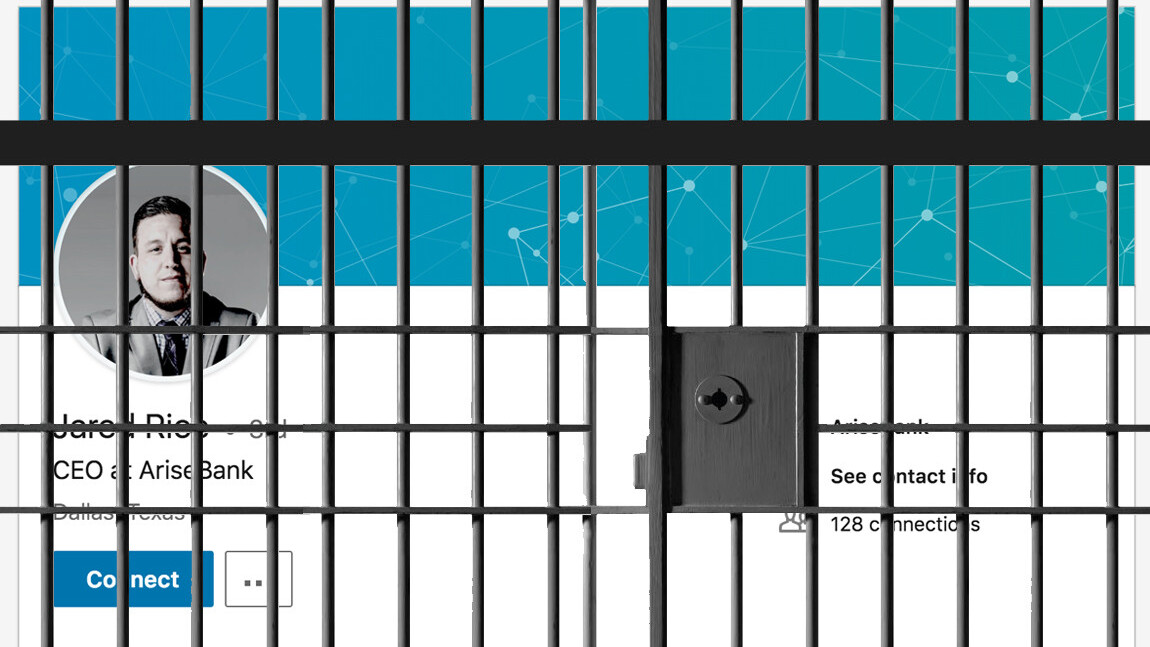

The CEO of blockchain startup AriseBank, Jared Rice, is facing up to 120 years in prison for duping numerous investors out of $4 million in a cryptocurrency scheme. Rice promised his cryptocurrency would offer Visa-like functionality, but instead he spent investors’ Bitcoin on hotels and clothes.

Rice allegedly misled would-be investors that AriseBank – which aimed to be the “first decentralized banking platform” – could offer FDIC-insured accounts and banking services, including Visa-brand credit cards and other cryptocurrency services, according to Northern District of Texas US Attorney, Erin Nealy Cox.

In reality though, Texas-based AriseBank had not been been authorized to operate in Texas, was not FDIC-insured, and did not have any agreements with Visa in place, a statement on the US Department of Justice’s portal suggests.

Still though, that didn’t stop Rice from promoting his cryptocurrency and raising millions of funds from investors – funds that he allegedly spent on hotels, food, clothing, and other costly legal services for his family.

Rice further claimed AriseBank’s initial coin offering (ICO) had raised $600 million within weeks, even though it only raised $4 million. He also eschewed disclosing that he plead guilty to state felony charges in connection with another internet business he was involved with. Meanwhile, he kept accepting funds in Ethereum, Bitcoin, Litecoin, and fiat.

“My office is committed to enforcing the rule of law in the cryptocurrency space,” said Nealy Cox. “The Northern District of Texas will not tolerate this sort of flagrant deception – online or off.”

Prior to this development, the US Securities and Exchange Commission (SEC) halted AriseBank’s ICO in March after Rice allegedly violated registration and anti-fraud provisions of US federal securities law.

Get the TNW newsletter

Get the most important tech news in your inbox each week.