Tesla finally enters the S&P 500 next month, an event Goldman Sachs says could spark an $8 billion rally for the electric vehicle wunderstock.

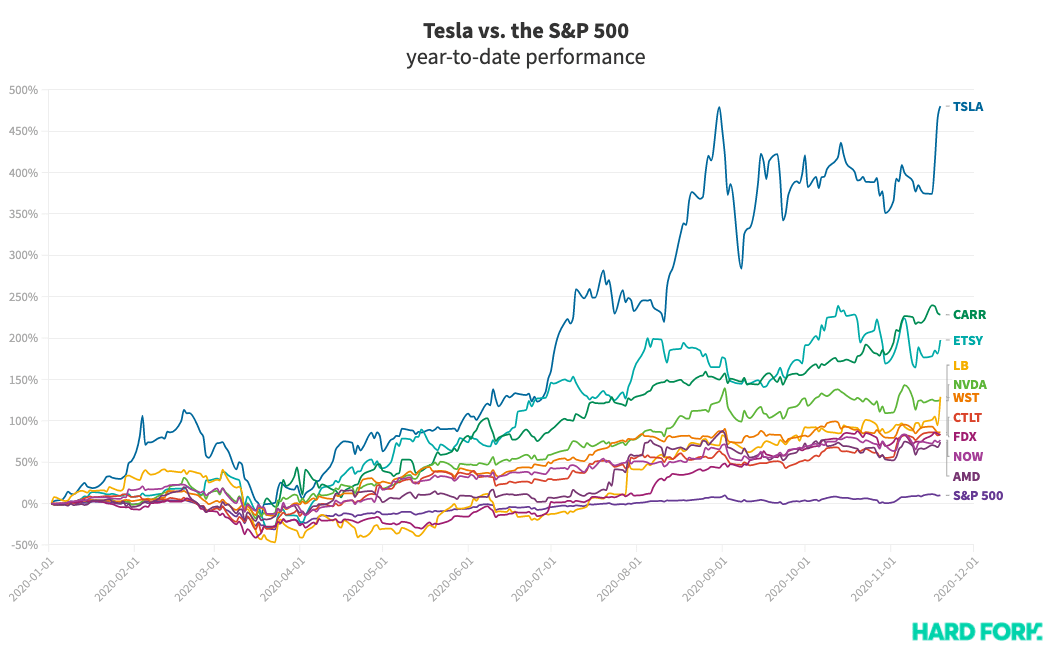

News of its S&P 500 nod has already pushed Tesla’s share price up 22% to eclipse the index’s top performers CARR and ETSY by more than 200%.

Indeed, if Tesla was in the S&P 500 today, it would be the index’s best performing stock this year — by far.

“They’re almost turning the S&P 500 into more of a momentum index,” Apriem Advisors’ Benjamin Lau, whose firm manages $850 million worth of assets, told Bloomberg.

“I’m more worried about how it affects our index funds and passive holdings than anything else.”

(If the visualization below doesn’t show, try reloading this page in your browser’s “Desktop Mode.”)

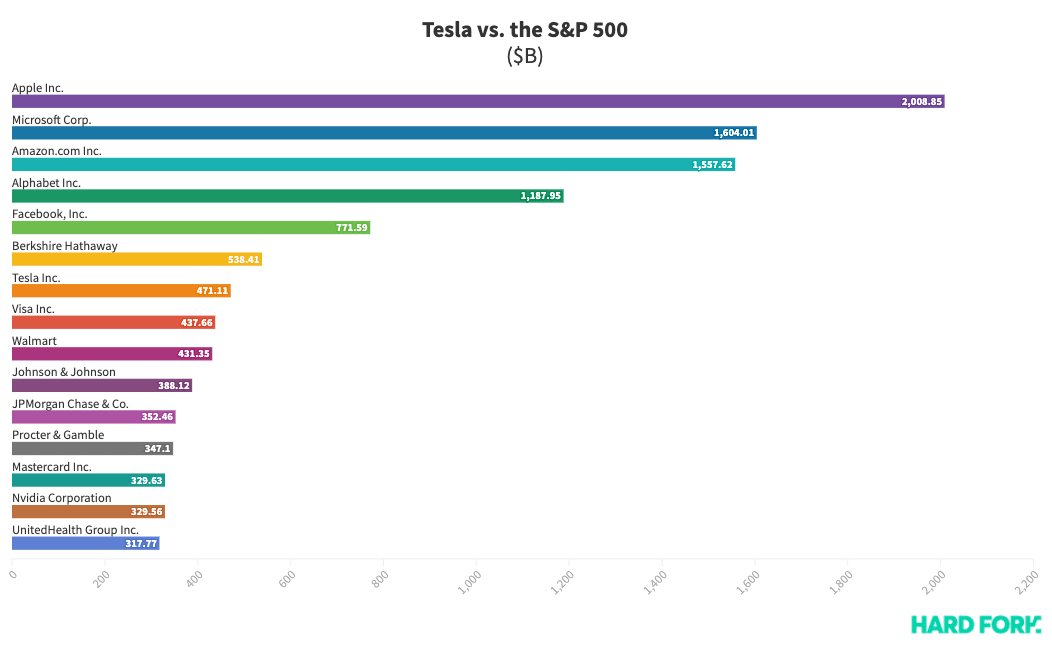

Tesla is bigger than Visa, but not quite as big as Berkshire

Lau has a point. Tesla is already one of the biggest companies in the world. If Tesla was part of the S&P 500 today, it would be the index’s seventh biggest company, ahead of industry giants Visa, Walmart, Johnson & Johnson, and JPMorgan Chase.

The only companies more valuable would be Warren Buffett’s Berkshire Hathaway, Facebook, Alphabet, Amazon, Microsoft, and Apple.

[Read: Watch Tesla’s meteoric rise — set to techno-remixed Elon Musk tweets]

Considering Tesla’s newly-found girth, any share price reversal could drag market-wide indexes like the S&P 500 down with it.

After all, stock that goes up can come down just as quickly.

Whatever happens, Tesla’s addition to the S&P 500 gives a degree of validation to investors who’ve already bought in, and offers incentive for the world’s largest funds to jump in — even as the stock trades at new record highs.

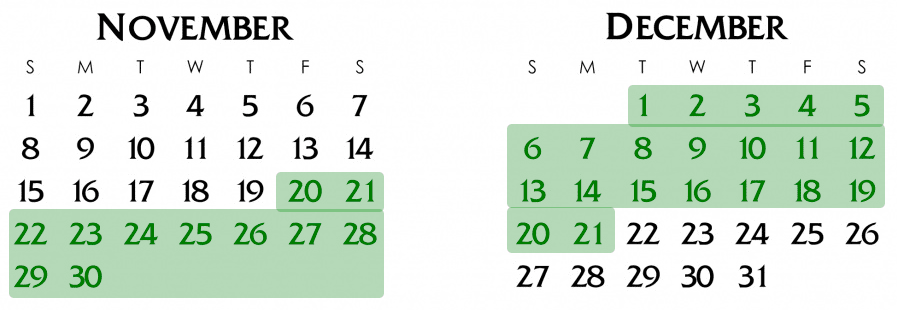

Just 4.20 weeks to go…

Get the TNW newsletter

Get the most important tech news in your inbox each week.