Big tech might be thriving thanks to the coronavirus pandemic, but the firearms industry is experiencing even faster growth as Black Lives Matter (BLM) protests grip the US.

Shares in weapons giants Smith & Wessen, and Sturm Ruger & Co have surged since the first BLM rallies on May 30, up 27% and 14% respectively as of Tuesday’s market close. Taser’s Axon has risen 28%, and ammo and gun retailer Vista Outdoors jumped 18%.

Traders have even flocked to the Olin Corporation, which makes the popular Winchester brand of firearms. Olin stock rallied by more than 9% this week, while the likes of Google, Microsoft, and Amazon have remained relatively flat.

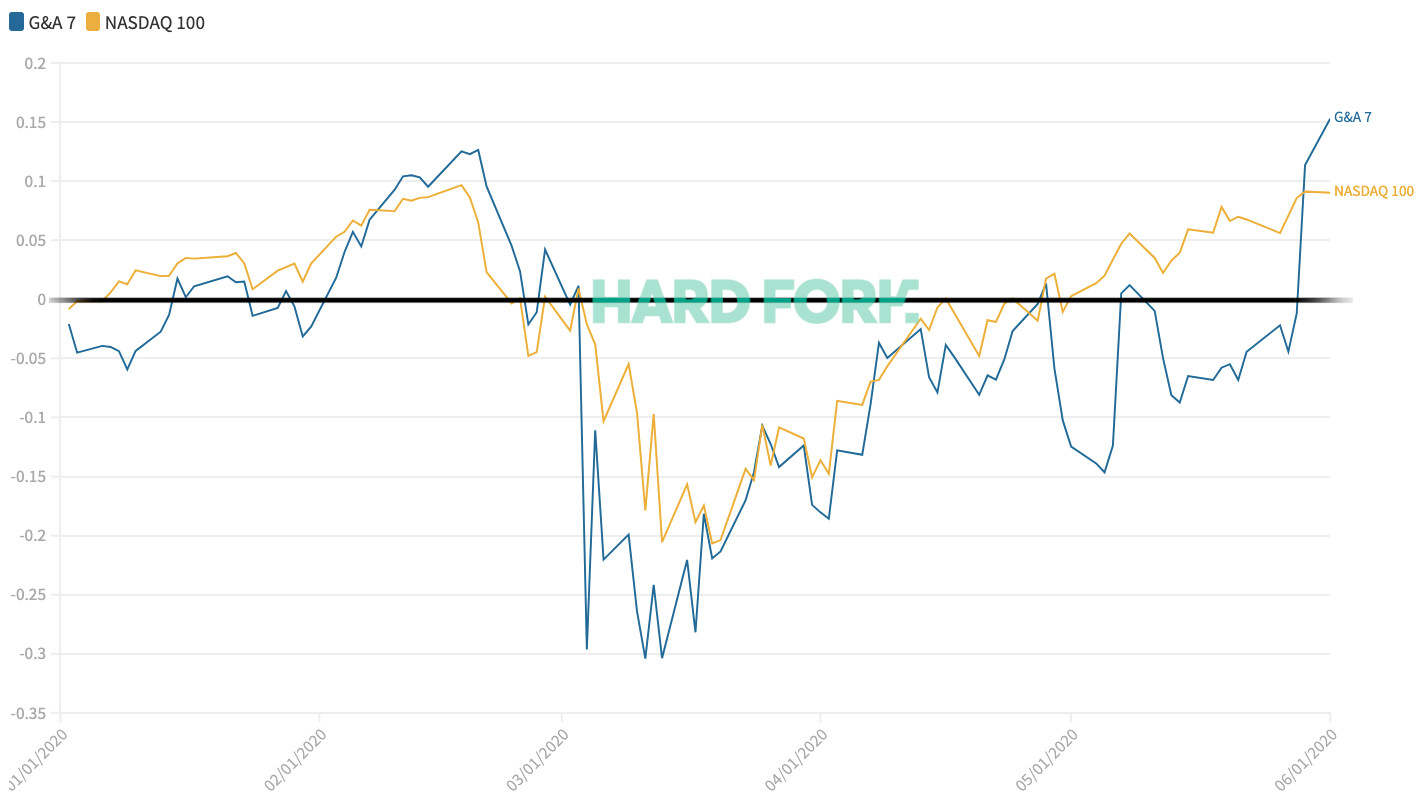

The Guns & Ammo 7 are outperforming US tech

To illustrate how well the US firearms sector is performing, Hard Fork created a new index: The Guns & Ammo 7 (G&A 7).

[Read: 3 tech stocks that haven’t fully recovered yet — yes, they still exist]

It includes the largest public companies that deal in guns and ammunitions in some way, such as the ones mentioned above. We also added major outlets that sell guns and ammo (Big 5 Sporting Goods), as well as AR-15 rifles (Sportsman’s Warehouse).

*The full list of G&A 7 companies is included at the end of this article.

The G&A 7 index actually staged an impressive recovery since COVID-19 decimated the Dow, having tracked alongside the NASDAQ 100 (a popular benchmark that includes top tech stocks) for most of the year.

Still, it struggled to stay positive — until May 30, when it exploded. In total, G&A 7 has added $1.98 billion to its overall market cap since then, a 21% increase.

On the other hand, the NASDAQ 100 has fallen slightly since protests erupted, but remains positive after seeping back into the green in early May.

Coronavirus lockdowns started the fire, civil unrest fans it

As for what’s causing gun stocks to turn so bullish, Bloomberg reported that background checks for first-time gun owners or repeat buyers have now risen for 13 consecutive months. They’ve also spiked over the past three months when compared with a year earlier: by 75% in May; 80% in March; and 69% in April.

“People are watching the news,” Interactive Brokers chief strategist Steve Sosnick told reporters. “The market is anticipating that there will be increased interest and demand for firearms as a result of what’s going on in the world right now.”

Wall Street analysts reportedly expect demand for firearms to continue as virus lockdowns ease, and especially so if Democratic presidential nominee Joe Biden edges closer to the White House, due to his comparably restrictive gun policies.

*The G&A 7 Index consists of the following stocks: Sturm Ruger & Co Inc (RGR), Smith & Wesson Brands Inc (SWBI), Olin Corp (OLN), Sportsman’s Warehouse Holdings Inc (SPWH), Vista Outdoor Inc (VSTO), Big 5 Sporting Goods Corp, and Axon Enterprise Inc (AAXN).

Get the TNW newsletter

Get the most important tech news in your inbox each week.