One of the most overlooked parts of going abroad is travel insurance. That’s probably because there’s a massive dichotomy between how easy booking a flight within Europe is, and how tedious it is to pick out a policy.

London fintech startup Revolut plans to make things even easier. The company has launched a new geolocation-based travel insurance product, called Pay-per-Day. If the company detects that you’re abroad, it’ll automatically sign you up to a policy.

To do this, the Revolut app uses your phone’s standard location services. If your GPS receiver picks up that you’re in a different country, a policy will automatically kick into action. In practical terms, this means that from the moment you get off the plane, you have medical and dental cover.

Speaking personally, this is hugely attractive. I travel a lot, and I inevitably leave travel insurance to the last minute. More often than not, I buy it when I’m in the airport terminal, just minutes from booking a plane.

As the name suggests, with Pay-per-Day, insurance policies are charged by the day, meaning you don’t have to pay for more coverage than you actually need.

Coverage can cost as little as £1 (about $1.25) per day, and there’s an annual cap, so you don’t end up paying more than you would with an average annual travel insurance policy.

There’s also a grace period. If you don’t want coverage, but forgot to turn Pay-per-Day off on your phone, you’ve got up to eight hours to cancel your policy.

Revolut told me that European policies aren’t based on a specific country, but rather the entire continent. So, suppose you’re traveling from Paris to Amsterdam via train, the company won’t charge you for each country you visit, however briefly.

That’s also true of North America. If you’re on vacation to the States, and you take a day trip to Canada, your coverage will continue.

Speaking to TNW, Nikolay Storonsky, CEO and Founder of Revolut, said “We wanted to create a type of insurance that uses technology to help our customers and only cover you on the days you actually needed to be covered – all for the best price. Pay-per-Day travel insurance is a global first, and is another step in our journey to build a platform to offer a better kind of banking.”

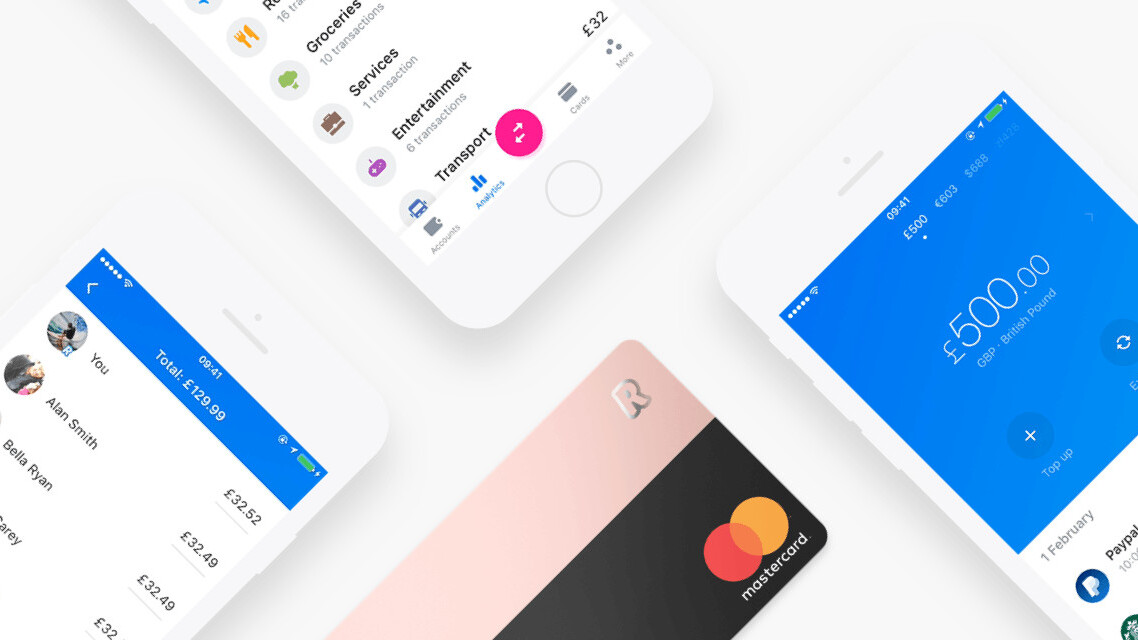

This is the latest offering from Revolut. The company started life as a prepaid debit card solution for travelers, and has since evolved into a fully licensed bank. The company also acts as a peer-to-peer payment provider, and cryptocurrency exchange.

As shown by this product, the company also has serious ambitions for the insurance market, too.

This obviously won’t be for everyone. Some people simply won’t have need for this, as they get their travel insurance through their bank or credit card. Others may prefer to shop around, in order to pick the appropriate policy for them.

But for those who simply want to ‘set and forget,’ this offering from Revolut is pretty compelling indeed.

Get the TNW newsletter

Get the most important tech news in your inbox each week.