For many people, selling a business for $50 million is a win. But for venture capitalists, it’s a poor outcome. VC success is defined as achieving top quartile return status among your peers. In other words, go big or go home.

At the same time, barriers to building software are falling exponentially. Many startups are lost in a sea of commoditization, running on other people’s platforms, integrations, go-to-market channels, and data management technologies. Many don’t have a lot of differentiation because their business is a collection of a whole bunch of other people’s stuff.

How do you go big in a world where the barriers to innovation can be so low? How do you hit a home run when the “how will you win” of your startup isn’t yet worked out?

As a startup founder, you need to understand how you’ll build a sustainable competitive advantage and that everything you do needs to support the creation of that strategy.

That’s strategy — and that’s also how VCs think about strategy. Here are some of the questions venture capitalists will ask you when judging value creation and whether or not to invest.

How is your software generating data that can build a wall around your business?

A proprietary data pool creates value. Your core software shouldn’t just be helping your customers achieve a goal — it should also be generating data.

For example, Rentable (full disclosure: this is a portfolio company) is an apartment listing company that helps apartment companies market their inventory online and enables a digitized buying experience for their customers.

In that process, Rentable is able to capture info on consumer demand and behavior, like when people buy, how they buy, at what prices, and success rates.

That’s a lot of data coming out of the back of their core piece of software, and that’s valuable market-specific information that can build a wall around a business.

Can you build a unique set of analytics or tie more generic analytics to a unique legacy problem?

In my experience, the most valuable analytics come from really understanding customers’ pain points and building analytics into a workflow that is part of the ordinary course of business. When you combine a set of analytics and with a legacy business problem, you have a new opportunity to build best-of-breed capabilities for that particular problem, and “go big” in the process.

Consider, for example, an inventory manager who uses your analytics to do their job better. Having information on how many units are in a marketplace, what units sell for, and at what realized prices is useful analytics?

But if you can automate the inventory manager’s daily workflow by providing, automated daily recommendations on what units to buy, sell and reprice and then provide automated functions that execute those recommendations. You now have an automated workflow powered by analytics.

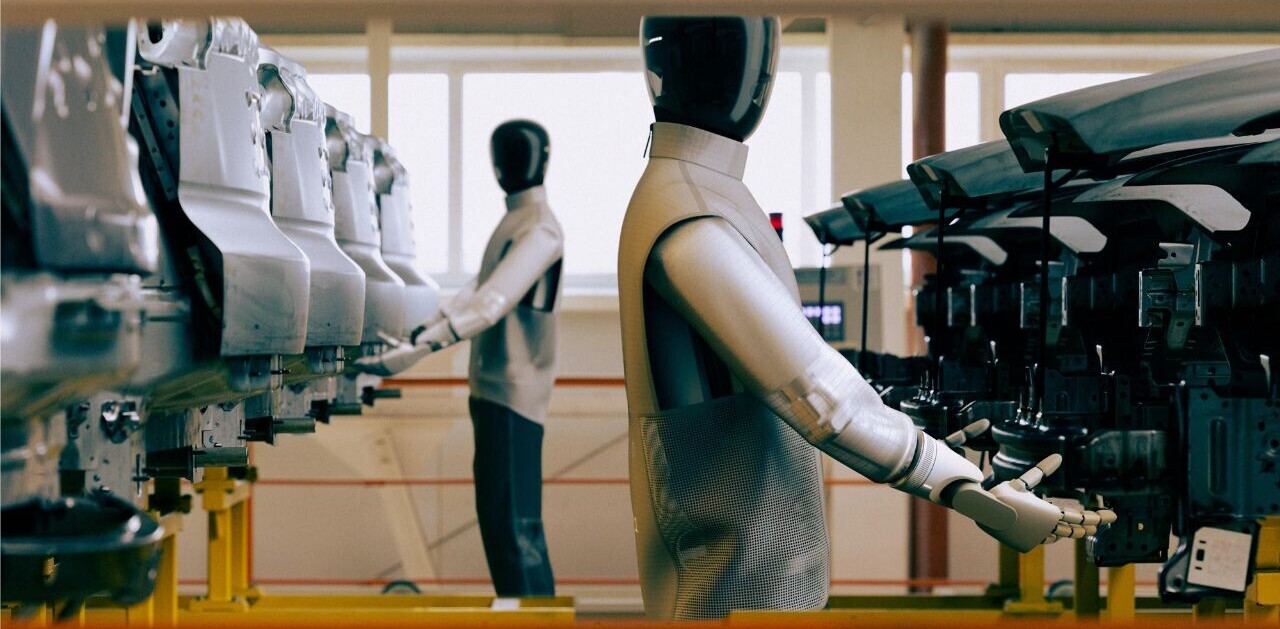

Can you connect this to a unique piece of hardware, such as an IoT device?

Can you pair your software with a device to create something proprietary? Such a pairing takes you out of the world of commoditized software by adding a unique differentiator.

Let’s say you have software that helps urban planners and real estate developers by providing demographic and population growth information on certain geographies. It’s slick and has analytics, but it’s not a solution.

What if you add a computer vision system that monitors vehicle and pedestrian traffic, analyzes vehicle and consumer behavior, and combine that with the demographic information, all wrapped into an algorithm to predict best use cases for buildings and transport? Then you have a real differentiator.

With the explosion of cheap IoT devices and pervasive connectivity, there is a whole host of hardware devices that could be a real source of differentiation for your startup.

Can you build a two-sided network?

Airbnb and DoorDash are classic examples of two-sided networks: startups that serve both consumers and businesses, and build such large networks that the network itself becomes a competitive barrier to entry. Such businesses are frequently winner-take-all markets, and are highly risky and expensive to create.

Simultaneously convincing both consumers and businesses to participate can be difficult and very expensive, but the rewards can be very large. Given the valuations the public markets have attributed to both Airbnb and DoorDash, they have proven that the risk was worth it for their early investors.

Unlike with hardware, not all businesses are suited to two-sided networks, and they can be very difficult to scale. If yours is, however, the risk may pay off not just in terms of hitting it big, but in creating a unicorn — which all VCs are looking for.

There’s a reason that VCs are searching for “unicorns” and not just your basic “good business idea.” To gain the attention of investors, startups need to find the unique qualities that differentiate them from every other good idea. That focus, differentiation, and competitive advantage will attract capital and, ultimately, will enable your company to survive the competitive threats.

Get the TNW newsletter

Get the most important tech news in your inbox each week.