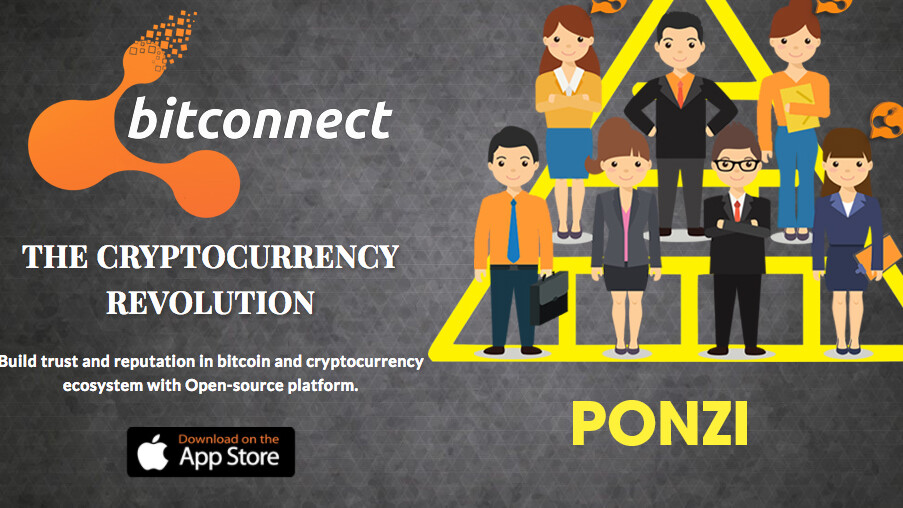

The cryptocurrency community is slowly but steadily growing more suspicious of BitConnect and its dubious business model. Crypto pioneers, including Ethereum founder Vitalik Buterin and Litecoin founder Charlie lee, have spoken up against the bullish Bitcoin investment platform, calling it a Ponzi scheme.

Shortly after former Fortress Investment Group partner Michael Novogratz took to Twitter to share his opinion that BitConnect “really seems like a scam,” Buterin and Lee also chimed in to second the ex-hedge fund manager’s criticism.

BitConnect really seems like a scam. an old school ponzi … bad actors hurt the community. period. #bitcoin #ether

— Michael Novogratz (@novogratz) November 30, 2017

Anyone who doesn't yet agree with this should watch this video:https://t.co/mA2NxKlSQN https://t.co/k2YJvWMnzE

— Vitalik Buterin (@VitalikButerin) December 1, 2017

I've been asked what I think about BitConnect. From the surface, seems like a classic ponzi scheme. I wouldn't invest in it and wouldn't recommend anyone else to.

I follow this rule of thumb:

"If it looks like a ?, walks like a ?, and quacks like a ?, then it's a ponzi." ?

— Charlie Lee [LTC] (@SatoshiLite) November 30, 2017

Backing up Novogratz’s suspicions, Buterin and Lee both noted the Bitcoin lending investment site is showing all symptoms of a “classic Ponzi scheme.”

When asked to elaborate on his stance, the Ethereum founder said the following:

Their official videos are effectively promising 1% daily returns and touting this as the primary benefit of the project.

Ethereum and bitcoin, on the other hand, are backed by a proven and consistent record of 200-700k daily txs and $100k-4m daily txfees.

— Vitalik Buterin (@VitalikButerin) December 1, 2017

While this marks the first time Lee has shared his thoughts on BitConnect, Buterin had previously expressed skepticism about the Bitcoin lending platform on other occasions.

Asked about the sustainability of its business model, which roughly offers 1-percent daily return on investments, the Ethereum founder commented that all signs seem to suggest BitConnect is running a Ponzi scheme. In all fairness, Buterin did clarify that he wasn’t all that familiar with BitConnect at the time.

Yeah, if 1%/day is what they offer then that's a ponzi.

— Vitalik Buterin (@VitalikButerin) November 2, 2017

Earlier in November, a filing on the UK Registrar of Companies revealed the British Companies House has sent an official warning to BitConnect, threatening to shut down the Bitcoin investment site and dissolve its operations.

According to the documents, BitConnect was given two months to prove “cause to the contrary” until the decision has been formally enforced.

Still, as pointed out in our previous coverage, House of Companies’ records indicate that BitConnect has been listed on its registrar under at least three different names – BITCONNECT LTD, BITCONNECT INTERNATIONAL PLC, and BITCOIN AMR LIMITED.

The concerning strike-off notice was sent to BITCONNECT LTD, but its connection to the other two entities remains unclear. In fact, many speculate that neither of these UK registrations are legitimate.

An alarming number of the individuals listed as stakeholders in BitConnect appear to be registered with inconsistent addresses and birth dates. Additionally, Twitter sleuths have since confirmed with some of the purported stakeholders that the details behind their names are indeed not authentic.

Cryptocurrency influencers had so far opted to maintain a safe distance from BitConnect and all the Ponzi talk around it, but it all but seems the situation is swiftly starting to change.

As I recently argued in another piece, when mainstream attention is finally shifting to the cryptocurrency market, every little fail could have huge repercussions for the entire market. This is why it is so important that respected figures in the community don’t shy away from openly discussing their reservations about other players in the field.

Another reason for concern is that the stunning popularity of BitConnect has spawned off a number of equally fishy copycat companies, seeking to mimic the business model of the Bitcoin investment platform, but with other currencies.

Among others, the list so far includes EthConnect (based on Ethereum), XRPConnect (based on Ripple), and NEOConnect (based on NEO).

A new day, a new scam, welcome to crypto 2017. pic.twitter.com/x7YelRTqYj

— Ponzi crypto coins (@bccponzi) November 30, 2017

Despite all the doubt surrounding BitConnect, the platform has managed to cement its position as one of the twenty leading cryptocurrencies by market share, according to stats from Coin Market Cap. In fact, prior to a re-calculation of its total circulating supply, BitConnect used to be among the top 10 biggest cryptocurrencies by market cap.

One of the ways in which the Bitcoin lending investment platform has managed to maintain its popularity is through its large network of (affiliate) promoters, defending the platform on YouTube and other social channels – though often without offering legitimate proof in return, other than screenshots of their earnings.

Do your research thoroughly before placing all your eggs in BitConnect’s basket: all that glitters is not gold.

Could not stop laughing at this!

Posted by Sam Capizzi on Tuesday, November 7, 2017

Get the TNW newsletter

Get the most important tech news in your inbox each week.