All eyes in the tech industry are on Chinese e-commerce giant Alibaba after it finally kickstarted its long-awaited IPO by submitting its prospectus.

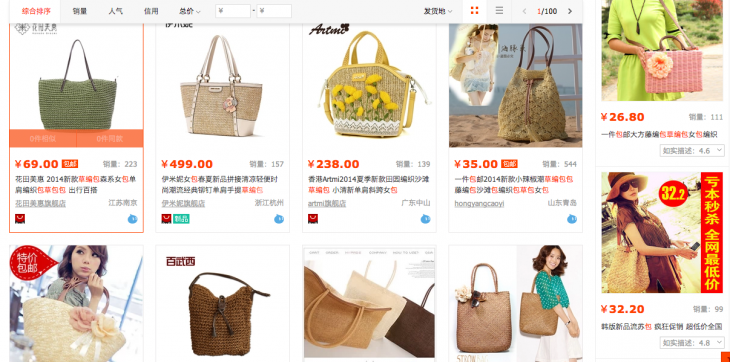

We noted earlier that as many talked up the event, which may very well be the world’s biggest IPO potentially raising up to $20 billion, some in the US are puzzled that Alibaba hasn’t explicitly announced plans to expand its consumer-to-consumer eBay-like empire into the US — think in particular of its marketplace Taobao.

On the other hand, Alibaba has always had international business-to-business operations. It also has AliExpress, which pivoted last year to allow individual consumers to purchase goods from Chinese manufacturers at wholesale prices, that is linking China up to the world.

Alibaba Vice Chairman Joe Tsai told Forbes in a recent interview: “We think of international by what we can do in a cross-border context. It’s one thing to think of exporting from China, which is what we have done a lot to date. But it’s another to situate ourselves in other countries.”

Even though Alibaba has launched its Taobao marketplace in overseas territories including Singapore, Hong Kong and Taiwan, its site is still in Chinese and features sellers from China. That is, Alibaba may not currently be venturing into overseas territories by setting up a Taobao for US businesses and consumers, for example.

However, it sure is busy finding ways to cooperate with various companies in countries beyond China — and this sheds some light on how it’s paving the way for Taobao US to happen eventually.

Expanding through partnerships

First up, Alipay. It appears that Alibaba is taking steps to lay an e-commerce infrastructure overseas, of which its payment solution Alipay is a key part of. Other than enabling overseas merchants to reach Chinese customers with spending power, bringing Alipay global means that Alibaba will have a ready-to-go payment mechanism that can be used to set up its own overseas consumer-to-consumer business.

Alibaba recently announced a deal with online shopping mall Lotte.com and Japanese e-commerce juggernaut Rakuten, opening the company up to retailers in Korea and Japan, two big e-commerce markets. Alibaba also revealed that popular British fashion e-commerce site ASOS has also added Alipay as a payments option.

Aside from facilitating payments, actually getting the goods to customers is another key part of e-commerce, and Alibaba is expanding its logistics footprint outside of China too.

This explains why Alibaba has just announced a S$312.5 million ($249 million) investment into Singapore’s national postal service provider SingPost, seeking to tap on its international logistics capabilities.

Recently, Alibaba also inked an agreement with Australia Post in a bid to help more Australian merchants sell to Chinese consumers through Tmall, which is a third-party platform selling products from major brands and retailers. This saw the launch of Australia Post’s flagship store on Tmall to offer Australian products to Chinese consumers. The agreement also involved Alipay, which makes it easier for Australian consumers to buy goods from China.

With this series of deals, it is clear that Alibaba has already set its global ambitions into pace. However, what it’s doing is ditching the trouble of creating an entire ecosystem as it has done so in China — and creating ties with foreign firms that will eventually stand it in better stead when it comes to a reputation and when it concerns intellectual property.

This strategy is also taking shape in the US, as Alibaba is starting off in the background first.

Alibaba confirmed plans earlier this year that it would be launching an online shopping site through its subsidiaries Vendio and Auctiva, called 11 Main. It is likely going to link up retailers on its platform to the site as well, a tactic which can already be seen in San Francisco-based mobile shopping app Wish. The startup works with retailers on Alibaba’s shopping platform Taobao to deliver items at a lower cost to their shoppers.

Hans Tung, who is a managing partner at GGV Capital, which was an early investor in Alibaba, told TNW in a recent interview that it is best for Chinese firms to start with Southeast Asia first or India, and over time step into the US. GGV Capital recently announced that it has raised $620 million for its fifth venture capital fund that will go to supporting more companies across the US and China.

“In the US, there will be a lot of IP battles, so I think what a Chinese company should do is tackle emerging markets first, and emerge bigger so they have a chance to win an IP war when they come to the US,” he said.

GGV Capital links up US and China

Tung said that there’s “no question” Alibaba has its eye set on the US:

A lot of people don’t realize how fast mobile commerce is growing. I invested in a company called Wish, they’re going to do hundreds of millions of dollars in GMV (gross merchandise volume) this year in the US and Europe, and all of the products you buy on it come from suppliers on Taobao. It’s growing very fast in tier two, tier three cities in the US.

What people don’t realize is that you can buy something on Amazon or Walmart, but the Walmart store has only 180,000 SKUs (stock keeping units). That sounds like a lot, but on Taobao it’s 8 million suppliers, so the SKU is 8 million. There is a lot of long tail that people don’t know about. Manufacturers in China manufacture for top brands in the US and Europe… You can get the same product manufactured by the same suppliers but at one-third or one-quarter of the price.

Tung told us that this means even small firms or individual entrepreneurs in the US and Europe can disrupt major brands by sourcing directly from suppliers in China, the same proposition that popular Chinese smartphone manufacturer Xiaomi has applied to its business — using first-tier suppliers, a direct sale model to the end-user and listening to customer feedback consistently.

This could lead to a mass of small sellers selling directly to consumers online, just like how Taobao looks like now in China. He believes that eventually Alibaba will launch a similar product to its Taobao marketplace in the US, but it will not look like Taobao.

“But the price will be cheap enough and there will be enough selections that people are willing to experiment, and that’s something Walmart or Amazon are not used to playing,” he said.

Alibaba’s future road in the US

It looks like Alibaba is taking the exact route that Tung has pinpointed — given that Chinese firms need a certain sense of confidence to conquer the US market, it makes sense to lay foundations all over the world first by inking deals with foreign companies, before taking the leap to target US consumers directly.

This means extending networks, gaining retailers and buyers in market by selling its strong base in China to the world and building up a reputation, laying an infrastructure, then launching a local version for specific countries if needed.

In any case, Alibaba is getting more press in the US because of its IPO, and that is sure to help boost its reputation there. Over time, it will be no surprise at all to witness the launch of a US version of Taobao and Tmall — giving current US e-commerce stalwarts such as eBay and Amazon a good run for their money.

Headline image via Peter Parks/AFP/Getty Images

Get the TNW newsletter

Get the most important tech news in your inbox each week.