Using computers for online trading and investing is far from a new concept. From the earliest days of computing, machines were used to make financial calculations and analyses. However, recent advancements in artificial intelligence (AI), and more specifically, machine learning, have introduced new and innovative ways to harness computing power for better financial management.

While artificial intelligence refers to the broader concept of creating machines that think for themselves, machine learning is a narrower field, which focuses on improving the way computers decipher the world around them. While AI is about creating consciousness, machine learning is about creating understanding.

How machine learning works

Utilizing machine learning requires the introduction of large amounts of data to a computer and letting it ‘learn’ on its own. While it is a complex process, a simple explanation would be this: If we want to teach a computer what a cat is, instead of inputting parameters such as “cats have pointy ears” or “cats have whiskers,” we would simply feed it an abundance of cat pictures, letting it decide on its own how to recognize cats. If given enough data, the machine will be able to efficiently carry out the task it has taught itself to do.

It is easy to understand how this can be utilized in finance. So much of investing has to do with technical analysis and pattern recognition, so, in this case, the aforementioned cat could be replaced with market charts and used for predictive analysis. Moreover, the internet created the possibility to generate enormous amounts of data and potentially unlimited data sets.

Machine learning opens up an array of new possibilities for trading and investing. For example, machines can be taught to recognize the trading habits of responsible traders, and predict who might pose a risk to certain institutions. Another use would be creating algorithms that find similarities in different successful portfolios and pinpointing the winning factors.

Outsmarting the market

Now that it is possible to comb through the behavior patterns of millions of traders and use algorithms to understand how they think, social trading networks, such as eToro, add another dimension of information to this process. In today’s information age, every action is logged and each trader’s history can be traced, presenting a blueprint of sorts for that trader’s ‘investing DNA.’

When dealing with a network that has millions of traders, there is a staggering amount of data that can be used. The relevant algorithm can sift through this giant database and extract the relevant information. Machine learning can be brought into the mix in order to identify the ‘right’ data.

Simply put, a computer can be taught what `successful trading’ looks like, and combine such information from various users to build an investment portfolio that draws from their cumulative wisdom.

Giving everyone access

It is no wonder, then, that financial giants such as JPMorgan Chase and Goldman Sachs are openly utilizing machine learning for their investing practices. After all, they have the resources and the data to make it work. However, this power is not reserved for these giant corporations. There are instances in which machine learning can benefit the ‘little guy’ as well.

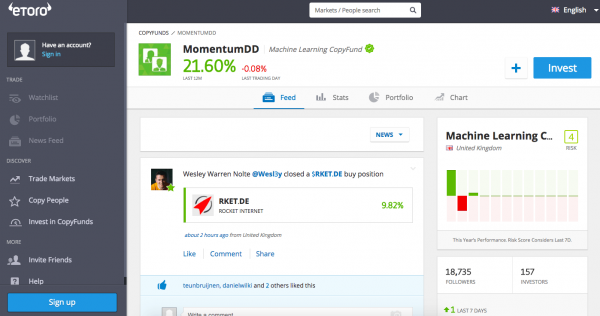

eToro’s declared mission is to disrupt the traditional financial industry and break down the barriers between private investors and professional-level practices. One such instance can be seen in eToro’s CopyFunds Investment Strategies, which are managed thematic portfolios, powered by advanced machine learning algorithms. This means private individuals now have access to technology previously reserved for giant corporations.

For example, one of eToro’s CopyFunds was created to outperform the popular Nasdaq 100 index, by studying the ‘investing DNA’ of successful Nasdaq traders. The algorithm locates `Nasdaq experts,’ and then sifts through their portfolios and trading history to locate the 15 Nasdaq 100 components towards which all of these investors are positively inclined. Additional factors, such as risk management, are taken under consideration, providing the end result of a low-risk, fully managed investment portfolio, which can potentially beat the Nasdaq 100.

Big data, big results

The use of machine learning for trading has been proven successful so far on eToro. A previous CopyFund, called MomentumDD, uses Microsoft’s Machine Learning engine to locate the traders most likely to generate a profit and bundles them into a single investment product. This CopyFund generated 22 percent profit in its first year while maintaining a relatively low risk.

As time passes, more advanced algorithms will be developed, and the amount of data will increase exponentially. With the earliest of eToro’s machine learning-powered products showing such great potential, there’s no doubt future practices leaning on the technology will yield impressive results.

Sounds good? You can now copy leading investors on eToro’s disruptive trading platform.

Get the TNW newsletter

Get the most important tech news in your inbox each week.

This post is brought to you by eToro. eToro is a multi-asset platform which offers both investing in stocks and cryptocurrencies, as well as trading CFD assets.

This post is brought to you by eToro. eToro is a multi-asset platform which offers both investing in stocks and cryptocurrencies, as well as trading CFD assets.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Past performance is not an indication of future results. This is not investment advice. Your capital is at risk.