Robinhood users simply can’t catch a break. First, a series of interruptions rocked the platform on some of the most volatile days in stock market history, for which the company offered only lacklustre subscription discounts.

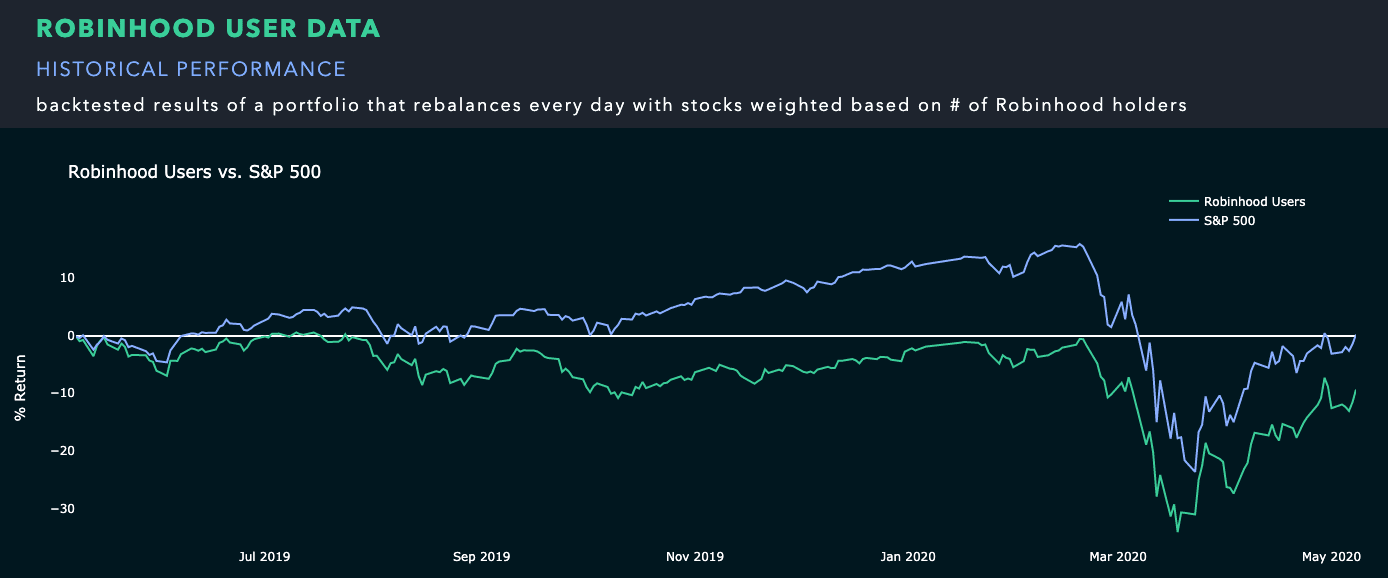

Now, fresh analysis has shown that the average Robinhood trader hasn’t just underperformed in 2020 — they’ve also posted 6.2% fewer returns than the S&P 500 (a basic index of top US companies) over the past two years.

[Read: Bitcoin vs. NASDAQ 100: Watch them thrive during the pandemic]

Indeed, instead of making plays themselves, it appears the average Robinhood trader would’ve made more money had they simply put their money in the S&P 500 and waited.

S&P 500 beats ‘average’ Robinhood trader, all day every day

Research firm QuiverQuant’s Robinhood portal works like this: the firm uses Robinhood’s public API feeds to backtest the performance of a portfolio that’s weighted to the number of Robinhood users holding each stock.

While this public data doesn’t reveal how many shares each trader holds, it still paints a decent picture of the portfolio managed by the hypothetically “average” Robinhood trader.

What’s particularly crushing is that the S&P 500 was ahead of the average Robinhood user over the entire chart (although, the two did perform similarly for a brief period in May 2019).

Warren Buffett isn’t beating the S&P 500, either

Famed investor Warren Buffett knows this frustration all too well. After all, the Omaha Oracle has forged a legendary career by consistently outperforming the market.

But the S&P 500 has beaten his flagship fund Berkshire Hathaway over the past decade — just like the average Robinhood trader in the chart above.

In February 2019, Buffett told reporters he considered the S&P 500 “the best investment” as “most people don’t know how to pick stocks,” including himself.

Later, when asked which would make a smarter long-term investment: Berkshire or the S&P 500, Buffett told the Financial Times he figured the final result would be pretty much the same.

So, whether you’re Warren Buffett or the “average” Robinhood trader, turns out it’s tough to beat the sheer momentum powering the US’ largest companies. Go figure.

Get the TNW newsletter

Get the most important tech news in your inbox each week.