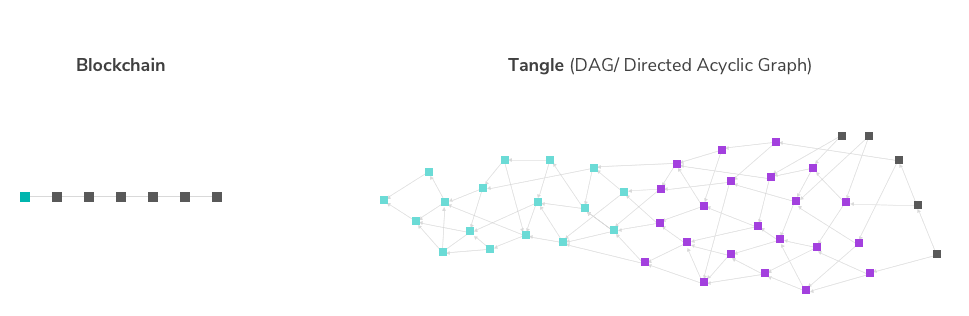

At a time when cryptocurrency was synonymous with blockchain technology, IOTA proposed a modification.

IOTA, as its name would suggest, aspired to be a cryptocurrency for the future of Internet of Things (IoT). But its founders thought that the blockchain had “too sluggish transaction times and skyrocketing fees” to be able to power the world of connected devices. Instead, they introduced a new distributed ledger technology based on Directed Acyclic Graph (DAG) — and named it Tangle.

As a participant, when you want to make a transaction on Tangle, you need to pick two previous transactions at random, validate them, and then connect them with your own transaction. The reward for doing so would be getting your own transaction verified by subsequent participants. This means that unlike with most cryptocurrencies, IOTA transactions don’t incur any fee.

So, what is holding IOTA back from dominating the cryptocurrency market? In order for Tangle to work as intended, IOTA first needs to scale — and so far, it hasn’t.

Additional concerns have been raised about IOTA by many industry experts. MIT’s Digital Currency Initiative (DCI) Director Neha Narula pointed out several cryptography vulnerabilities with Tangle. Ethereum developer Nick Johnson called IOTA a “bad actor” in the open-source community, claiming that it disregards cryptographic best-practices. Critics have also continuously argued that IOTA is actually centralized.

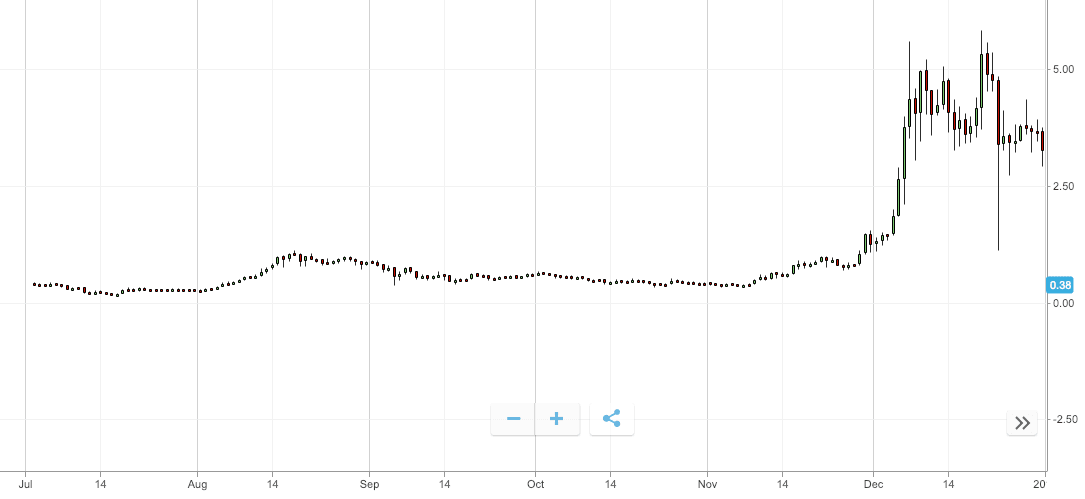

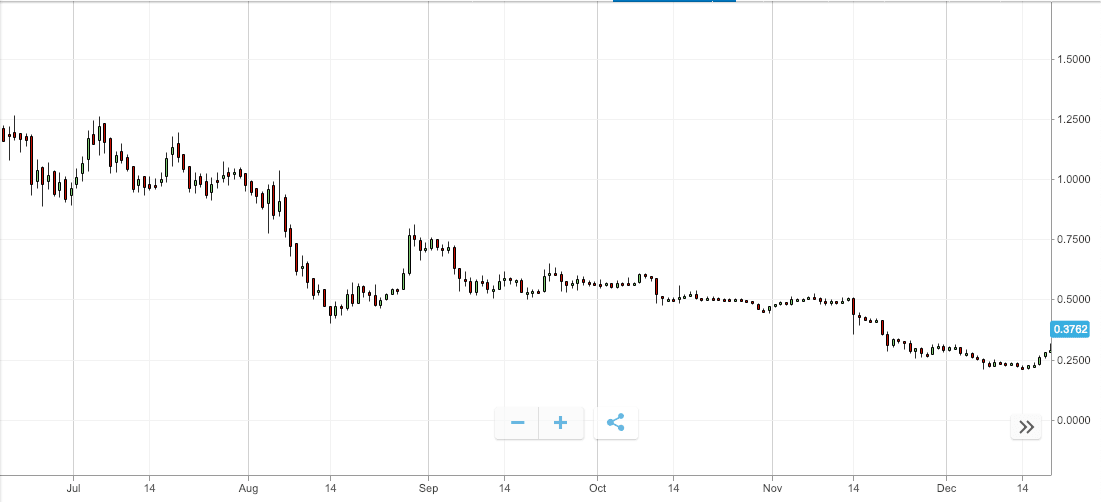

MIOTA/USD performance review

MIOTA, IOTA’s native cryptocurrency, opened the year 2018 at $3.56 — a nearly 500 percent increase in price since it first began trading in June last year. Most of this growth was accumulated in November-December during the “crypto boom.”

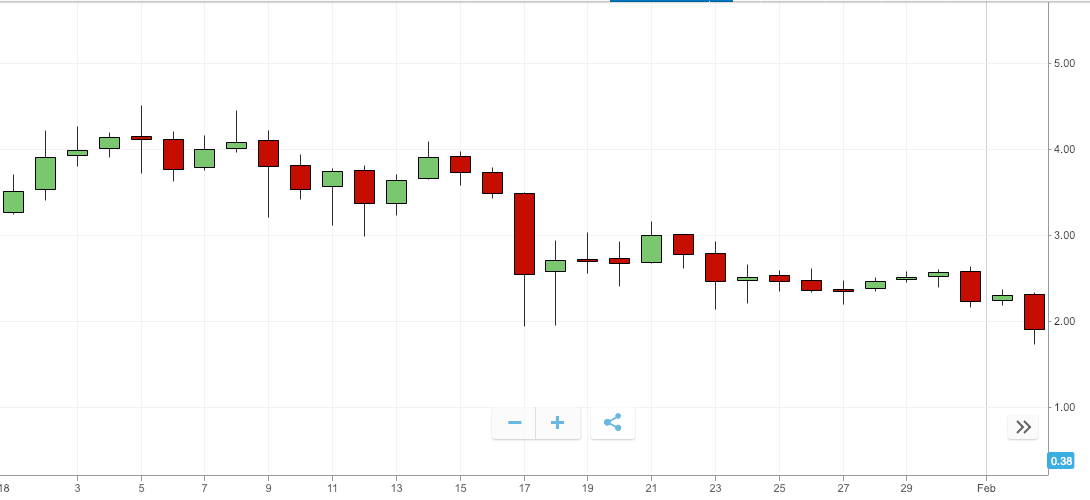

MIOTA traded above $3.50 for much of the first half of January, but then saw a sharp decline — falling by 25 percent on January 16 from $3.47 to $2.60. By February 1, it was trading at less than $2.

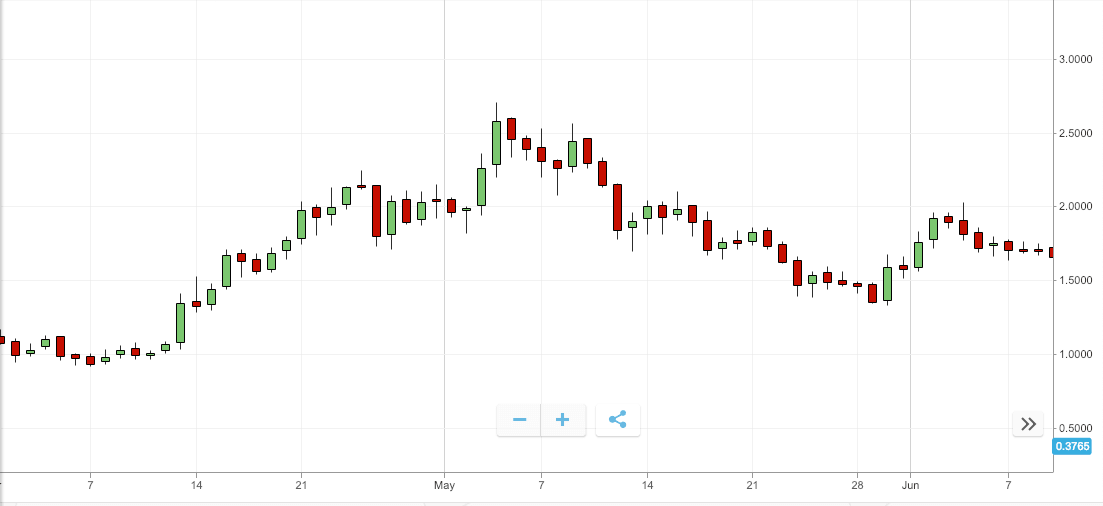

MIOTA market saw a minor upswing in mid-February trading at above $2 again, but saw a quick correction between February 21-23, bringing its price down to $1.60 again.

Starting mid-April, MIOTA’s price rallied upwards hitting $2.58 on May 04, when the bull run broke. By May 11, MIOTA was again trading under $2 at $1.86 — a 28 percent drop over the week.

MIOTA maintained a dominant downward trend for the second half of the year. The cryptocurrency was trading at less than a dollar by June end. By August 15, MIOTA was trading at $0.45 — a 87 percent drop in market price since the beginning of the year.

From mid-August onwards, MIOTA maintained relative stability in price for the rest of the year, although seeing a slump in November. As of December last week, MIOTA is trading at $0.32. The cryptocurrency has seen a 91 percent drop in market price through 2018, and has lost nearly half of its price from the day it first traded in June 2017.

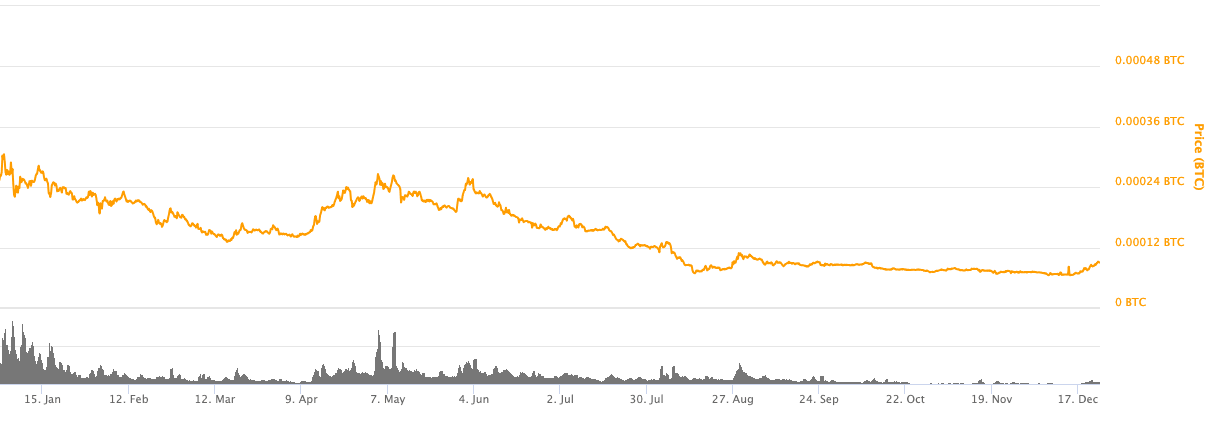

MIOTA has also performed poorly against BTC in 2018 with the MIOTA/BTC pair losing 64 percent of its value through the year.

IOTA — Major events in 2018

In February, the government of Taipei — Taiwan’s capital — announced that it is working with IOTA for its digital citizen identification project.

The United Nations Office for Project Services (UNOPS) also teamed up with IOTA in April to see how its decentralized ledger technology, Tangle, could help the organization streamline its operations.

In April, IOTA in partnership with IT services company DXC Technology presented a ‘juice-bar robot’ at Hannover-Messe-Industrie trade fair — showing Tangle’s integration for secure digital transformation services. Later that month University College London (UCL) severed its ties with IOTA Foundation on their open security research project. IOTA was also struck with multiple controversies related to internal strifes between team members.

In November, IOTA Foundation announced a partnership with Ledger to integrate its MIOTA tokens with the company’s hardware wallets. The foundation also announced the creation of a new research council to support the IOTA project.

In December, the organization partnered with cybersecurity firm Cybercrypt to create a new hash function called Troika — declaring a $220,000 bounty for anyone who helps find flaws with its security system.

What to expect in 2019

In the last one and a half years, few cryptocurrencies have courted nearly as many controversies as IOTA. Whether it is partnerships gone sour, internal strifes, or technology criticism. In spite of all this, IOTA has managed to remain one of the top performing coins throughout.

A lot of IOTA’s future depends upon whether it can successfully prove critics wrong on the feasibility of Tangle in enabling actual real-time transactions in a time and cost efficient manner as it promises, without compromising on the cryptographic principles.

The market price movements of IOTA show great reliance on overall cryptocurrency sentiments rather than individual performance. While this is true for most cryptocurrencies — the trend is comparatively stronger in case of IOTA.

IOTA is also one of the few top cryptocurrencies that are trading at a lower price at the end of 2018 than when it launched first, which is not true for its contemporaries like Binance Coin (BNB) and NEO (NEO).

The year 2019 could prove to be a ‘make it’ or ‘break it’ year for IOTA — possibly making it one of the more volatile investment options in cryptocurrencies.

Now that you have actionable information on the future of IOTA, it’s time to start investing. With eToro, a leading social trading platform, you can trade manually or copy the actions taken by leading traders, taking much of the stress and work out of your investments.

Get the TNW newsletter

Get the most important tech news in your inbox each week.

This post is brought to you by eToro. eToro is a multi-asset platform which offers both investing in stocks and cryptocurrencies, as well as trading CFD assets.

This post is brought to you by eToro. eToro is a multi-asset platform which offers both investing in stocks and cryptocurrencies, as well as trading CFD assets.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

Cryptocurrencies can fluctuate widely in price and are, therefore, not appropriate for all investors. Trading cryptocurrencies is not supervised by any EU regulatory framework.

Past performance is not an indication of future results. This is not investment advice. Your capital is at risk.