“We don’t have product market fit.”

The board room fell silent. How could a rapidly growing company with a $50 million revenue in a hot category not have product market fit? Yet having invested over $100 million, we as the board had just realized that lack of product market fit imperiled the business.

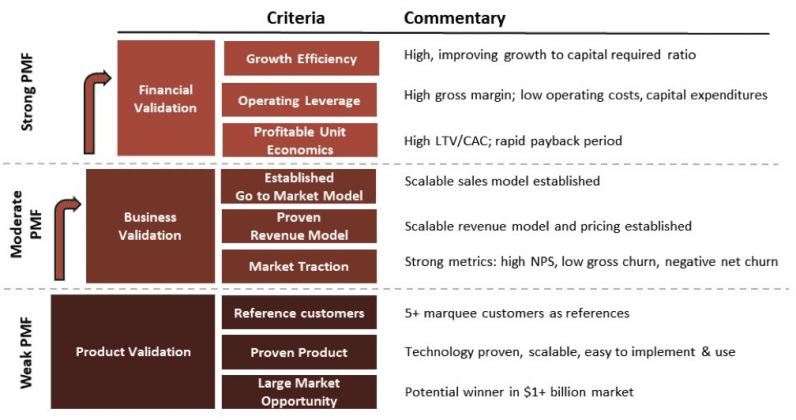

Product market fit (PMF) has evolved as a concept over time. Moreover, PMF requirements increase as a business matures. Here is a schematic that my team uses to assess PMF prior to investment and among our portfolio companies:

Across over 100 investments and over 50 exits at NGP Capital, we found that, unsurprisingly, company success is correlated with PMF. It was striking to observe the extent to which company success differed across these three PMF stages.

[Read: Here’s why ‘if you build it, they will come’ is shitty advice]

Among our exited companies, those with Product Validation when we initially investment ultimately had a 25% success rate with success defined as a positive financial outcome for investors and founders. Companies with Business Validation had a 50% success rate. Those with Financial Validation have had a 100% success rate.

Optimizing product market fit

Entrepreneurs and investors have a shared interest in optimizing company outcomes — or maximizing value for risk assumed and capital or time invested.

We have found that understanding the key elements of PMF and taking a systematic approach in validating the product, business, and unit economics at each stage can optimize company outcomes. Following are five principles that we have observed among our company successes:

1. Avoid premature scaling

A leading cause of startup death is mistaking early traction for PMF. Companies win markets by being first to PMF, not first to market. Hiring after PMF speeds up companies. Hiring before PMF slows companies down, increases burn and risks a death spiral.

As Warren Buffett observed, “Only when the tide goes out do you discover who’s been swimming naked.” In the aftermath of the Softbank-sponsored steroid era, there will be many new nude beach postings.

2. Go deep before trying to go broad

Focus on and win a market segment. This is the fastest, most efficient way to test PMF and the business model at scale. As an example, Ganji first proved its mobile classifieds business in Beijing, then developed its expansion playbook and tested transferability of its model to a new city when launching in Shanghai.

Only after winning Shanghai did Ganji expand rapidly across China. Ganji sold for $3.6 billion in 2015, the largest tech acquisition in China at that time.

3. Iterate quickly

In biology, species that reproduce rapidly (r-selection) survive and thrive best in unstable ecologies. The same applies to startups. Rapid iteration is essential for success in any fast-changing environment. Market segmentation allows companies to run multiple carefully designed experiments in parallel to test key hypotheses and optimize business models.

For instance, UCWeb, a mobile portal that Alibaba ultimately acquired for $4.9 billion, ran A/B tests daily. Similarly, Lime opened initially in a half dozen cities of varying size and demographics to test variations on its shared bike and scooter offerings before expanding to over 100 cities.

4. Focus on revenues

This may sound obvious, yet I frequently hear companies say, “We are focusing on growing our user base before we monetize it.” Monetizing is essential to strong PMF and is often harder than anticipated.

Serving as a prime example, Moovit launched its public transit app in over 2000 cities and had over 50 million users before seriously testing revenue models. CEO Nir Erez now acknowledges that he should have started much earlier.

Though it took much longer than expected, Moovit is fortunate in finding a revenue model that scales. Too often funding runs out before a company with great traction learns how to monetize its users.

5. Measure product market fit

NGP Capital benchmarks companies using key metrics for each of the nine categories identified in the above schematic. While entrepreneurs are understandably focused on their business, peer group comparisons help them see where their companies must improve or course correct. Growth efficiency — a ratio of revenue growth to burn rate — should improve over time if a company has PMF.

High-performing companies tend to be early adopters of Net Promoter Scores. Phil Koen converted Intermedia, a cloud services business, to NPS early in his tenure and reported it in his CEO report at each board meeting signaling his focus on customer service. Intermedia thrived under Phil’s watch and ultimately sold for about $500 million.

While varied in nature, startups follow a common path to success. Buzz around unicorns and large funding rounds easily distract founders from the mundane, but more vital, task of achieving PMF. Product market fit accelerates revenue momentum, shortens sales cycles, lowers customer acquisition costs and produces more lucrative outcomes. Ultimately, as the points above suggest, you may be pleasantly surprised to find that success is the accumulation of small things done well.

Re:Brand: Did you know we have an online conference about digital marketing coming up? Re:Brand will share strategies on how brands can still succeed in these unprecedented times.

Get the TNW newsletter

Get the most important tech news in your inbox each week.