Women’s Day is a day when we celebrate the achievements of the amazing women founders, developers, and VCs that are bringing innovation and disruption to the Dutch tech ecosystem.

But it should also be a day when we confront the barriers and challenges women continue to face. The fact that International Women’s Day still exists is both a sign of progress but also a sign that, in our society, inequality is endemic and not always clearly visible on the surface. The ultimate goal will be when everyday is ‘Women’s Day.’

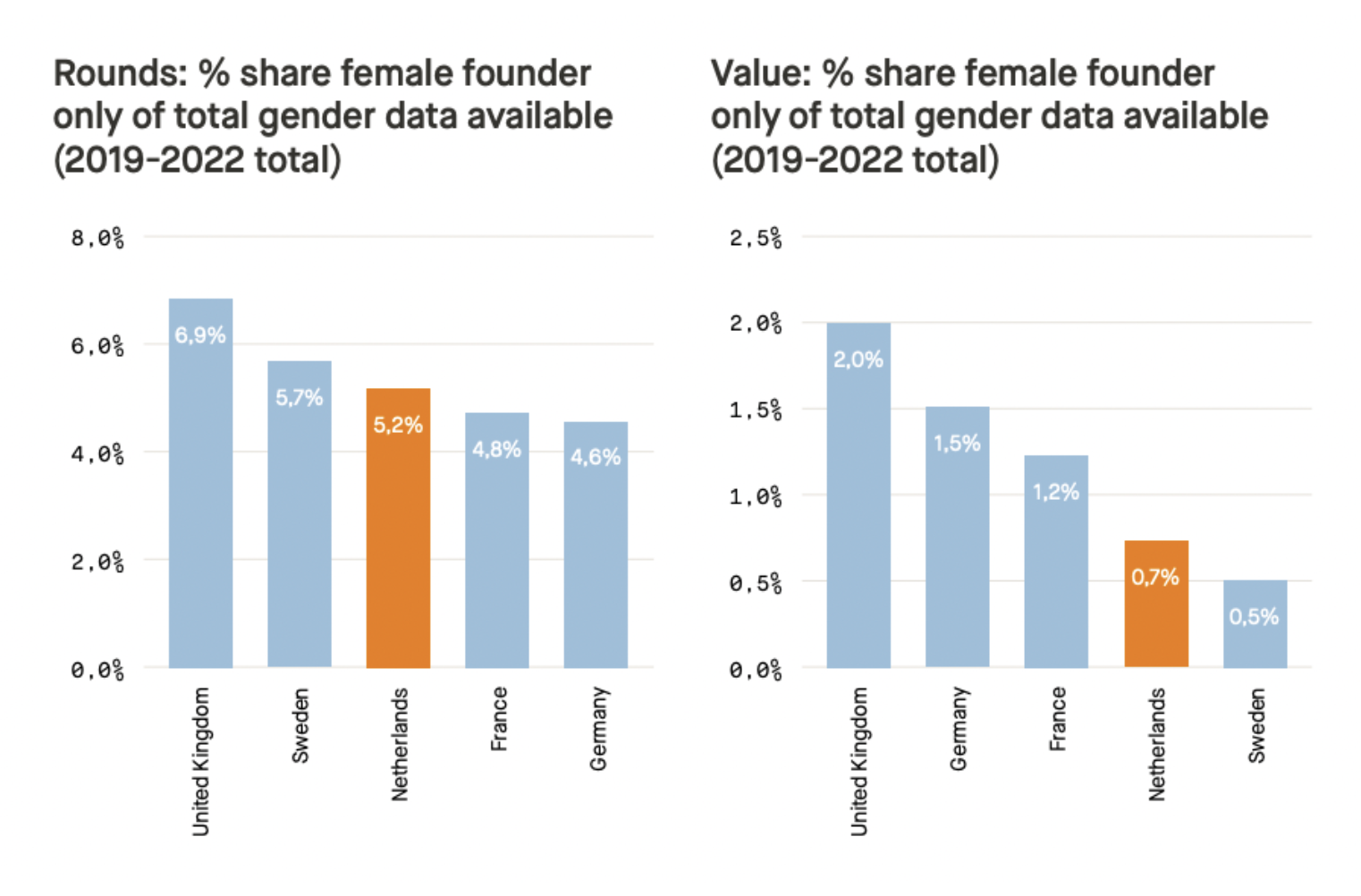

Although we’ve made progress and we should celebrate that, the truth is that we’re still far from reaching this point. According to Techleap.nl’s State of Dutch Tech Report 2023, women-led startups account for only 5.2% of all VC deals and just 0.7% of funding raised.

An important point that we need to bring home is that ‘women’ is an extremely broad term that doesn’t take into account the intersectionality and thereby diverse experiences women in the tech industry face when launching and growing a business.

One example of this is the fact that the Netherlands has little to no data on women of colour founders, from how many are represented in the ecosystem to how much funding they receive.

As we’ve covered in the past, Europe and the Netherlands’ diversity gap is largely hidden due to a lack of data. And this problem is particularly acute in a country which is trying to attract a large amount of tech talent from abroad. As a Black Latinx female founder, Christina Caljé told TNW she sees Europe, and the Netherlands in particular, as being “five to 10 years behind” the USA in the ethnic diversity conversation, in part because of the lack of data.

There’s not really a conversation yet from a professional perspective [on ethnicity]. When you talk to the stakeholders who would be well-positioned to try to lead, launch, or fund programmes, you always get down to this issue: ‘Well, is it really a problem here in the Netherlands? We don’t really have the data around it, so we can’t really diagnose this as an actual problem to address.’

That’s why this Women’s Day we want to focus on women of colour who’ve built successful tech businesses in the Netherlands. We want to celebrate their achievements, share their words of wisdom, and, most of all, hear from them about what they think needs to change to clear the path for the next generation of founders.

1. “The ‘typical’ investor often can’t relate to us” — Micky Chen

Many students struggle with the same issue: do I get a job as a barista and earn some extra cash or spend time on an unpaid internship and gain experience (while living off microwave pizzas)?

Micky Chen and her sister Linky realised there’s really no need to go for one or the other. There are plenty of early-stage startups out there that need the muscle, but don’t have the cash to hire full time employees. Meanwhile, there are plenty of students out there who want to try out different careers and meet potential employers, while still getting paid for their work. From this realisation, the sisters launched Minite in 2020. The platform connects companies to top students available to work on projects at hourly freelance rates.

Minite was bootstrapped for the first 1.5 years and managed to grow at an impressive 25-35% month over month. In January 2022, they launched their first funding round and have since secured 300k in investment.

Yet, while they had a number of enthusiastic investors approach them, they also experienced their share of bias with one VC telling Chen outright that having a man on their founding team would help them attract investment. For her, the biggest barrier facing women of colour founders is:

The lack of diversity among investors. The ‘typical’ investor often can’t relate to us, because we don’t look like them. Many people invest in those that they identify with. Investing in people of colour is in fact a great business opportunity. We often literally come from far, and have overcome a mountain of challenges before having embarked on our entrepreneurial journeys. We’re incredibly resilient and have unique perspectives and experiences, and that makes us strong, driven entrepreneurs.

My sister (also my co-founder) and I know how to execute and are proud of everything we have achieved with Minite — yet, we too have faced our fair share of investor biases. It’s important to work towards creating a more equitable and supportive ecosystem that provides all entrepreneurs with the resources and opportunities they need to succeed.

What’s one piece of advice Chen would like to share with would-be founders?

Find your why! That means understanding the core values and beliefs that drive you as a person and how you want to apply them to your business. Identify the problem you want to solve and the positive impact you want to have. How can you make a difference through your business?

If you find your why, everything else will fall into place. Whenever I’m having a bad day, I remind myself of my why. And that is to help the next generation prepare for their future, and provide them with the opportunities I lacked as a student myself.

2. “I’m always in a room with Dutch men in their late 30s that only invested in/worked with companies founded by other Dutch men in their 30s” — Layla Li

As AI becomes a key technology underpinning everything from the way we’re hired to the way we’re screened for health issues, failing to identify and mitigate bias could have deep societal impacts. KOSA is helping arm companies with the tools they need to introduce responsible AI principles.

After having worked in a number of large corporates, including Philipps and Tesla, across a number of countries (Japan, the US, Kenya, and the Netherlands), tech inclusion and the challenge that the advent of new AI tools bring to this complicated issue became a passion for Layla Li.

She and co-founder Sonali Sanghrajka founded KOSA in 2020, in the midst of the pandemic, growing a remote team that spans across The Netherlands, Kenya, India, Ethiopia, North Macedonia, and South Korea. With diversity already deeply embedded in her company’s DNA, for Li, the lack of women of colour in the Dutch tech industry has been stark to say the least:

I have yet to meet a woman of colour in leadership positions across the Dutch tech ecosystems, maybe a couple of startup founders, but more often than not, I’m in a room of Dutch men in their late 30s that only invested in/worked with companies founded by other Dutch men in their 30s. We need more female decision-makers that will understand the issues other female entrepreneurs are facing and solving.

On top of often being the outsider in the room, Li and her team still face the challenge of convincing investors of the extreme importance of AI responsibility. In an interview with TechCrunch, Eghosa Omoigui, founder of EchoVC Partners shared that when leading an investment round for the company:

Quite a few investors that we spoke to about the opportunity felt very strongly that AI bias wasn’t a thing or that a ‘woke product’ wouldn’t have product-market fit, which is surprising, to say the least.

But these barriers won’t faze Li’s drive to bring ethical AI standards to the tech world.

“Very rarely will people tell you that you’re doing a good job once you become an entrepreneur, you’re just faced with new challenges day after day, you have to motivate yourself and everyone else around you, so work on something you’re truly passionate about, otherwise it’s hard to keep at it,” Li told TNW.

3. “Female entrepreneurs of colour are at a greater risk of having their ideas replicated without consent” — Iffat Rose Gill

Iffat Rose Gill has long been a champion for the inclusion of women through a number of innovative digital initiatives she’s launched across Europe, Asia, and Africa. In 2010, she launched The Code to Change, which is aimed at tackling both the gender and skills gap within the tech industry by training women and underrepresented groups in digital skills.

The program has so far impacted 15,000 women across Europe and Asia with its digital-skills training programs. In addition to trainings, they also offer inspirational events and policy advice to governments on how they can work towards gender equality through the economic empowerment of women. Her newest initiative, Digital Starling, is aimed at connecting women tech talent in Asia and Africa with early-stage, women-led startups that need help scaling.

For the amazing work she’s done, Gill’s been recognized as one of the Wonder Women of Amsterdam by the city and as one of the “female solopreneurs to watch in 2022” by Silicon Canals. She was also nominated for the UNESCO Prize for Girls’ and Women’s Education.

With a lifetime of experience in the hurdles facing greater inclusion and equality in the tech industry, TNW asked Gill what she believes are the biggest challenges we need to tackle now.

First and foremost, (aside from equal access to funding) she pointed out that women of colour often also lack social capital and networks in heavily male-dominated industries such as the Netherlands. In Gill’s view, what’s needed are more support programs, such as accelerators and networking events, as well as partnerships between government, academia, and industry specifically aimed at supporting women of colour. Standalone mentoring programs that are geared towards ‘fixing women’ instead of the system are also ineffective. Instead we need access to mentoring which is geared towards capital.

The second biggest challenge she sees is business ethics, an issue which she’s faced herself and has been approached about by other women.

Female entrepreneurs of colour are at a greater risk of having their ideas replicated without consent in the entrepreneurship ecosystem, as they face both gender and race-based biases. This unethical practice not only undermines the hard work and creativity of these entrepreneurs, but also perpetuates systemic inequalities in the business world. Investors, incubators, and other stakeholders must work towards creating a level playing field where innovative ideas are valued, protected, and credited to their rightful owners.

Finally, while a lot of programs and initiatives aimed at women of colour are meant to be supportive, there is a very real possibility that they can actually be more damaging.

Often, we are invited to speak on panels or participate in projects solely for the purpose of filling a diversity quota or checking a box. While we appreciate the opportunity to showcase our expertise and perspectives, these opportunities often come with a catch: we are never compensated for our time, and our expertise and talent are exploited for free. This exploitative practice is disguised under the guise of ‘we are giving you exposure’ or ‘we are providing you with a stage to send your message out.’ Not only is tokenism wrong, but it also hurts us and our businesses.

4. “To grow a diverse team, we had to change the way we did our application process, how we appealed to candidates, etc.” — Lethabo Motsoaledi

You may have a great product, a great marketing team, and sales going through the roof, but having just a few bad reviews from disgruntled customers can make or break your business. That’s why Lethabo Motsoaledi and Matthew Westaway created Voyc in 2018, an AI based platform that monitors and analyses conversations between customers and call centre reps.

Originally from South Africa, Motsoaledi shared that the pair decided to move their HQ to Amsterdam in 2020 because the Dutch government has put a lot of investment into the startup ecosystem, providing more opportunities. Motsoaledi told TNW:

It’s phenomenal. The luxury of being a startup in the Netherlands is that you can just focus on the problem your startup is trying to solve whereas, in other countries and regions, where there are social and political issues, political instability, and infrastructure issues, you not only have to solve x but also y and z and every other problem that the ecosystem is supposed to solve.

For founders coming from abroad, she said the YES!Delft community and the Hague Business Agency were extremely helpful in providing support and networking opportunities. After moving to Amsterdam, Motsoaledi and her team also joined the BOLD community by Techleap.nl and participated in a new program called Exceptional Leaders in Tech that hosts dinners where diverse founders can meet and share their insights on what the government can do to build a diverse and inclusive ecosystem.

At the same time, Motsoaledi was surprised to hear that the number of women founders in the Netherlands is alarmingly low in comparison to other countries. This is something she believes could be helped by improving the visibility of these founders.

The same goes for diversity within startups. A recent study by the University of Amsterdam found that in one in five startups women represent less than 15% of the workforce and, in those cases, women applicants are almost 30% less likely to apply. Motsoaledi shared her tips:

Our team at Voyc is now sitting at a 50/50 diversity ratio in terms of men and women, and I’ll tell you, it was incredibly difficult to get there. We had to change the way we did our application process, how we appealed to candidates, etc. to make sure women feel confident to apply for our roles. You have to start from the beginning, not forgetting that, if your leadership team or your board is just white men, women and people of colour are going to be hesitant to apply. It’s a perpetuating system.

Advice Motsoaledi wanted to share with newbie founders: “Stay as close to the problem as you can and be more passionate about the problem than the solution.”

5. “We are seeing a strong trend where angel investors are stepping in to plug the funding gap at the early stages” —Christina Caljé

A former Executive Director at Goldman Sachs, Christina Caljé, became a serial entrepreneur successfully launching and scaling several businesses including Autheos, a video-marketing platform, which was acquired in 2021.

With the vast knowledge she acquired in raising capital and breaking into different markets, Caljé has now taken on the VC world serving as an advisor, mentor, and angel investor for pre-seed startups, with a particular focus on investing in women founders and founders of colour. She shared some important insights into the current market that founders should take note of:

The ‘market correction’ in the VC fundraising market has impacted founders throughout the fundraising life cycle, resulting in slower fundraising cycles and normalising of valuations to historical levels. I see these both as healthy dynamics, though, because in actuality the extreme dynamics we saw during the prior 18 months were not setting up founders for success in future fundraising cycles, we are now seeing that play out now with down/flat rounds in the headlines.

Founders onboarded misaligned investors without proper vetting, at too high valuations that necessitated unrealistic milestones in short order to validate appreciated valuations at future fundraises. Moreover, the underperformance of public markets and inflationary dynamics empower investors to employ fear tactics around capital access. In reality, there is still a lot of ‘dry powder’ out there, meaning funds that raised capital in the past 12 months but have yet to deploy it. Founders just need to spend some extra time researching and developing relationships with the right investors for their proposition / vision.

Caljé explained that women founders of colour will have an advantage in this upcoming period because a number of VC funds, angel syndicates, and accelerator programs were launched in the past 18 months in the wake of BLM with a specific mandate to invest in black and brown founders.

I see the fastest and most impactful change coming from the angel investor community. Whether it be via direct investment or syndicated investment vehicles, we are seeing a strong trend where angel investors are stepping in to plug the funding gap at the earliest stages, particularly for gender and ethnically diverse communities. The much sought after ‘fly-wheel’ effect first seen in Silicon Valley is finally reaching this side of the Atlantic; a positive feedback loop in which success breeds a self-sustaining cycle of investment and success!

For all you future founders out there, Caljé shared her top tips on how to successfully fundraise (in any market):

1. Know what you’re looking for from an investor and do your diligence

This is particularly important for earlier stage companies that are still working towards product market fit and commercial traction. Identify those investors (angel or pre/seed venture funds) who understand your sector challenges and timelines, and be clear about what you want them to bring to the table. Is it a network in a target client base? Experience? Geographic access? Product or sector knowledge?

Discuss this upfront and ask for examples of how they’ve delivered such value to their portfolio companies. When considering a lead investor, reach out to their portfolio companies and speak to the founder(s); they’ll most likely give you a candid and honest picture of what it’s like to have that investor on the cap table.

2. It’s not about tailoring the story to the investor, it’s about finding the audience to match your story

As a founder, I understand the frustration when the fundraising process feels long and drawn out because it’s distracting us from what we really want to do — build and grow. But, investing the time in researching potential investors, building relationships and ensuring that you onboard the right investor to match your business needs will bring huge ROI and set you up for success in the longer term. Its importance should not be underestimated.

3. Fundraising is a relay

Once your first fundraise is behind you, you should expect that your investors, whether angel or VC, will provide you with intros to follow-on investors. Many times, we will have preferred funding partners that we ‘pass the baton’ to for the next stage of fundraising. An important thing to realise is that your first investors will set the tone for future fundraises; with each stage, keep in mind how this round will set you up for success in the next round. Remember, it’s a numbers game and you should aim for 50-100+ investor names on your target list.

Want to learn more about the amazing products and opportunities these founders have to offer? TNW is offering all five a free startup pass to the annual TNW Conference in June 2023 including an exhibition booth where you can meet them in person and learn more about their solution.

Whether you’re a future leader or a talented innovator, check out the Women-in-Tech Business Pass which provides discounted rates for all tech talent who identify as women.

Get the TNW newsletter

Get the most important tech news in your inbox each week.