Jon Norris is a freelance content specialist for audience.io and writes for the Fueled blog. This post comes courtesy of Fueled, a mobile design and development company based in New York and London.

The mobile wallet dream may still be a way off for the average consumer, but a cashless and cardless utopia is closer than ever before for the adventurous technophile.

Making a purchase in-store, paying back a generous pal, and even transferring money to a foreign country can now be done from the screen of a smartphone – and this niche market is heating up.

If you want an early taste of the coming mobile wallet revolution, here are ten apps and services to test drive.

Peer-to-peer payments

The granddaddy of online payments is still alive and kicking, processing north of $300 million per day. Now boasting apps on all major smartphone platforms and a mobile-friendly website (as well as a separate card reader and merchant products), PayPal is the most established mobile payment service.

Although PayPal’s main selling point – send money to someone using just their email address – still works exactly as it always has, a reputation for hit-and-miss customer service and higher fees than challenger services is beginning to make the poster child for mobile cash look a little over the hill.

That said, it’s still leaps and bounds ahead of most financial institutions with its new fully-native checkout service for merchants.

Ostensibly a no-nonsense system for collecting recurring fees, the UK only company GoCardless is a great way to collect one-off payments, with flat fees of 1 percent, capped at £2.

As the name might suggest, GoCardless is all about ditching credit cards altogether by relying on the Direct Debit system to power payments. Payers simply provide their bank account details and the payment will be sucked from their bank account and into your own.

There’s no mobile app, but the responsive forms throughout the site ensure that you’ll have no problem arranging payments from a smartphone browser with no plastic involved.

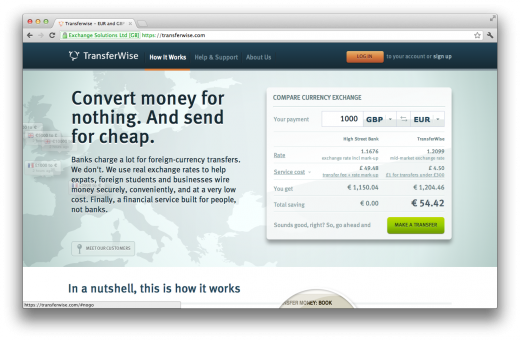

Jetsetting type with friends littering the globe? Clever crowd-powered currency swappers TransferWise will not only charge you much lower fees than a bank, but will give you a much better exchange rate too.

This financial sorcery is actually deceptively simple – when you make a transfer, the money never leaves its country of origin. Your deposit is matched with another in your recipient’s country, and sent out domestically.

A usability dream, TransferWise’s mobile site will have you flinging payments around the globe in minutes.

Your bank of choice

With most big banks now sporting a mobile app of their own, you no longer need to go in-branch or use ATMs to make transfers. In the United States, Chase, Bank of America, and many others have mobile apps that can take care of most day-to-day banking tasks. Some even allow you to cash cheques by taking a picture of them.

Barclays in the UK has a dedicated app, PingIt, to take care of simple money transfers between individuals.

For those who like payments with a social networking twist (don’t all yell at once), Venmo offers free peer-to-peer transfers from its app to mobile numbers, email addresses or Facebook accounts.

You’ll get a feed of transactions going on between contacts, and this service has some of the most competitive pricing around – Venmo balance, bank and debit card transfers are totally gratis – you’ll only incur a fee if using a credit card.

Going shopping

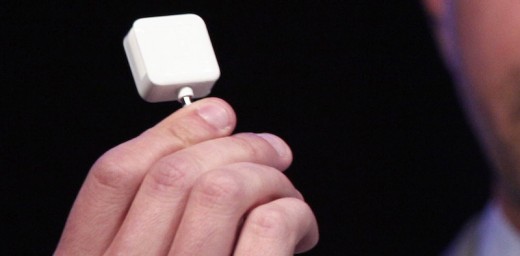

If PayPal is the granddaddy of online peer-to-peer payments, Square is surely the grandmomma of card-reader dongles. Effectively turning your iPhone or iPad into a cash register with a tiny card reader inserted into the headphone jack, Square is the progenitor of similar products from Verifone, Groupon and even PayPal themselves.

Now processing tens of millions of dollars per day, Square has branched out into entirely cardless payments, allowing customers to settle up simply by checking-in at the store via the Square Wallet app. When they check out, the cashier confirms their identity and the Square payment system handles the rest.

Coin isn’t a purely phone-based solution – instead it’s a credit card that can imitate any of your other plastic, letting you leave them at home and simply select which you’d like to charge before swiping.

Coin is inextricably linked to your smartphone, both in the sense that the Coin app lets you manage your various cards and add new ones to the device, and in that a low-power Bluetooth sensor connects the two, and sounds an alarm if you leave your card behind.

Coin is US-only for the time being, and is expected to launch this summer.

Another US-only option and the only NFC-powered app to make our list, Google Wallet does just about everything you might want from a mobile wallet app. Pay by tapping your phone at the checkout, send money to friends with just an email address; you can even order a plastic card that will let you withdraw your Google Wallet balance from ATMs.

Initially conceived as a partnership between Google and carriers (who would ship the app on their smartphones), Google Wallet had a few false starts and some major staff changes before re-emerging as the standalone product it is today.

With NFC becoming standard across smartphones (Apple being the notable holdout here), and tap-to-pay now baked into the Android operating system, Google Wallet’s second coming could become a force to be reckoned with.

This mysterious startup, famous for raising one of the biggest rounds of seed funding in Valley history (a cool $25 million), is promising to change the way we view and use currency wholesale. This lofty ambition is backed by a secretive product that was impressive enough to ensnare some of the highest profile investors around.

Nobody is quite sure what form the finished product will take – it’s a mobile app, it lets you send money to friends, and there are whispers it has something to do with Bitcoin and other algorithmic currencies.

The details are scarce, save an infuriatingly-cryptic promo video, but if you’re a mobile wallet enthusiast, Clinkle is one to keep an eye on.

Built specifically for the restaurant and bar crowd, TabbedOut allows you to pay with your smartphone at any establishment that supports the app, as well as a bevy of other smart features. You can see your tab in real time (great for avoiding that end-of-meal bill shock after one too many bottles of wine), add a tip, split the bill with fellow diners, and pay straight from the app.

TabbedOut also lets you build a relationship with your favorite eateries – you can leave written feedback once you’ve paid your bill, and you may get vouchers back for next time!

This year could well be the defining chapter of the mobile wallet story. The contenders are growing both more numerous and more usable, and increasing adoption means consumers are now almost as likely to have a smartphone in their pocket as they are a regular wallet.

The question is, who will win out? Several carriers have launched mobile wallet products which have flopped (UK network O2 announced the closure of their wallet product just a few days ago), and no company has emerged as a clear leader yet.

The NFC question also remains – a solution cannot be truly mainstream these days unless Apple supports it, and the iPhone is the last big NFC holdout.

It’s foolish to throw around predictions in a market this immature – the only thing that’s certain is that 2014 looks to be a mighty interesting year in the mobile wallet space.

Get the TNW newsletter

Get the most important tech news in your inbox each week.