Relationships between VC and startup founders are tenuous. While both sides of the table ultimately share the same end goal of scaling a company and bringing in profit, they’re approaching it at different angles and with different step-by-step objectives. The most successful startups are often the result of founders finding ways to work with investors and VC’s – striking a balance so that both sides feel satiated. But this is easier said than done.

Often, problems arise between startup entrepreneurs and investors before any money has even exchanged hands. Part of the startup mythos focuses on the idea that the only way to achieve success is to find funding from quality investors early on, because many new business owners simply don’t have the credit to take on new loans. Entrepreneurs feel the pressure to impress a room of investors before their product is even built or they’ve launched in a marketplace. Because of this hyper-focus on securing investment, many entrepreneurs make mistakes in the pitch room that cost them the chance to secure funding. It’s easy to tailor a pitch toward what you think an investor wants to hear, but altering your message and roadmap just to secure funding will ultimately cause issues down the road.

When it comes to preparing investor pitches there are a few things all startup founders need to keep in mind, regardless of industry or investor.

Don’t overlook the basics

There’s a tried and true process when it comes to pitching investors, and they want to see that you’ve done your due diligence in following through on that process. From compiling a sound pitch deck to offering comprehensive market research, investors will not feel confident writing a check unless they can trust that a startup team thoroughly understand the market they’re trying to enter, knows their value proposition, and has built out models and financial scenarios to prepare themselves for any kind of market reaction – positive or negative.

Emphasize your team

A startup company’s team, although it is likely still growing and evolving, is one of the most important factors in assessing value and long-term feasibility. It is the job of a founder to build out a team comprised of people who bring experience, complementary skillsets, and a passion for building a product or service. Startup life is not easy, and if a team dynamic is not solid, the chances of failure increase exponentially – regardless of how groundbreaking an idea is. Another company can always come along and try a new iteration of a product idea, but bringing together a group of people who can bring a product to life is the real indicator of success. Investors want to see entrepreneurs who are just as invested in developing their employees as they are in developing their ideas.

Have an agile mindset

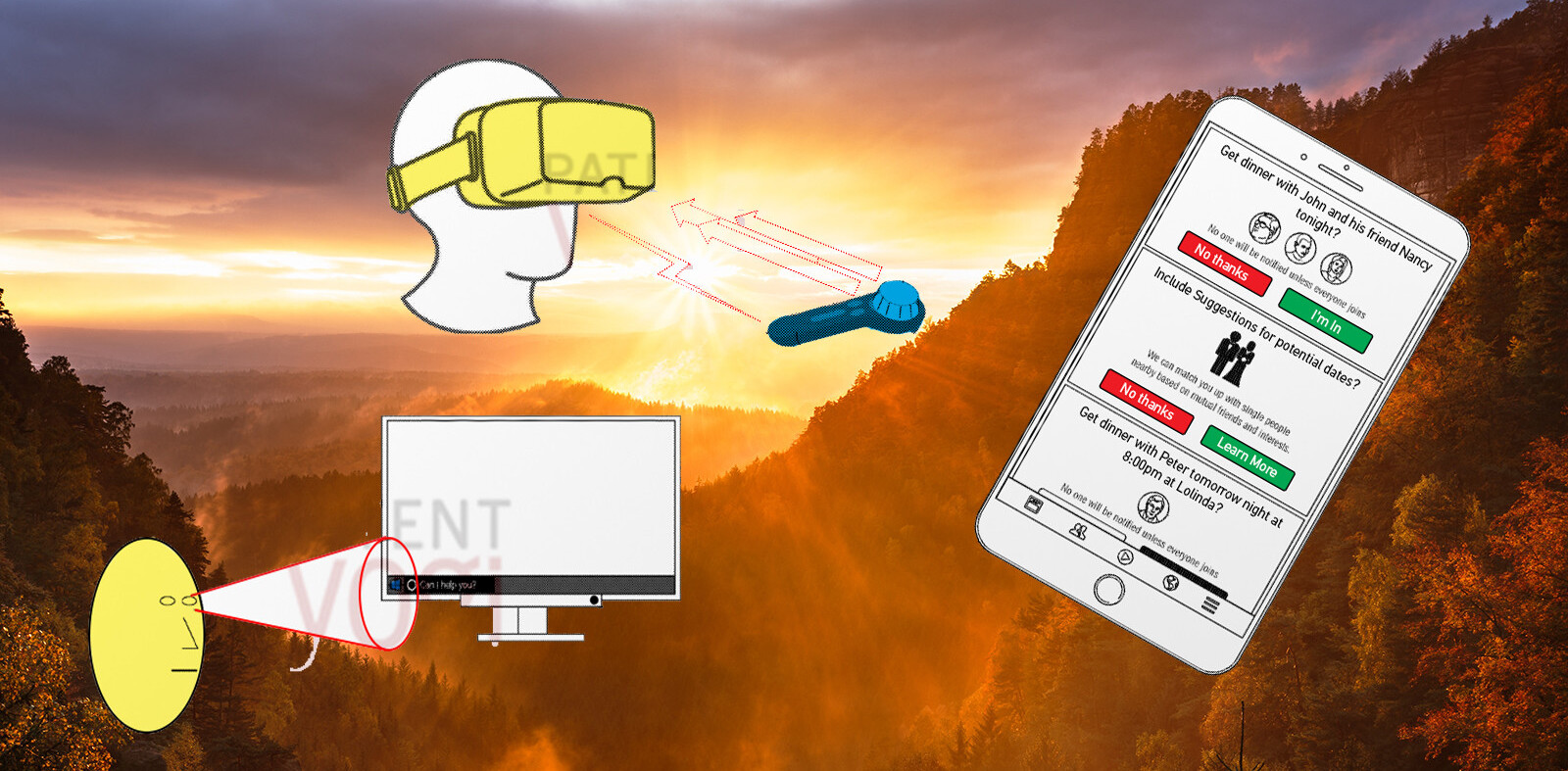

It’s rare to find a startup that has succeeded by building out the exact product or service that they originally intended to bring to market. Pivoting is part of the process. Throughout a company’s growth there are external factors that will inevitably come into play and influence the direction of the company. From emerging technology, to competitor successes and shifting consumer behaviors, startup teams have to be nimble and willing to adapt. Often lean startups are able to swiftly adapt and take on new customer touchpoints and marketing approaches, whereas startups that concentrate on building out their original visions from the get-go have a more difficult time correcting course. Being agile doesn’t just mean being open-minded when it comes to final product and service offering, but also when it comes to tackling new operations methodologies.

It’s imperative for entrepreneurs to demonstrate their potential and willingness to adapt in investor pitch meetings. But it’s also just as imperative for founders to consider the qualities they want in investors and VC partners. Investors don’t just write checks and walk away; by offering funding, they become part of the startup, which means that their ideas and perspectives will shape the company’s future as much as the founder’s. In addition to making a list of questions to better understand an investor’s objective and working style, it’s also helpful to glean the insights of other founders who may have worked alongside specific investors before. Platforms like Know Your VC make it easy to browse anonymous reviews of investors so that you know exactly what to expect before entering into a working relationship. Know Your VC offers a safe space for entrepreneurs to feel comfortable sharing their experiences and reporting abuse, so that others can learn from them. Each post is manually reviewed before going live, and the platform automatically scans for abusive language and fake reviews so that both entrepreneurs and investors can benefit fairly from the power of anonymous reviews.

Get the TNW newsletter

Get the most important tech news in your inbox each week.