The price of Bitcoin is slipping, corresponding to a decline in its exchange volume to dollars, and a decidedly negative operating margin for those working to ‘mine’ the currency. Currently, Bitcoin trades for roughly $73.

The dizzying assent of Bitcoin was followed by a predictable fall. What would come next for the virtual currency, however, was an open question. Advocates of Bitcoin predicted a reinflation of its value, and deeper integration of it into the financial world and lives of its users.

Undoubtedly, Bitcoin has found new entrance and exit points into the Internet realm, with companies that are fans of the currency now accepting it as payment in lieu of traditional money. However, now in its post-explosion phase, Bitcoin appears struggling to hold its inherently invented value.

That isn’t as pejorative as it sounds: the current currency market depends on trust, and agreed upon value that often isn’t backed by physical assets. Gold fanatics call this lunacy, but the simple reality is that fiat currency is our only option without a comical constriction of our monetary pool, or a nightmarish advance in the value of the metal. This is a negative for Bitcoin in that it isn’t state-backed; the irony of that is the precise lack of backing that could lead to its deflation is the same freedom that its advocates tout. Bitcoin is an exceptionally interesting experiment.

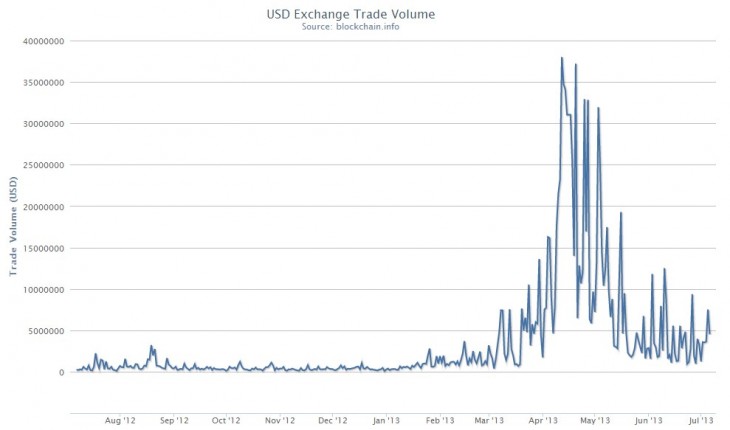

Here’s a quick chart, via BlockChain – a Bitcoin tracking service – that details how Bitcoin’s exchange volume into dollars has slowed:

A lower exchange volume is indicative of a less fluid marketplace; for a currency to proceed, it needs to have a liquid foreign exchange market. If not, it becomes a monetary dead-end, and one that is eschewed.

Here’s another kicker from BlockChain: The current operating margin on mining new Bitcoins is -34.39 percent. That discourages the mining of new coin, lowers the inherent value of marginal units of the currency, and therefore its extant circulation as well.

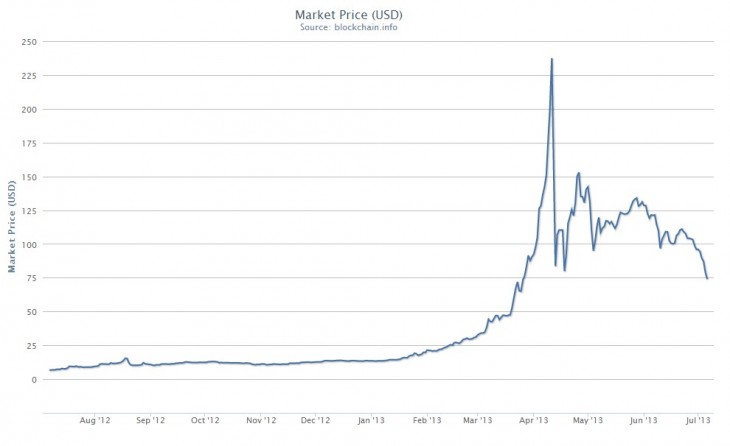

The above friction is embodied in Bitcoin’s slipping price:

This is an almost academic chart in its exemplification of a boom, dead cat bounce, and later decline. You can see the price floor at $100 per attempting to stay valid, but a lack of buy-side pressure has simply lead to a decline in price.

The question is now this: How can demand for Bitcoin steady its value, and begin advancing its worth?

Top Image Credit: Luz Bratcher

Get the TNW newsletter

Get the most important tech news in your inbox each week.