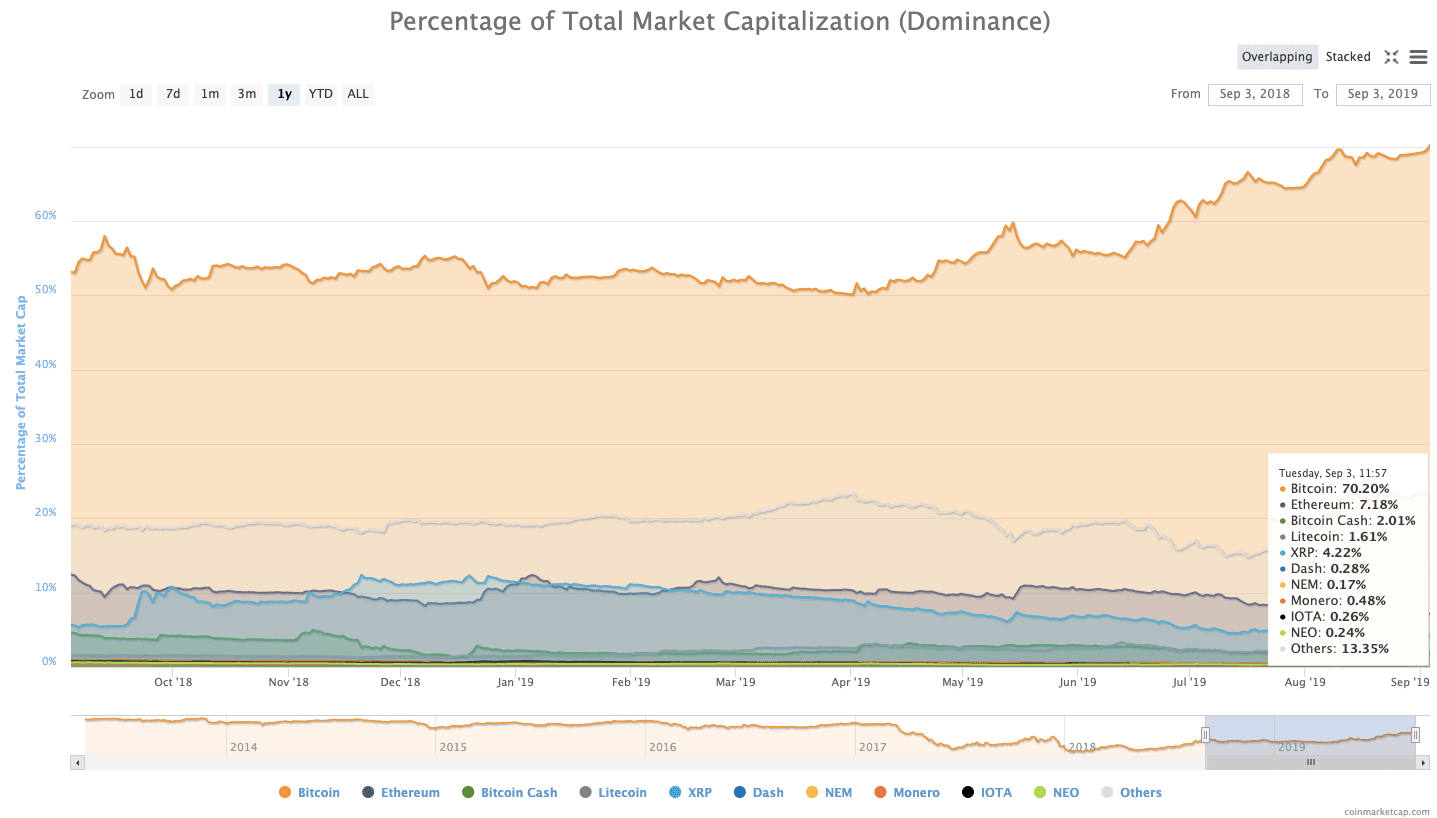

Bitcoin’s market capitalization has exceeded 70 percent of the total cryptocurrency market for the first time since March 2017 — when it was worth just $1,000 per coin.

This metric is commonly referred to as its “dominance.” It’s a rather simple estimate that’s typically used to show how popular investing in that particular currency is.

To determine the market capitalization of any particular digital asset, simply take its price and multiply it by the number of tokens in circulation (Note: circulating supply and total supply often differ).

When you see #bitcoin dominance breaking out to a new high pic.twitter.com/Mi7XYm1PTM

— Moon Overlord (@MoonOverlord) September 2, 2019

For example, if there are 100,000 Buttcoins in circulation, and they’re worth $10 each, the total market capitalization for Buttcoins would be $1,000,000.

OK, market caps and Bitcoin dominance aren’t great metrics

The thing is, market dominance and market capitalizations are far from perfect metrics. While they do provide an easy and quick overview of a particular cryptocurrency and its related market, they do nothing to represent liquidity.

For instance, one may be able to sell 100 Dogecoins for the current market price of $0.002580, but selling 1,000,000 Dogecoins for that amount would be a lot more difficult.

In that situation, the first few thousand Dogecoins could probably be sold for the current market price, but securing that price for the full million Dogecoins is unlikely.

Please

Stop

Doing

Technical

Analysis

On

The

Bitcoin

Dominance

Chart… new coins & tokens are being added all the time and the metric is close to meaningless

— Alistair Milne (@alistairmilne) April 1, 2019

So, how much are those 1,000,000 Dogecoins really worth? What about the total value of all circulating Dogecoins? Again, it depends on market liquidity, which is significantly more difficult to gauge.

There are alternatives to market caps that make more sense

This isn’t a secret among industry insiders. In fact, there’s been repeated attempts to determine more useful metrics to map the cryptocurrency market.

One interesting solution is research firm Messari’s ‘liquid market cap,’ which excludes stablecoins from the total cryptocurrency market capitalization, and makes other considerations, like accounting for the notorious “Tether premium.”

Here’s one chart describing why “BTC dominance” is a completely worthless metric.

Included data is from:

* BTC “market cap”

* all gold ever mined

* “broad” fiat money supplyLet’s focus on the real opponent please? The alts are ephemeral distractions. pic.twitter.com/FTCjZjHtPd

— Warren Togami (@wtogami) April 2, 2019

Still, there’s no harm in using Bitcoin dominance as a rough guide for market sentiment, which indeed seems to be heavily in favor of Bitcoin over anything else.

For more Bitcoin market stats automatically generated every single day, be on the lookout for articles posted by our in-house robot, Satoshi Nakaboto. You can find an archive of its posts here.

Get the TNW newsletter

Get the most important tech news in your inbox each week.