This article was originally published by Lenny Rachitsky as issue 25 of his newsletter. You can read the original piece here, and sign up to the newsletter here.

The only thing that matters is getting to product/market fit. — Marc Andreessen

I’ve noticed that most people (including myself) have only a vague grasp on what Product/Market Fit actually is. And even fewer people are going after it in a systematic way. For my own benefit if nothing else, last year I began collecting the best descriptions of PMF that I came across from Twitter, podcasts, books, and blog posts.

Below, I’ve put together my favorite (and most actionable) definitions of product/market fit, broken up into pre-product and post-product, and sorted from the most concrete to least concrete. I’ve also added my favorite guides for finding PMF. If you’ve come across anything better, or have gone through this journey yourself and have a story to share, I’d love to hear it.

What to look for pre-product

1. Visible excitement

“The real metric for both consumer apps and enterprise is — do someone’s pupils dilate when they use your stuff? Whether you’re handing them a demo or if you drew something on the whiteboard. Do they say, ‘You’re not leaving’ or ‘Where have you been all of my life?’” — Steve Blank (at 1:30m)

“You have very strong customer feedback, even from a small group of people. For example, at Color early on, we were getting literal love letters from customers.” — Elad Gil

2. People are willing to pay for it now

“Are people willing to pay you for this product? Ask them this directly. Even try to get them to pay you now (i.e. literally send them an invoice) to get early access to the product. Nothing will be a better signal of interest and PMF if you can get people to put down money before you have a product. Try this even if it’s a consumer app that you won’t charge for — it’ll show you how much value you’re creating in people’s lives.”

What to look for post-product

1. Retention – users stick around

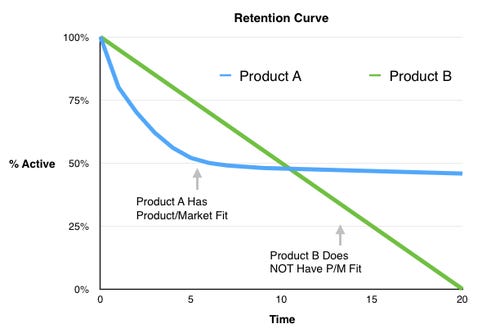

“Plot the % active users over time (for various cohorts) to create a retention curve. If it flattens off at some point, you have probably found product/market fit for some market or audience. — Brian Balfour

“Do a cohort analysis. Look at a group of people that tried your product in a period of time (e.g. during one month). Then look at how many of those people continue to use your product later (e.g. 12 months later). You will have a fairly deep drop-off on the first month, that’s OK. What you want to know is, does it flatten somewhere? If it flattens, that means there is a group of customers that are finding value in your product, which means you have PMF, at least for those customers. The ability to acquire users at less than the amount of money you make from that curve represents your true product/market fit. — Casey Winters

“Long term cohort retention is the best metric for determining if there is product market fit. Once you have a few cohorts that level off at a vertical-specific number, then you’ve achieved product market fit!

Different types of products have different points of product market fit, so it’s important to find the retention rate of some comparable products that have been able to significantly grow to find the right benchmark for you.” — Jeff Chang

2. Surveys – users say they’d be very disappointed if your product went away

“Survey your users and ask them ‘How would you feel if you could no longer use the product?’ and measure the percent who answer ‘very disappointed.’ If that percentage is over 40%, you have PMF.” — Sean Ellis / Rahul Vohra

“For enterprise businesses, at the end of your free trial, you should pull the trial. If the customer doesn’t scream, you don’t have PMF. Because if they aren’t going to buy it at the end of the 30 days, they aren’t desperate. And if they aren’t desperate, you don’t have PMF.” — Doug Leone / Andy Rachleff

3. Exponential organic growth

“For consumer apps, you start to experience ‘exponential organic growth’, driven by word of mouth.” — Andy Rachleff (starting at 3:00)

“The only way you know if you’ve built what customers want is because they are using it in an explosive and destructive way. If you are not getting explosive usage you are not building what customers want, or there aren’t that many customers which means you don’t have a big business. — Michael Seibel

“I think the right initial metric is ‘do any users love our product so much they spontaneously tell other people to use it?’ — Sam Altman

“Organic growth is the key indicator of product/market fit. People love to seem smart and cool. They want to recommend something great to their friends. They don’t need a share button to do it. If they love your product, they will tell people about it. Ideally more than 50% of your new accounts come from direct or organic traffic.” — Merci Victoria Grace

“If you’re a SaaS company and you have major brands finding and using you organically, and paying for your product, that’s a sign of PMF. Examples of that would be PagerDuty, which had Apple as an early customer. Zeplin, which had Facebook using them very early. Airtable has all sorts of brands that have adopted it.” — Elad Gil

4. Cost-efficient growth

Burn Multiple = Net Burn / Net New ARR

The higher the Burn Multiple, the more the startup is burning to achieve each unit of growth. The lower the Burn Multiple, the more efficient the growth is.

This is a Measure of Product-Market Fit. The startup that generates $1M million in ARR by burning $2M is more impressive than one that does it by burning $5M. In the former case, it appears that the market is pulling product out of the startup, whereas in the latter case, the startup is pushing its product onto the market. VCs will make inferences about product-market fit accordingly. — David Sacks

“For enterprise businesses, look at the contribution margin of a sales team, divided by the total cost to field the sales team… A sales team may cost on the order of $500k – $600k. When a company gets to a sales yield of greater than 1.0, that’s how you know you’ve hit PMF.” — Andy Rachleff (starting at 4:30)

5. CAC < LTV

“You have found product/market fit when you can repeatably acquire customers for a lower cost than what they are worth to you.” — Elizabeth Yin

“Here’s my simple definition of product/market fit: The value of each user is greater than the cost of bringing them into the product. It means there are enough customers out there and you can efficiently bring them in” — Nikhyl Singhal

“You have PMF when you see retention that creates enough $ or content/virality to drive sustainable acquisition.” — Casey Winters

6. Customers clamor for your product

“You can always feel product/market fit when it’s happening. The customers are buying the product just as fast as you can make it — or usage is growing just as fast as you can add more servers. Money from customers is piling up in your company checking account. You’re hiring sales and customer support staff as fast as you can. Reporters are calling because they’ve heard about your hot new thing and they want to talk to you about it. You start getting entrepreneur of the year awards from Harvard Business School. Investment bankers are staking out your house. You could eat free for a year at Buck’s.” — Marc Andreessen

“Are people grabbing the product out of your hands saying I want it, or I’m using it, or I’m buying it, or I’m downloading it, or I’m giving you my email address.” — Steve Blank

“Founding a startup is deciding to take on the burden of Sisyphus: pushing a boulder up a hill.

Pushing a boulder: don’t have product/market fit. Chasing a boulder: have product/market fit. Both are very demanding, but feel totally different. If you’re still pushing the boulder, you don’t have it yet.” — Emmett Shear

7. People are using it even when it’s broken

“If your product is broken and people are still using it, if you have high retention with a broken product, that’s a clear sign you have PMF. When Twitter was constantly going down in the fail whale days, and no one moved off of Twitter. That was a sign of raw market adoption.” — Elad Gil

“A great measure of product/market fit, particularly in consumer, is when a company is growing quickly despite poor execution and management.” — Brett Berson

“When the customers want your products so badly that you can screw everything up and still succeed.” — Don Valentine

Guides for finding product/market fit:

- The Lean Startup Playbook for Achieving Product-Market Fit by Eric Ries

- The Never-Ending Road To Product Market Fit by Brian Balfour

- The Only Thing That Matters by Marc Andreesen

- How To Find Product Market Fit by David Rusenko

- How Superhuman Built an Engine to Find Product/Market Fit by Rahul Vohra

Three bonus tips:

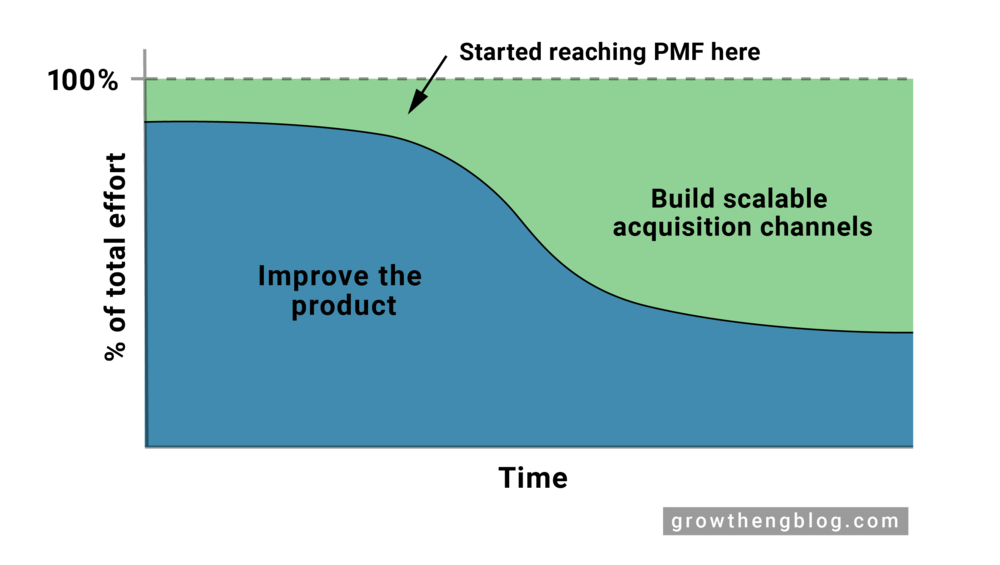

My number one predictor of whether or not a company will find product-market fit: High shipping cadence.

— Naval (@naval) May 14, 2019

1/ If you don’t have product-market fit, your startup is fucked. You probably don’t have it if:

You aren’t growing

You have high churn

Your product is hard to sell

Customers don’t seem to care that muchHere are some simple steps to find product-market fit

— Justin Kan (@justinkan) May 29, 2019

Product-market fit pic.twitter.com/Wx8DlovsNt

— Ryan Hoover (@rrhoover) January 21, 2020

Lastly…

“Product/market fit isn’t a one-time, discrete point in time that announces itself with trumpet fanfares. Competitors arrive, markets segment and evolve, and stuff happens—all of which often make it hard to know you’re headed in the right direction before jamming down on the accelerator.” — Ben Horowitz

Get the TNW newsletter

Get the most important tech news in your inbox each week.