Our startup ClearBrain was recently acquired by Amplitude.

As a product intelligence platform, the synergy between our technologies was clear, even more so as we compared several offers from companies public and private. This process, while successful, was nonetheless quite challenging at times.

Thankfully we had some great investors and advisors to guide us along the way. We came to realize acquisitions actually follow a fairly consistent process. And we wanted to now open-source a protocol for those who may be navigating their acquisition for the first time.

[Read: 7 tips on lockdown career advancement — for employees and managers]

Step 0: Build Assets

Most acquisitions happen due to an acquirer wanting one of three assets: your team, your product, or your revenue. And if you’re lucky, all three.

Nothing compensates for building a great product. Products with unique technology command multiples. Both Oculus and Cruise were bought for billions before they went to market.

Our own product had just launched but commanded interest due to our patents in machine learning (ML). The lesson here? Build your product from the lense of “is this patentable?” because patented — the harder technology compounds in value.

But great technologies can still fail to be acquired. Acquisition decisions are made by humans, and humans make decisions based on relationships. Therefore, you should focus on building relationships with partners through technology integrations and reach competitors indirectly through the press. Our first offer came from a public company that read about our launch in the media.

The key is to be making these technology and business investments while you are building your product, and before you actually decide to sell.

Step 1: Decide to sell

The first step of an acquisition is to make the mental decision to actually sell.

Like fundraising, getting acquired is a process. It is long and grueling. Based on my experience, it takes on average six months to finish, though it can go faster depending on your pre-existing relationships in Step 0.

The process will also be taxing. Outside of a close circle of investors and advisors, you will not be able to discuss it with anyone — including your own employees — for some time.

Make sure you’re committed to seeing this through.

Step 2: Create a target list

Once you’ve made the decision to sell, the next step is to compile a list of contacts at potential acquiring companies.

Focus on those companies that could have a strategic interest in your product. Every acquisition, big or small, is predicated by an acquirer asking: “How much can I accelerate my product roadmap?” Focus on companies where you share a user, or your technology enhances theirs. Plaid was worth $5 billion to Visa, not to Google.

Include both public companies and startups on your list. Public companies offer more immediate cash, while startups typically offer more future stock. Public companies move faster once interested, given their corporate development (corp dev) teams, while startups don’t have such functions until Series D.

In either route, the key is to find the right champion. Acquisitions are made not by companies, but by humans making decisions — typically the CEO (at startups) or Director of Product (at public companies). Start with them, not corp dev.

Ask investors for referrals, or find them on LinkedIn. Our journey with Amplitude began via a serendipitous InMail from the cofounder Jeffrey, kindly congratulating us on a recent launch.

Step 3: Email outreach

With points of contact identified, it’s time to reach out. Keep your emails concise, expressing value while building urgency.

It’s a balance of enticing without divulging, considering there is no NDA in place yet (Step 5).

So start with warm intros. Email the relationships you built in Step 0. If reaching out via a second degree connection, go through your investor/advisor, and provide them with a one-paragraph1-para company brief to forward.

Again, it is very important to keep outreach tight. Do not tell friends, family, or employees (or the public). Premature internal communication can increase anxiety and halt productivity, while external communication can reduce leverage in future negotiations.

Step 4: Initial conversation

You should get a response fairly quickly if there’s interest, with an invitation to meet up.

A surprising element of the first meeting is you don’t actually need a pitch deck. This is a conversation, not a pitch. Your goal is to build a rapport over shared values and vision.

We always had our first meetings over brunch or dinner. Keep the conversation organic, but try to cover the following topics:

- Personal – Share your individual backgrounds, while emphasizing domain expertise

- Vision – Express your vision for the market, and ask for the acquirer’s vision

- Product – Describe your product, in the context of the acquirer’s vision

- Brainstorm – Ideate with the acquirer on synergies between your products

You really want the acquirer to come out feeling that you have the technology and expertise to accelerate their product roadmap.

If it feels more like brainstorming and not talking, or play and not work, you’ll know it’s going well.

Over dinner with Amplitude’s CEO Spenser, we probably spent as much time discussing Nobel Peace Prize winners as we did discussing analytics.

Step 5: NDA

If there’s interest the acquirer will ask to dive deeper into your technology and business. They’ll also loop in corp dev to facilitate. Before proceeding though, you need to ask for an NDA.

This is important to protect the confidentiality of any information you share. Specifically, an NDA will enable you to request the deletion of any information from the companies that don’t acquire you. All companies are willing to sign for this reason, as it’s in their own best interest.

Going forward, make sure all future correspondence, documents, and presentations have a “CONFIDENTIAL” disclaimer.

Step 6: Technical deep dive

With an NDA signed, the acquirer’s CTO or head of engineering will kick-off two sets of meetings: a product demo and architecture overview.

The product demo is standard fare. Describe who the user is, what problem they have, and how your app solves it. If you can, sprinkle in anecdotes how your product enhances the acquirers’.

The architecture overview should mirror the product demo. Describe the systems, languages, and data flow at each step of your app. The acquirer will assess for quality and scalability, ultimately trying to determine how difficult it is to integrate your product into theirs. A whiteboard exercise is effective here, but you can send a technical doc afterward for posterity.

The key is to position your conversation in the context of “what was difficult about this to build.” You ultimately want the acquirer to take away that they need you to build this product, and cannot do so themselves.

Step 7: Business deep dive

In parallel to Step 6, you will be asked by the CFO or head of product to provide information on your business. The type of information requested typically includes:

- Metrics – signups, customers, revenue, growth rate

- Business – fundraising history, business model, patents

- Product – features, roadmap

- Org – team bios, expertise

Here the acquirer is trying to assess your future value to their team, product, or revenue. Specifically: “How many months will this accelerate our product and hiring goals?,” and “How much additional revenue will this product bring in?”

Convey your answers in person, and make sure these points come across. Be honest and answer with integrity. The ultimate acquisition price the acquirer will offer will be a premium, from their perspective, on future revenue acceleration or cost reduction.

Also, know acquisitions are a two-way street.

Ask the acquirer about their business here, just as much as they ask about yours. Cover tech stack, roadmap, financials, challenges.

Part of what sold us on Amplitude was their thoughtfulness. When asked how we’d be integrated post-acquisition, VPs Shadi and Justin asked us instead about every engineer’s personal career goals, and constructed a new org structure in kind.

Step 8: Q&A

Not all questions asked by an acquirer need to be answered. There are a couple that seem innocuous, but can be detrimental. Namely:

- “What price are you looking for, and what have others offered?”

- “What is your cash balance and monthly burn?”

The first question is designed to ascertain an anchor. A company could offer you $100 million, but if you tell them you’re looking for $50 million, you’ve just anchored yourself.

And if you disclose who that offer is from, you reduce the leverage of imagination. Google is more likely to bid higher if they believe your offer is from Facebook, not from Yahoo.

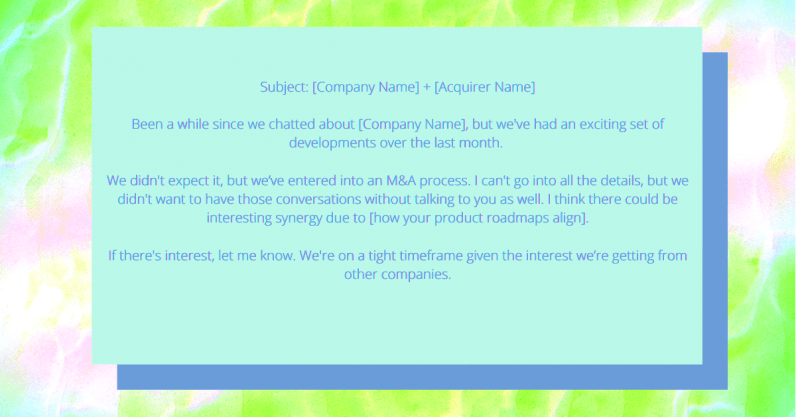

We were asked this question by so many acquirers, we effectively had a script:

The second question will come in the form of requesting a cash or balance statement. The acquirer’s intent here is to gauge your runway. If they determine you have three months left, they’ll wait two months to bid when you have less leverage.

The important note here is that the acquirer doesn’t actually need all this info to make an offer. The acquisition price is a function of the future value your company can provide, not your cash on hand.

Keep the acquirer focused on that, and push back on unnecessary requests.

Step 9: Verbal offer

At this point, a company has enough information to decide if they want to make an offer.

Getting a verbal offer is understandably a hard goalpost to get past. It forces the acquirer to finally and explicitly quantify their interest. You need to convert their inertia into qualified interest. If they ask for more meetings, we’d push back with a simple reply of:

I appreciate the continued interest. Would love to continue the conversation, but feel we need clarity on the overall deal terms to proceed. This will help us know in good faith if we’re aligned, and keep us in step with the other opportunities we have.

Remain steadfast, and you’ll get a verbal offer. It’ll be high-level, conveyed by total deal value and percent allocation of cash/stock. That’s all you need to decide if you want to proceed.

Step 10: Telling the team

To get to concrete terms, the acquirer will need to interview your team. This is understandable as the intent of acquisitions is partly talent, which means you’ll have to disclose the potential deal to your team.

This is an important step. Your team joined your startup for a mission and placed their trust in you. It’s your responsibility to convey that an acquisition is the best way to fulfill that mission.

Prepare a pitch deck. Review your company’s original vision, and reframe the acquisition as the fastest path to achieving it. Share your product roadmap again, and explain how each acquirer could accelerate it. The goal is to get the team excited before they proceed to the next stage.

If possible, bring in your champion to meet the team as well. A high point for us was when Spenser and Jeffrey came in to share their founding story and ended up bonding with the engineers over a love for historical simulation games.

Step 11: Interviews

The acquiring firm will now formally interview your entire team. Their objective is to evaluate domain expertise and performance leveling, so as to inform overall deal price and compensation.

The process will typically be the same as a normal onsite interview — one behavioral, one technical, and one design element. But like a normal interview, success is mostly a function of practice.

You’ll get two weeks to prep, so use that time to help your team thoroughly review. Have regular 1:1s to check-in and assuage any anxieties as well — controlling nerves is half the battle.

As hard as it is to admit, there is no guarantee that the full team will pass their interviews with each potential acquirer the first time round. So schedule your interviews in descending order of company preference. That way by the time you interview with your first choice acquirer, your team will have had enough practice to will pass with flying colors.

Step 12: Term sheet

After the interviews, the acquirer should turn around a formal term sheet in 48 hours. The document is about 5 pages, and details one of four acquisition types

- Waive and release – a simple waiver to hire the team

- Asset purchase – an agreement to buy specific assets along with the team

- Stock purchase – an agreement to buy the company alongside the assets and team

- Merger – an agreement to formally merge both companies into one entity

Waivers are less complex, involving less paperwork and in turn less legal fees. Mergers have a more favorable tax treatment but involve greater complexity and in turn higher legal fees. Most acquisitions by consequence fall in the less complex end.

The term sheet will outline deal specifics: a) cash/stock allocation to the preferred vs. common, b) cash/stock retention packages to the employees, c) indemnity and liability periods, and d) escrow period for cash disbursement (typical is 90% at close and 10% at 12 months).

Have your legal counsel review the term sheet, so you know what to negotiate in the next step.

Step 13: Negotiation

Negotiating the term sheet will be one of the more stressful parts of the acquisition. To help navigate the process, we read ‘Getting to Yes‘ by Roger Fisher.

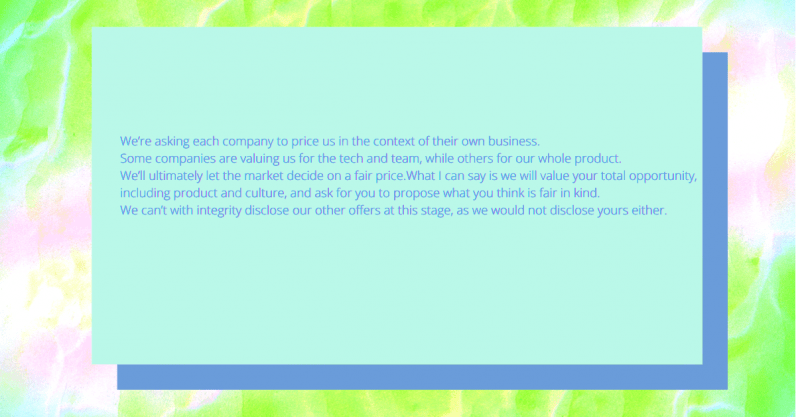

The idea is to not negotiate positions, but instead align interests with facts to negotiate. Ask the acquirer to walk you through which facets interest them (team, product, revenue), and what assumptions they are making to assign a value to those facets. Debate the assumptions not the positions, and use competitive offers (without disclosing names) as an anchor.

If you don’t have other offers, that’s okay — find the best alternative. If the acquirer says they value team retention, anchor compensation discussions with a higher job offer. If the acquirer says they value your SaaS revenue, propose a factual SaaS multiple of 10X for deal value. You can usually increase your offer by 20%-50%, with more flexibility the more bids you have.

You can go through two rounds of negotiation before it gets frustrating for parties. Don’t short-change your employees/investors or argue minutiae with the acquirer — you’re about to work with these people so be equitable. Startups are a long game, and reputation compounds over cash.

Once you’re comfortable with the terms and okayed by your legal counsel, you’re good to sign!

Step 14: Due diligence

Signing the term sheet enters you into an exclusivity period. This means you can no longer engage with other buyers, while the acquirer conducts formal due diligence on your company.

The diligence stage is where the acquirer tries to validate the information you previously shared. Not dissimilar to a financing round, they’ll typically request official documents relating to:

- Legal – articles, bylaws, cap table, msas, vendor agreements

- Employees – offer letters, piia agreements, census data

- Financials – balance sheets, p&l statements, tax returns

- IP – patents, trademarks, open source code

Remember it will likely take you a couple of weeks to compile and review everything.

Step 15: Definitive agreement

Simultaneous to diligence, the acquirer will prepare the definitive agreement for the acquisition.

This document covers the same facets as the term sheet, but in 100+ pages of detail. The documents are written by external legal counsel, take weeks of revisions, and will involve frequent negotiations over legal jargon.

Fair warning — lawyers love to lengthen this stage of the process (they are billed by the hour). Be prepared and actively involved. If you can, try to find an independent third party to help weigh which clauses were worth negotiating (in our case it was Y Combinator, a shared investor).

Once you’ve agreed on all the final documents, collate them for signature. Once signed, the deal proceeds are released by wire, and the acquisition is legally bound and closed.

Closing

Congratulations, you’ve just sold your company!

But while the deal is complete, there’s still some work left to close the business. Namely, paying off liabilities and disbursing assets.

First, you need to pay off your remaining payroll and or PTO. Next, you must close any accounts payable (to vendors) and collect any accounts receivable (from customers). Once accounts are settled you can disburse the proceeds from the acquisition, file for dissolution, and pay taxes. The combination of legal fees and taxes will total six to seven figures — so plan accordingly.

End-to-end, the entire acquisition process takes about six months. Two months to the term sheet, one month to negotiations, one month to a definitive agreement, and two months to dissolve.

So you like our media brand Growth Quarters? You should join our Growth Quarters event track at TNW2020, where you’ll hear how the most successful founders kickstarted and grew their companies.

Get the TNW newsletter

Get the most important tech news in your inbox each week.