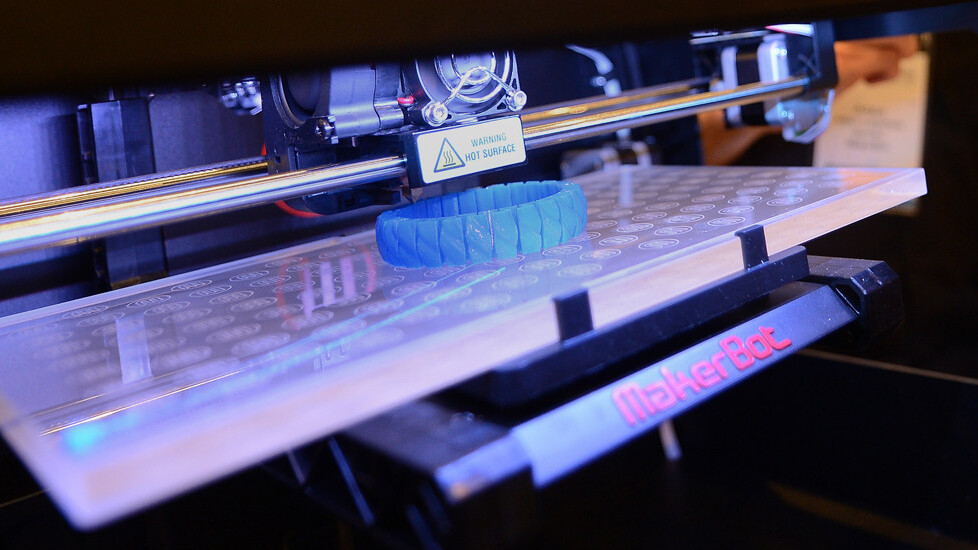

MakerBot, a Brooklyn, NY-based startup which makes desktop 3D printers for consumers and professionals alike, is being acquired by Stratasys, an Israeli-based 3D printer and additive manufacturer. The initial value of the proposed merger is $403 million based on Stratasys’ stock price today. It’s said that the combination of the two will aid in accelerating adoption of 3D printers by the mass market.

In a statement, the two companies noted that they have signed a “definitive merger agreement” where MakerBot will be acquired as a subsidiary of Stratasys in a stock-for-stock transaction.

Since its founding in 2009, MakerBot reveals that it has sold more than 22,000 3D printers, of which its latest product, the Replicator 2 Desktop 3D printer accounted for 11,000 of them.

The announcement today falls in line with news reported by The Wall Street Journal earlier this month hinting at acquisition talks.

Stratasys says that it believes the acquisition of MakerBot will help enhance its leadership position in the 3D printing space and soon will allow customers to buy much more affordable desktop printers with a “seamless user experience”. With the deal, the company will gain access to MakerBot’s 3D ecosystem, which consists of not only software and service providers, but also a retail store, 3D photo booth, and strategic partnerships with Autodesk, Adafruit, Nokia, OUYA, MoMA, and Amazon.

MakerBot’s CEO and co-founder Bre Pettis will continue to lead his company: “The last couple of years have been incredibly inspiring and exciting for us. We have an aggressive model for growth, and partnering with Stratasys will allow us to supercharge our mission to empower individuals to make things using a MakerBot, and allow us to bring 3D technology to more people.”

Stratasys says that its proposed merger is initially valued at $403 million in stock. MakerBot’s stakeholders are eligible to qualify for “performance-based earn-outs” that provide an additional 2.38 million shares through the end of 2014. This buy-out is estimated to have an initial value of $201 million.

Prior to today, MakerBot reported $11.5 million in total revenue during the first quarter of 2013, compared to $15.7 million for all of 2012. It’s online content portal, Thingiverse.com, has more than 90,000 3D product files available for people to download and share their designs. To date, it receives 500,000 unique visitors and 1 million downloads each month.

Stratasys is a company specializing in the manufacture of 3D printers and materials for prototyping and production. It has more than 130 3D printing materials in its library and has more than 500 granted or pending additive manufacturing patents globally. The company was formed in 2012 through a merger between two 3D printing companies, Stratasys Inc. and Objet Ltd.

We’ve reached out to MakerBot about the announcement, but the company would not provide any additional details.

Photo credit: EMMANUEL DUNAND/AFP/Getty Images

Get the TNW newsletter

Get the most important tech news in your inbox each week.