“It’s the next big revolution, just like the internet was.”

“No… it’s a bubble!”

Love it or hate it, cryptocurrencies have now grown to a point where they cannot be ignored. The CBOE and CME have launched their own cryptocurrency futures, the SEC and CTFC have gotten involved, and pretty much every mainstream publication that matters discusses cryptocurrencies one way or the other every day.

In other words, cryptocurrencies are here to stay — at least for the foreseeable future.

What cryptocurrency trends should you watch out for, though. What will drive the cryptocurrency landscape in the foreseeable future? Below are four trends to watch out for:

More stablecoins and increased market stability

The cryptocurrency market has survived a lot of things: major exchange hacks, involvement from the US Securities and Exchange Commission (SEC), ban on cryptocurrency ads by Google, Facebook, Twitter and other online giants, and unpredictable government intervention and attempts at regulation.

All these factors have in some way been responsible for a massive correction in cryptocurrency market cap, from an all-time high of over $850 billion in January to about $260 billion at the time of writing this.

Amidst these events many experts, renowned economists, and pundits have declared the death of cryptocurrency. But it hasn’t died.

However, many experts agree that one factor could finally deal cryptocurrencies a fatal blow: the stablecoin Tether.

Most cryptocurrencies are pegged to Bitcoin and, due to Bitcoin’s huge price swings and volatility, this affects the prices of other cryptocurrencies. The idea behind the stablecoin is to have a coin with a fixed price that isn’t subject to sudden price swings. This “stablecoin” is then pegged to, and backed by, actual fiat currency to guarantee its stability.

The most notable of all stablecoins is Tether, and most exchanges now pair every major cryptocurrency — and some smaller altcoins — to Tether’s USDT which is equal to a dollar.

This is generally supposed to be a good thing, because, due to being backed by the dollar, pegging a cryptocurrency to Tether makes it more stable than pegging it to the more volatile Bitcoin. Well, this should be the case assuming that Tether is actually indeed backed 1:1 by the dollar as is generally assumed. However, damning reports to the contrary have emerged.

It’s been speculated that Tethers are often printed out of thin air in response to market conditions in order to manipulate cryptocurrency prices. It’s also been alleged that about 48.8 percent of Bitcoin’s price rice occurred within hours of new Tethers being released. In other words, there is strong reason to believe that Tether has been released severally in order to manipulate Bitcoin, and consequently cryptocurrency, prices.

Now, this piece isn’t about Tether per se. Several sources like Tether Report and Bitfinexed provide more detailed and logical information on the subject. The problem lies in Tether being the major stablecoin cryptocurrencies are pegged to: Tether’s USDT is recognized and used by every major exchange, and Tether has the second highest volume of all cryptocurrencies after Bitcoin according to data from CoinMarketCap.

Due to this high dependency on Tether, any revelation of questionable activity could send cryptocurrency prices crashing — with many experts predicting an up to 80 percent price crash for Bitcoin.

The good news, however, is that the introduction and proliferation of more stablecoins, and less dependency on Tether will reduce the potential after-effects should Tether be revealed to be a sham and ensure more market stability in general.

Bitcoin dominance will increase

Bitcoin is undoubtedly the king of crypto — when it sneezes, altcoins catch the cold.

However, cryptocurrency observers would have noticed a trend in which Bitcoin dominance has slowly been eroding — at 38 percent at the time of this writing, Bitcoin dominance is at one of its lowest points ever. This is a far cry from the 87 percent it started January 2017 with.

Despite the sharp decline in Bitcoin dominance, it will only go up from here. In fact, I won’t be surprised if Bitcoin dominance increases to 50 percent or more in the nearest future.

There are a few key reasons why Bitcoin dominance will increase:

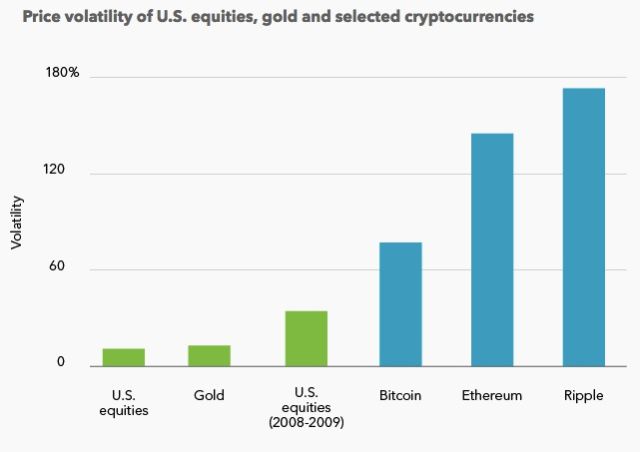

1. Despite Bitcoin’s volatility, it has been more stable than other major cryptocurrencies. Research from the BlackRock Investment Institute found that Bitcoin is significantly less volatile than the next two most popular cryptocurrencies — Ethereum and Ripple.

Just take a look at the chart below:

The fact that Bitcoin is generally less volatile than other cryptocurrencies, and Bitcoin’s synonymy with cryptocurrency to the average new investor, will further drive its market dominance.

2. Many of the scaling issues plaguing Bitcoin are being addressed thanks to fixes like SegWit and Lightning Network. Perhaps the biggest threat to Bitcoin’s dominance is its scalability issues; due to the very limited number of transactions supported per second, the Bitcoin network gets bogged down as more people use the network.

This has resulted in some transactions taking days to complete, which doesn’t exactly bode well considering the cryptocurrency’s volatility. With these fixes, however, these issues are addressed: the result is faster transaction times and a more stable Bitcoin.

3. Altcoins have always been influenced by Bitcoin price movements. When Bitcoin price goes up, altcoins go up. When it goes down, altcoins go down. This trend will prompt more and more investors to see Bitcoin as a safer store of value and further shore up its dominance.

Cryptocurrencies will become more mainstream

Goldman Sachs is reportedly planning to start its own Bitcoin futures trading and help use its own money to help its clients trade Bitcoin. UK-based Crypto Facilities also recently made news for launching the first regulated Ethereum futures contract in the UK.

While many have claimed that the launch of futures will only water down the value of cryptocurrencies because it allows institutional investors to short cryptocurrencies, researchers have found that the introduction of futures have aided mainstream adoption of cryptocurrencies. In particular, a study by the Federal Reserve Bank of San Francisco noted that the introduction of Bitcoin futures in 2017 helped encourage many pessimists to enter the cryptocurrency market.

When eight-graders are talking about Bitcoin, you know it has gone mainstream. However, many new investors are still coming to terms with the extreme volatility of cryptocurrencies, and as they do, not only will cryptocurrencies become more mainstream but they will also become less volatile due to an understanding of their nature.

The rise of decentralized exchanges

Decentralized exchanges will rise, and it won’t be too long into the future. While many experts are speculating that decentralized exchanges aren’t ready for mass adoption yet, I believe that the rise of decentralized exchanges is more closer than is assumed.

Many factors will drive the rise of decentralized exchanges:

1. Centralized exchanges generally defeat the purpose of cryptocurrencies. The selling point of most cryptocurrencies is decentralization, and it’s ironic that the success and failure of most of these decentralized cryptocurrencies depends on centralized exchanges.

This will change.

2. While the above point is realistically not going to be enough to get many people to turn to decentralized exchanges, the fact that cryptocurrencies have now become more mainstream and that many are seeing how much of an impact exchanges are having on the cryptocurrency landscape — the Mt. Gox hack, the Bitfinex hack, the Coincheck hack and raid — will drive the need for decentralized exchanges.

3. Major players getting into the decentralized exchange business will also drive adoption. Huobi recently announced plans to invest $100 million towards building its own decentralized exchange, and Binance recently announced development of Binance Chain, its own decentralized exchange.

With more major players having stakes in decentralized exchanges, we can expect decentralized exchanges to be less clunky and buggy and more intuitive. As a result, mainstream interest and adoption will increase.

Conclusion

While the cryptocurrency landscape is still nascent, there are a lot of exciting developments. The rise of stablecoins, increase in Bitcoin dominance, more mainstream adoption, and the rise of decentralized exchanges are some trends to watch out for.

Get the TNW newsletter

Get the most important tech news in your inbox each week.