Bitcoin’s recent sell-off, which pushed its price below $7,500 for the first time since May, wasn’t caused by capitulating long-term holders.

Instead, newbie Bitcoin investors (those that had held for between one and three months) initiated October’s steep price decline, reports boutique research firm Delphi Digital.

“In the days following the selloff, there was additional movement from slightly older holders in the 6-12 month range and 12-18 month range, with heightened exchange inflows to match,” said the firm.

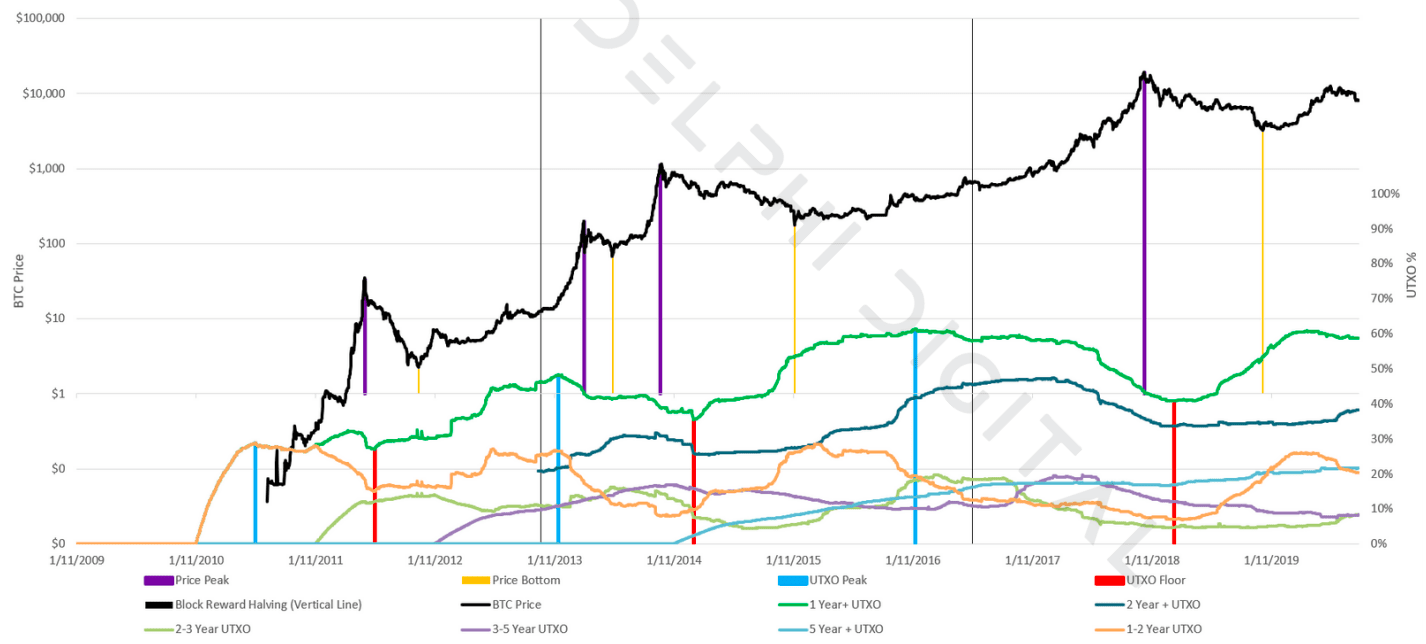

Bitcoins with five-year UXTO ages reaches all-time high

Delphi Digital uses “Unspent Transaction Output” (UXTO) data to sort Bitcoins by the last time they were moved. The amount of time an amount of Bitcoin stays still is referred to as its “UXTO age.”

The graph below groups Bitcoins into colored bands: the green band represents those that haven’t moved for at least one year, for example. The black squiggly line indicates Bitcoin’s price.

“There hasn’t been much movement from long-term holders this year despite the rollercoaster of price and sentiment,” said Delphi Digital. “The portion of supply that hasn’t moved in at least one year started the year at 55.6 percent, peaked at the end of April at 60.8 percent, and currently sits at 58.3 percent.”

As well, the amount of Bitcoins that haven’t moved for at least two years now represents 38.7 percent of the overall circulating supply, up from 34.6 percent at the start of the year.

Most notable however is that Delphi Digital’s data shows that 21.6 percent of available Bitcoin hasn’t moved for at least five years — an all-time high, and a year-to-date increase of 1.1 percent.

“This is one of things that distinguishes this mini-cycle from true bull and bear cycles, you don’t have long term holders cashing out as prices really take off,” said Delphi Digital.

“Long-term holders will dictate cyclical tops and bottoms, but it’s the short-term traders that will have a larger impact on intra-cycle prices as they gauge, among other things, the flow of new money entering the space,” added the firm.

Get the TNW newsletter

Get the most important tech news in your inbox each week.