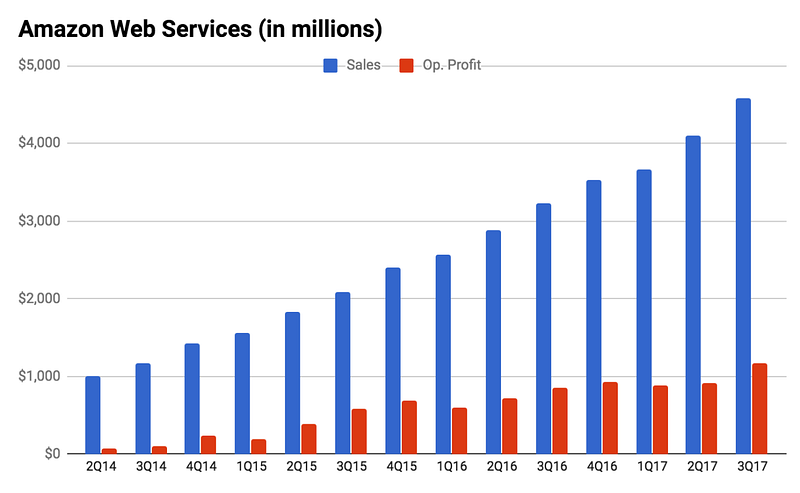

And growth isn’t slowing, quite the opposite actually. AWS accounts for 10% of Amazon’s overall revenue, with $4.6B in Q3 of 2017 (up 42% over last year) and $1.2B in profit (up 36% over last year).

Amazon owns the infrastructure the majority of the internet is built on, can decentralization change that?

How blockchain beats Amazon

I have my money on Amazon. They are the best positioned of the tech giants to own the future.

That said, blockchain can create challenges for Bezos’ beast, it depends how it is implemented, incentivized and evolves.

1. E-commerce

While Amazon owns e-commerce today, there are many projects focused on building decentralized marketplaces.

Most miss the point though. The issue isn’t Amazon’s ~15%+ transaction fee, that is par for the course and the cost of doing business. And besides, consumers could care less how much sellers pay in fees, it doesn’t affect them.

(Plus 10% is a fraction of the 5–10x improvement needed to switch — it wouldn’t be meaningful enough for sellers to abandon Amazon entirely).

Yes, sellers care about fees, but what is more important is control. As referenced previously, Amazon sellers (like myself previously — more on my backstory here) play on Amazon’s playground.

You never knew if/when you will be uninvited — or Amazon could copy your product (Amazon Basics) and cut you out.

This creates a constant fear of suspension. If 80%+ of your business is on Amazon, what happens if you lose access?

A decentralized marketplace NEEDS to be built first and foremost by sellers. That is doable in my opinion.

Most sellers would do ANYTHING to control their company’s destiny. If that means promoting a blockchain based e-commerce platform (BBEP), you can bet your ass they would — even without tokenized incentives. Adding incentives further accelerates adoption among sellers.

But buyers are another story. Here tokenized “discounts” or “bonuses” could be used to lure buyers to the platform.

The challenge is that most sellers cannot easily access their customer base on Amazon. And to contact them and try to bring them off-Amazon can result in suspension.

Plus sellers wouldn’t want to send their own customers (ie from their standalone site or email list) to an unproven, competitive marketplace unless it was as an affiliate for other products.

Here an Amazon Affiliates type program would be necessary (ie: I sell X and recommend Y related products to past customers on the BBEP, earning tokens for each signup/sale).

This could also be employed for heavily incentivized buyer-to-buyer and publisher-to-buyer referral programs to get customers “in-the-door.”

If sufficient supply and trust were built, the platform would start to take off, with crypto-economics driving adoption. If the user experience is inferior, however, this would take a lot of time.

Plus consider the options. If Amazon has 100x the product selection, why would consumers use a BBEP? You need better prices or a huge token incentivizes initially — or today’s massive “speculative-esque” belief in the business and team to drive token appreciation.

2. File storage & web services

To be honest, decentralized file storage seems like overkill for many applications. With dirt cheap AWS/S3 file storage, you need a compelling case to justify relatively unproven blockchain based web services (BBWS).

Even the CIA (and 2000 other US government organizations) prefer AWS to their own systems — the security is superior and the price is unbeatable.

Currently, the only use case that seems valuable is decentralized file storage for other decentralized apps and protocols. When full decentralization is necessary (or wanted), it makes sense to use a service like Sia or Storj.

But even then, it will take time to scale the eco-system, ie primary customer base. Without enough dApp traction, who will blockchain based storage systems (BBSS) serve? This creates a bit of a chicken-egg scenario…

Storj claims a fully decentralized storage system where users are able to buy/rent harddrive space autonomously will make that storage cost 10–100x cheaper than centralized solutions.

I am a bit skeptical.

To store 1T of data on Storj today costs $15/mo plus additional bandwidth fees (for downloads). Google Drive is a flat $10 for that same Terrabyte (plus comes with all the additional functionality of Google Docs etc…)

Compared to AWS S3, Storj does better. While AWS/S3 is $0.023/GB/mo, Storj is only $0.015/GB/mo. But that is only a 34% improvement, well shy of the 5–10x improvement typically needed to switch products/service providers.

That said, some of the top VCs like Union Square Ventures, Sequoia Capital, and Andressen Horowitz all invested in Filecoin so maybe I am totally wrong here.

A BBSS is the simplest blockchain model to understand. Users are easily incentivized to provide storage space and customers/enterprises can save a little money on storage.

But usually when an opportunity is obvious, it isn’t a great opportunity and becomes pretty competitive, so only time will tell…

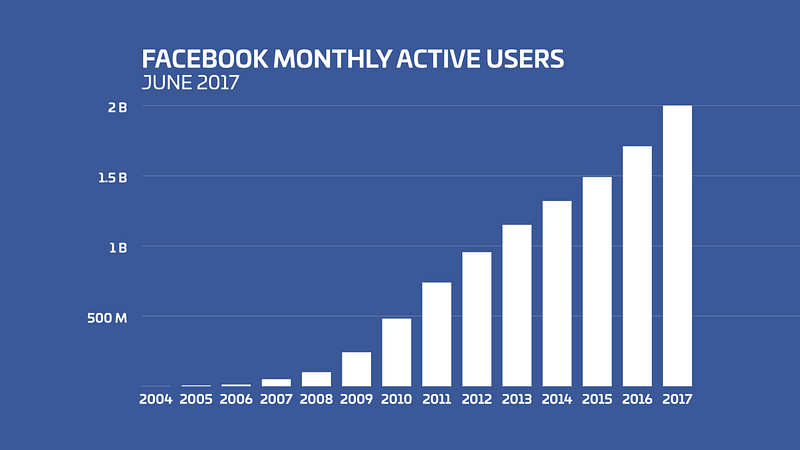

As of June 2017, Facebook hit an unprecedented 2B MAUs (monthly active users). That is nearly ⅓ of the population.

While there are several divisions within Facebook (thanks to a few successful acquisitions), Facebook is at its core a social media and communications company. We will focus on Facebook.com, Instagram, and Whatsapp/Facebook Messenger as these are their three primary businesses and those ripest for blockchain disruption.

1. Facebook.com

Facebook has over 2B monthly active users — yet despite the massive market penetration, they are still growing 16% year-over-year. How is that possible?

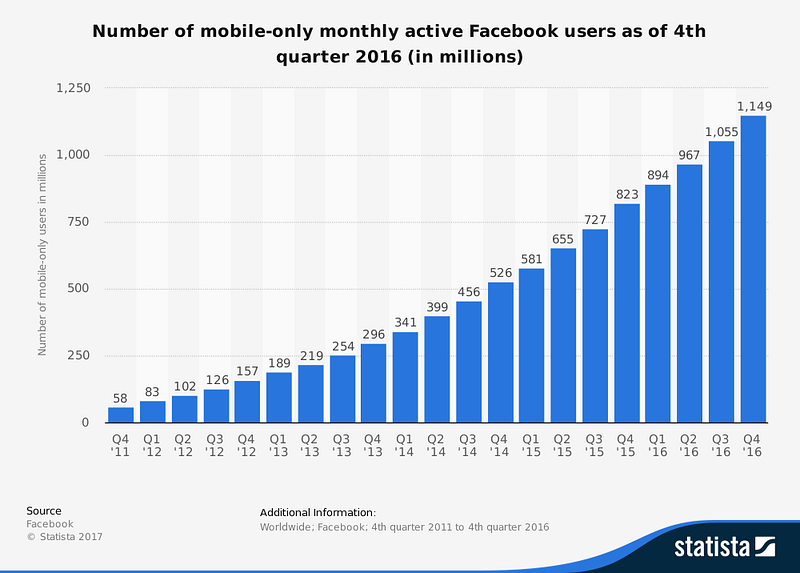

This is due in large part to the brilliant leadership of Mark Zuckerberg where Facebook bet the farm on mobile — it worked. They were able to go from ~135M MAUs (mobile only) in early-mid 2012 to over 1.15B in Q4 of 2016.

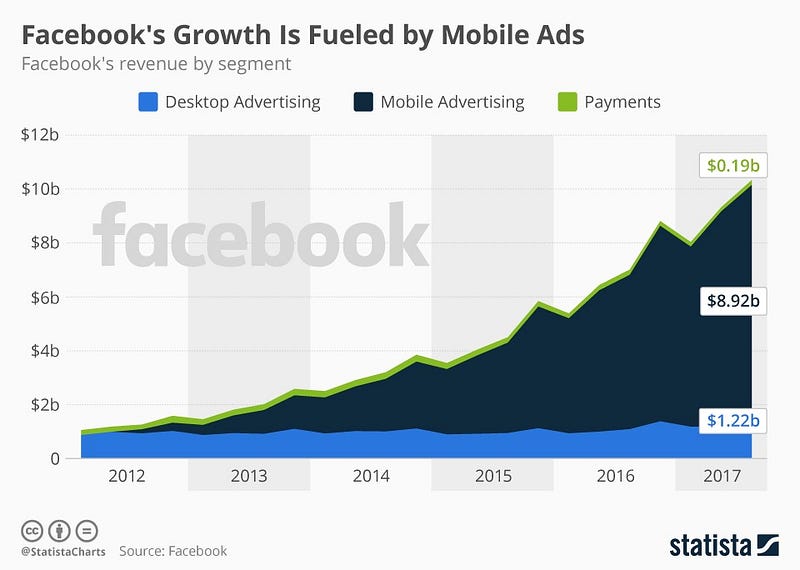

The lion share of growth has been mobile advertising — with mobile now accounting for 86% of their revenue — better than ANYONE expected.

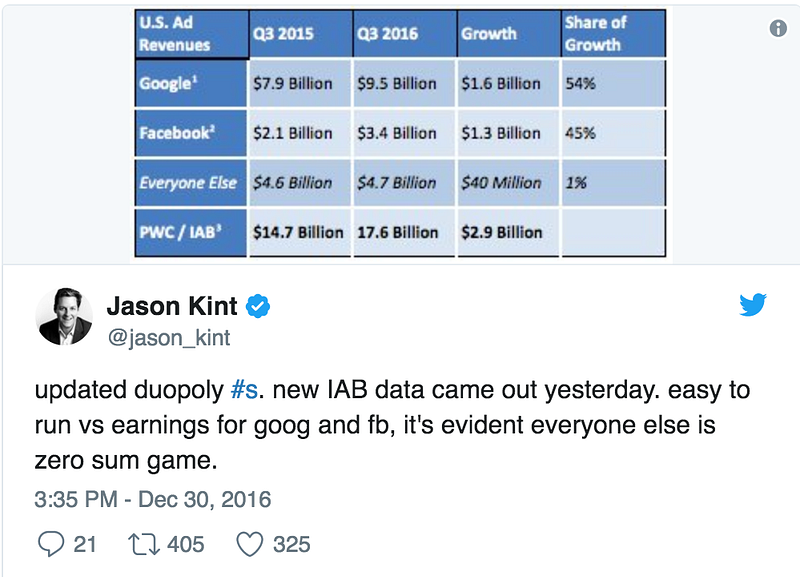

Today digital advertising is a duopoly, with Google and Facebook attracting between 57–84% of global digital (outside of China) depending on the source. (Source — FT.com, Recode).

Scarier still is the fact that the duopoly is taking >99% of new growth is digital ad spend (as of Q3 2016).

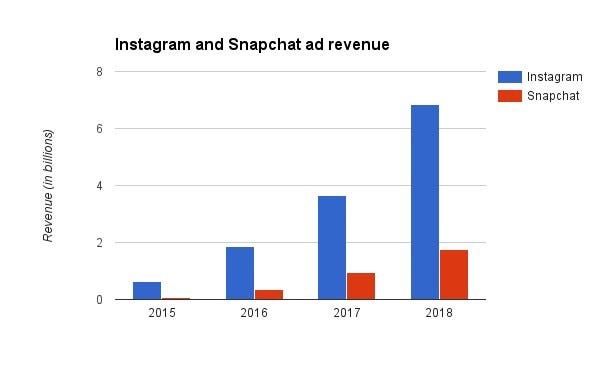

2. Instagram

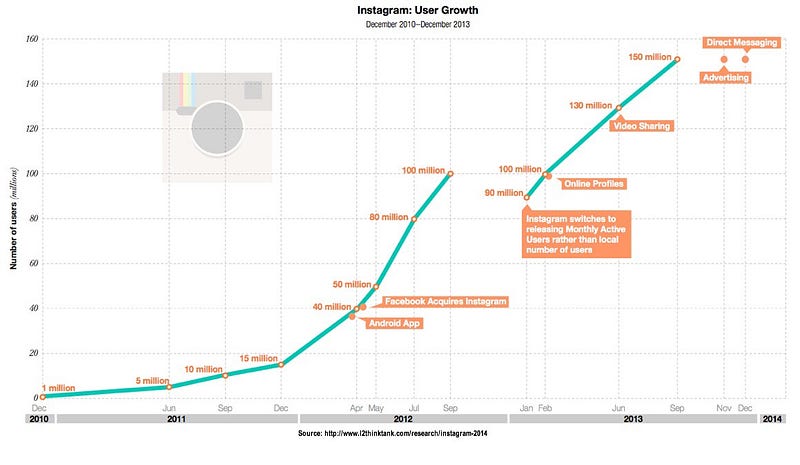

Facebook acquired Instagram in 2012 for a $1B for a pre-revenue company with 30M users (formed only 2 years prior).

After waiting 3 years to monetize (to focus on growth), Instagram turned on ads and became a cash cow.

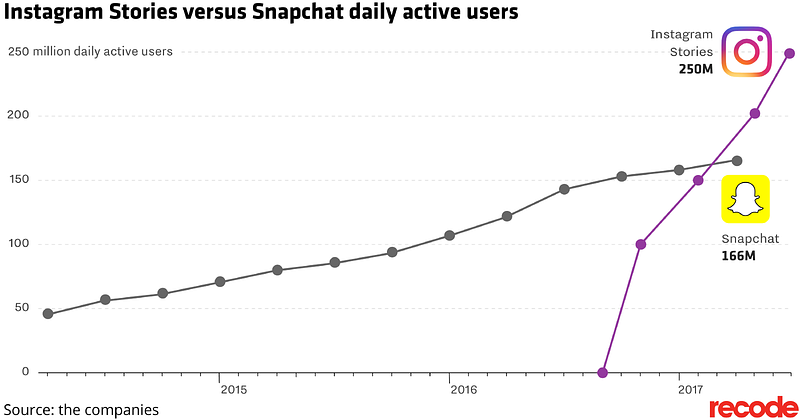

And with 100M new MAUs every 6 months, Instagram is exploding in popularity. Copying Snapchat Stories certainly helped (which Zuck was 100% happy to rip — pixel by pixel).

NOTE: Snap’s stock has dropped 50% since the ill-timed (controversial and greedy) IPO.

Plus Instagram addresses a different market (millennials) and use case than the Facebook— building their advertising base even larger.

3. Whatsapp and Facebook Messenger

NOTE: I refuse to consider Facebook messenger a messaging app as it is just the messaging feature of Facebook — thus messages from Facebook come through and grossly distort the usage numbers.

Either way, Whatsapp and Facebook Messenger are the two largest “messaging apps” worldwide.

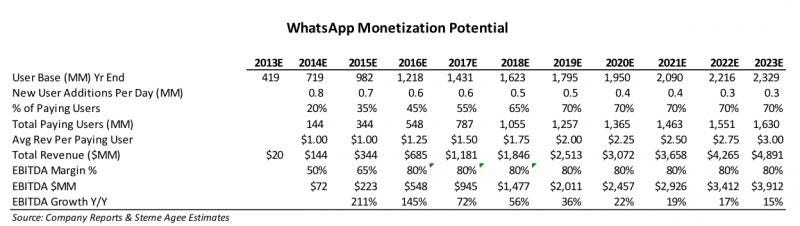

Facebook bought Whatsapp in February of 2014 for a whopping $19B, which again seemed absurd.

But Facebook’s business has ALWAYS been built around attention, eyeballs, and waiting to monetize. And if Instagram is any indication, they know what they are doing.

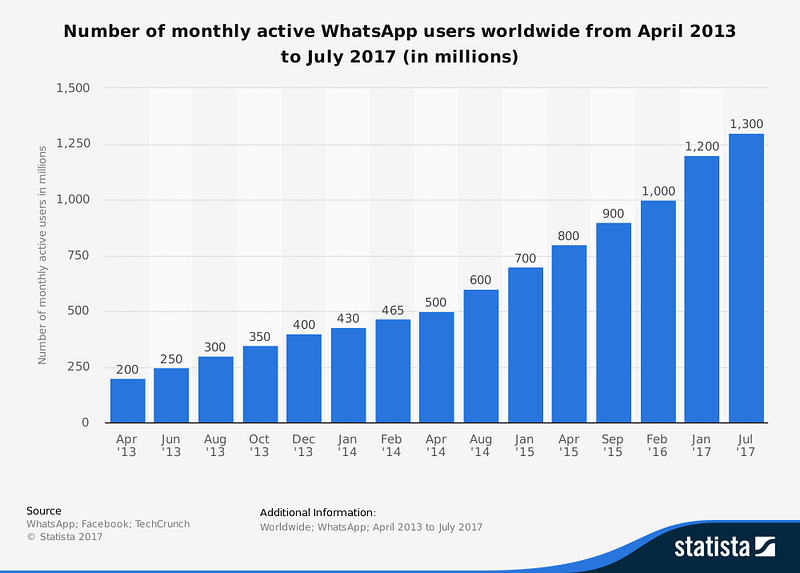

Stern Agee, the financial services company estimates Whatsapp could be generating close to $5B in revenue with over 2.3B users by 2023. I would go bigger.

Due to Whatsapp’s more private, intimate nature, it creates growth opportunities that an outward facing site like Facebook and to some extent Instagram cannot match. Essentially even if/as people become more reserved about social media, sharing and controlling their data, Whatsapp can still win — rigging the game in Facebook’s favor.

How blockchain beats Facebook

Of all the Big Four, blockchain poses the largest threat to Facebook. Facebook’s business is built on attention, advertising and collecting user data.

A network out of Harvard originally built for college hookups is now worth $524B — and users never saw a dime. They see quite a few ads though.

1. Facebook.com

A decentralized version of Facebook seems obvious at this point. In a social ecosystem without a centralized party, algorithms can be optimized for user happiness, rather than engagement.

The biggest problem with Facebook (and Google) is that they are advertising-based businesses. Facebook makes their money on impressions, making it more and more user-hostile over time to drive ad revenues.

From a purely economic standpoint, this means Zuck wants users on Facebook as close to 24 hrs a day as humanly possible.

Obviously, this isn’t sustainable, and studies show social media usage (especially Facebook) have a net negative impact on happiness. In the long term this is not sustainable for Facebook — the more you use Facebook, the worse you feel.

Russian election hacking and Jew hate based targeting aside, Facebook could have a serious problem on its hands if more and more users start to churn — which appears to be the case.

Why else would Facebook be actively trying to reduce user addiction?

Enter a blockchain based competitor…

The token incentive structure should be pretty straightforward. Like Airbnb’s refer a friend and you both get $10 credit, a blockchain based social network (BBSN) could rewards users with BBSN tokens for referrals, creating popular content, posting daily etc…

Tokens could represent virtual economies in the network (buying/selling stickers, access to certain bonuses, or even upvote/downvote micropayments) or they could be positioned as advertising prerequisites, where users could “sell” their attention or engagement to advertisers.

It seems highly likely a BBSN will pop up to compete with Facebook. The question is, will tokenized incentives be enough to overcome Facebook’s enormous network effect? I believe yes, but think it will take at least ½ a generation.

2. Instagram

Same as above, plus with the added bonus of influencers. Because Instagram is more focused on one-to-many communication, users that build followings could sell access tokens to advertisers looking to promote products in a more transparent and simple fashion.

Although outside of the target market here, I would give a blockchain based social photo site (BBSPS) a decent chance at gaining significant traction

3. Whatsapp

The odds of a blockchain based messaging app (BBMA) taking off are pretty slim. There are so many messaging apps, why build a blockchain based one? Most messaging apps are encrypted anyway so the trust and security level is relatively high.

The big challenge, however, is scale. As of July 2017, there were over 55B Whatsapp messages sent every day (Source — AndroidPolice).

Crypto kitties crashed Ethereum’s network, and that was only a few hundred thousand “transactions”.

But cryptocurrencies built on a centralized service is a different story.

The popular messaging app Kik just completed a successful ICO, raising $98M to build a “KIN” currency into their app. With 300M users as of May 2016, it is no surprise that Kik had to quickly switch off ethereum’s net to handle their volume.

Rumors are circulating that Facebook may be looking to (or starting to) implement Litecoin for p2p payments.

This would be a landmark moment not just for Facebook but for cryptocurrency — bringing decentralized, non-governmental payments to the masses.

If this is the case, Facebook could set itself up as the dominant p2p payment system. Here is why.

The banking and financial services infrastructure is old, outdated and expensive. Even newer, leaner companies like Paypal charge $0.30 + 2.9% on every transaction they process. And Venmo is in the process of starting to charge as well.

And while these may seem tiny, especially compared to traditional banking, cryptocurrencies unlock a totally new dimension of money — one that approaches 0% fees with no middlemen or hoops to jump through.

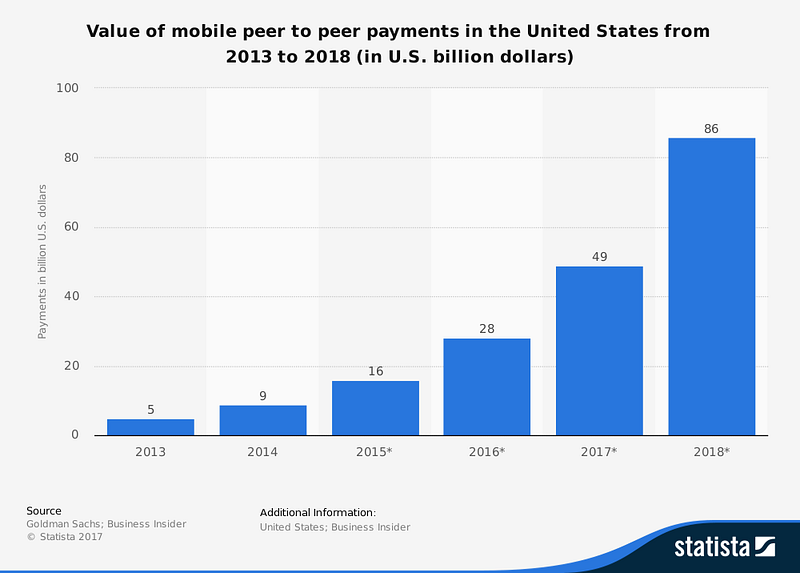

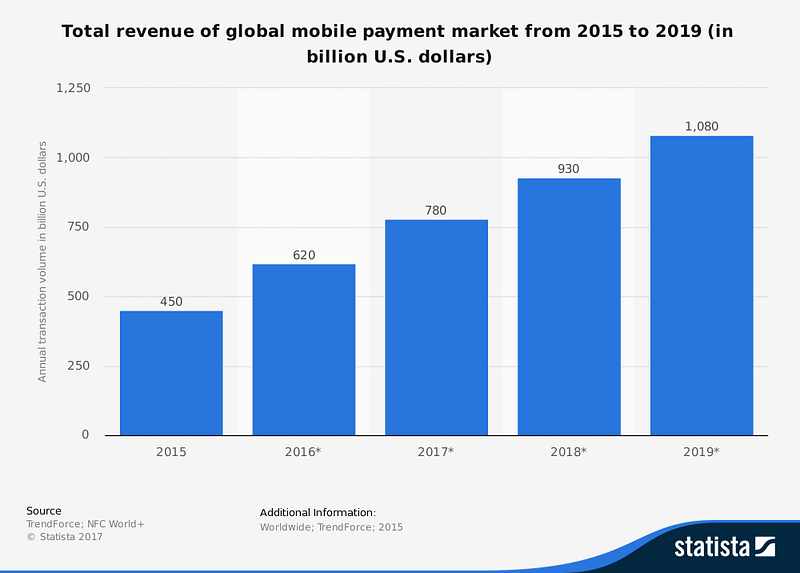

As we have seen, the peer-to-peer payments market is exploding, forecasted to reach $86B in 2018 in the US alone. And with global mobile payments expected to exceed $930B, this opportunity dwarfs the digital advertising space.

If Facebook goes big on implementing either an established cryptocurrency or creating FBcoin, they could own the messaging and p2p payments spaces.

Apple

Apple is the most valuable company and arguably the most beloved brand worldwide.

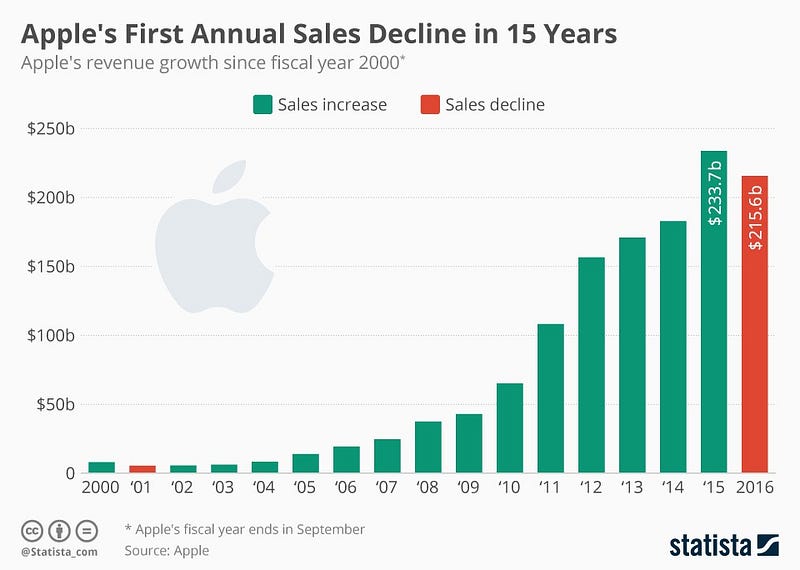

It is also a money printing machine to the tune of $215B in 2016. And that was a down year…

The iPhone and iOS

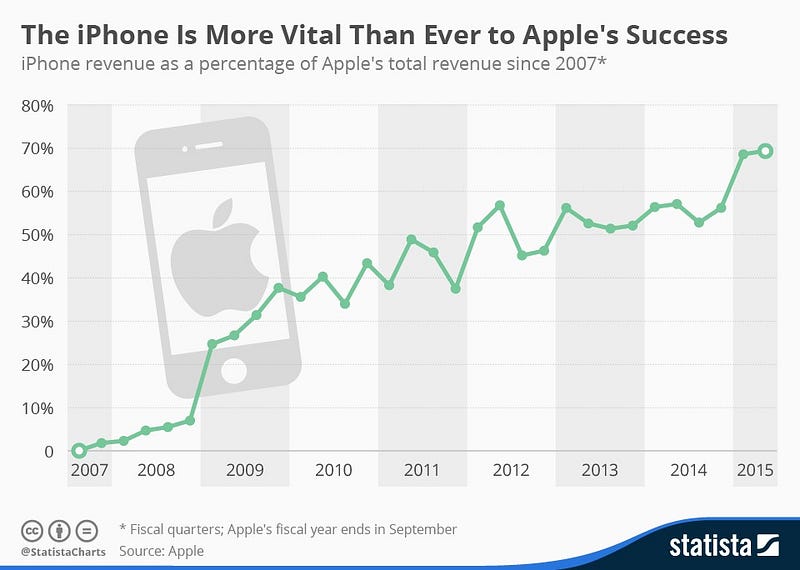

The iPhone makes up the lion share of Apple’s revenue, 69.4% of (Q1 2017).

And if we are being honest, the iPhone is the connection with consumers — the driver of iTunes, the App Store, AirPods, accessories… pretty much the whole shebang.

This creates potential problems going forward…

How blockchain beats Apple

Of all the tech giants, Apple is the least threatened by blockchain because ~80% of revenue comes from hardware.

That said, there could be issues with decentralized apps and token economies inside Apple’s closed ecosystem. The largest implications center around iOS and the App Store.

iOS + the App Store

Apple is the antithesis of decentralization. A future of dApps built on a decentralized blockchain could create a nightmare scenario for Apple.

The most obvious issue is monetization. How could Apple justify charging users to download freely distributed, open-source apps? I don’t see that ending well. And the App Store is incredibly valuable for Apple, bringing in $8.6B per year.

It has also given iOS a big leg up on Android, bringing in 75% more revenue than Google Play despite the difference in downloads. But in a blockchain based future that revenue probably goes away.

More importantly, Apple isn’t friendly with outsiders — they love control. In an open-source world, would Apple become more developer and user-friendly? I do not know.

Given the fact that Apple slows down your old iPhone when they launch a new one seems to indicate they are milking the smartphone craze for all it is worth.

And up until recently, consumers were also lied to concerning the “upgradeability” of iPhone parts. No one knew iPhone batteries were interchangeable… I cannot see a company so focused on secrecy adapting well to blockchain-based applications and transparency.

That said, Apple has better security than their Android counterparts which will be increasingly important as consumers store cryptographic assets directly on their mobile devices.

If Apple adapts, this could be a big win. If not, it could accelerate their undoing — especially because ALMOST everything depends on the iPhone ecosystem.

Closing thoughts

Blockchain technology is creating an interesting and ever-changing world.

While we have seen hundreds of ICOs promising everything under the sun, little has actually been accomplished or implemented to date. And though I am bullish on blockchain, in the long run, I believe we are headed for a coming crypto winter where teams build, markets (and market caps) crash and only the strong survive.

Thinning the herd will benefit the community, forging stronger teams and bonds among blockchain devs and the ecosystem at large.

The big questions to be answered are timeline and scale. Crypto enthusiasts claim Bitcoin and blockchain are the best things since sliced bread, but actions speak louder than words.

What are your thoughts? Which tech companies are you betting on and where do you see dApps, tokenization and blockchain based tech taking over the world? Would love to hear predictions and educated guesses in the comments section below. Which areas of the economy will be most impacted in the coming 5 years? 10 years?

This story is republished from Hacker Noon: how hackers start their afternoons. Like them on Facebook here and follow them down here:

Get the TNW newsletter

Get the most important tech news in your inbox each week.