Last summer, Pipedrive was fortunate to be part of Angelpad, an accelerator run by a few very smart ex-Googlers. The 3 intensive months thoroughly changed our understanding of how to build a successful product, and a successful company. And more importantly, it boosted our growth to the next level. Here are the five most important lessons I learned from this crazy time.

1. Be open to being challenged, be prepared to be wrong

Running a startup is like being punched in the face repeatedly.

Paul Graham

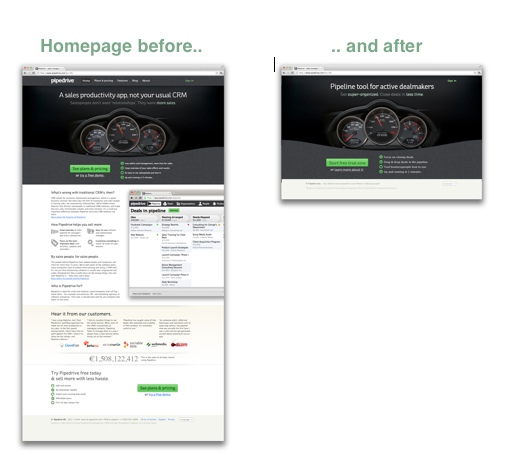

The Angelpad team and mentors challenged us in many ways. “You have too many things on your home page” was something we didn’t agree with at first, but we’re happy to test. And it turned out we had been wrong indeed. We removed 80% of the content, and left one sign-up button and one Learn More link on the home page. Conversion to sign up increased by 300%.

Another important piece of feedback early on was to add more languages to the product. Four months after adding Brazilian Portuguese, Brazil is became our second largest revenue source, ahead of the UK and Australia.

2. Location matters, a lot.

Finnish companies tend to be very traditional, not taking many risks. Silicon Valley is completely different: people here really live on the edge.

Linus Torvalds

We began building Pipedrive in Europe, in the tiny country of Estonia. It wasn’t long before we realized the importance of living next to your customers and investors. “You guys are in Estonia and I’m in San Francisco, so we are making this about as hard ourselves as possible… – was a common answer.

Lastly, it’s only in Silicon Valley where you have startup celebrities randomly walk into your office. One day Robert Scoble popped round to the Angelpad office, and video interviewed us. Next week, Dave Mcclure walked in, which was a rare opportunity to see him without mentioning any F*** words. No matter what we were looking — investor intros, partners for an event or product feedback — we got it so much easier and quicker during our stay at Angelpad.

Your location will also impact your valuation. The same early stage startup can be valued at $1-2 million in Europe, $2-3 million on the East-Coast and $3-5 million in Silicon Valley.

Hackathon House in Estonia

3. Momentum is your best friend for fundraising

Your best work involves timing. If someone wrote the best hip hop song of all time in the Middle Ages, he had bad timing.

Scott Adams

Fundraising is like a dating, you need to have two-way chemistry and you’re only “hot” for a short period of time. Before you even start fundraising, make sure that the timing is right. Having traction helps, but if this is not speaking for you for one reason or another, there are other creative ways to be talked about. For example having commitment from a well-known angel, press coverage, new superstar hires, rolling out new features. If you lose momentum, it might be better to end fundraising and go back to building the product.

Another thing to keep in mind is that more and more startups need more time than the 3 -6 months at an incubator before they are on right track for funding.

4. Investors look for four things when assessing new tech startups

Whatever you’re thinking, think bigger.

Tony Hsieh

-Can they build the product?

-Will people use it?

-Will people pay for it? (Instagram is a black swan, remember?)

-Will people come in hordes?

Make sure you answer these questions when you pitch.

5. Your emails and presentations are looked at on a tiny screen

Make every detail perfect and limit the number of details to perfect.

Jack Dorsey

More often than not investors don’t make time to go through your brilliant pitch deck. Assume it is checked in a hurry or when waiting for a meeting to start or stuck in a traffic jam, So before you send your e-mail, look at your email and deck on an iPhone screen. Is the e-mail too long? Is there too much data on the slides? Probably, yes. We started with 12 and ended up with 7 slides.

It’s also worth mentioning that the email deck and your meeting presentation deck serve very different purposes. The only aim of the former is to get an investor or partner to have a meeting with you, not to drop a load of other information on them.

Top accelerators will test your limits in many ways. If your team manages to get into one and make the most of it, your business will greatly be accelerated — just like it says on the tin. Just six months after “graduating” from Angelpad, Pipedrive surpassed the 1,200 paying customers milestone to reach “break-even”, which was faster than we ever imagined.

Pipedrive Hackathon

Morgan Lane Photography, StockLite via shutterstock

Get the TNW newsletter

Get the most important tech news in your inbox each week.