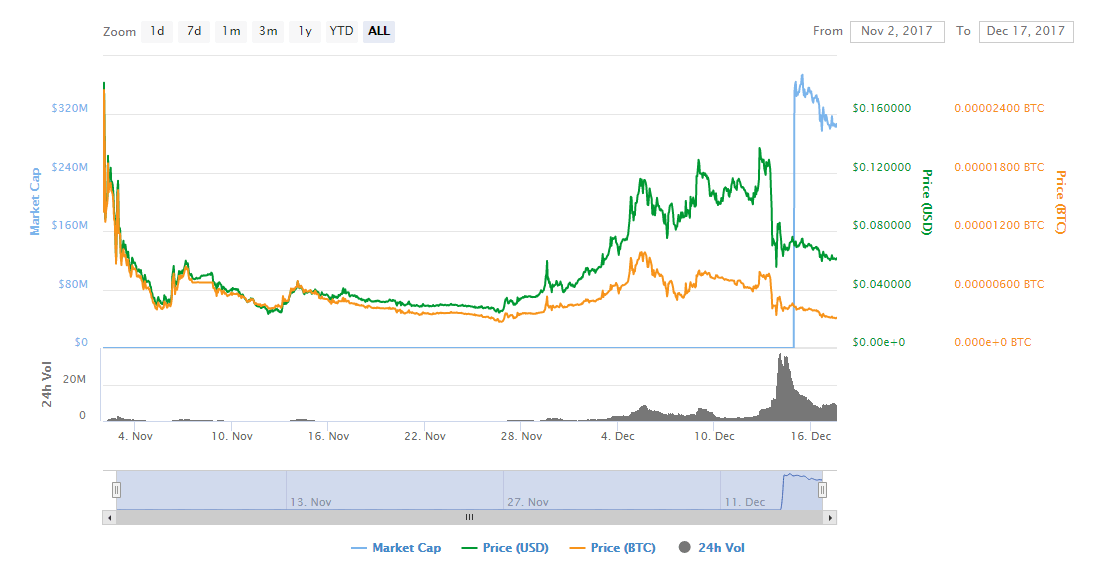

Bitcoin’s recent rise to almost $20,000 sent investors to a frenzy wild enough to cause popular trading platform Coinbase to crash due to the sheer volume of transactions. Bitcoin supporters continue to preach investing in Bitcoin as general market predictions indicate a continued rise next year. Crypto assets are definitely worth looking into. But if you’re looking for the same ten-thousand-fold profits early adopters enjoyed, you may want to look beyond Bitcoin. Remember, there are over a thousand crypto tokens and coins out there that you can invest in. You can even get into new ones through initial coin offerings (ICOs). Who knows? Some of these lesser known or new tokens may yet become the next tenbaggers. However, some of them are also just here to make a quick cash grab and disappear. In order to make an educated decision, there are a few important factors to consider when approaching ICO investments. ICOs are now primarily used to secure funding for blockchain projects. Like traditional initial public offerings (IPOs), these are great opportunities to get new tokens at the cheaper end. Many of these new coins can be purchased for about a dollar or even less. Yet, they could immediately rise in value soon after the ICO finishes. On the flip side, they can crash and never recover. Electroneum, for instance, was offered at just $0.01 each during its token sale last October. The coin already went over $0.10 before settling to around $0.06 as of writing this. What’s the reason? No one knows, to be honest. Electroneum’s investors are probably not too bothered either, as they made their monies.

Exciting as these immediate gains may be, you must approach investing in crypto assets with great caution. You need to do some work in order to spot potential baggers and avoid scams and losers. Here are four crucial steps to evaluate an ICO.

1. Know who’s running the ICO

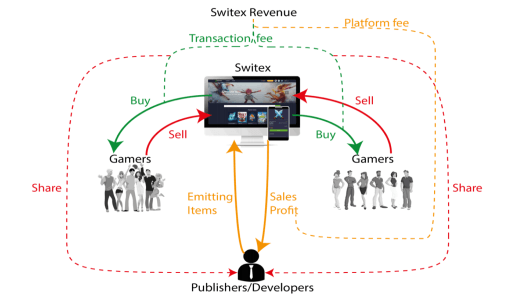

Understand who the people and companies are, and their motivations for getting into the blockchain game. Many of these companies are startups, but the people behind them are often veterans from various industries. Check out the profiles of the founding team to see if they have the balance between technical and business expertise. Some teams may be comprised exclusively of marketers, which might be a problem when it comes to the actual development of the product. Aside from startups, some established companies may also be holding ICOs. In this regard, credibility and track record count. They should already have proven track record of launching and commercializing products. With established companies, investors could also worry less wondering if the company is even capable of delivering a minimum viable product. Let’s look at German fintech firm Naga, which is set to use blockchain and its own crypto token to power a finance-focused ecosystem and which will include its existing trading platform and virtual item marketplace. Its blockchain effort, therefore, can be seen as an expansion of existing operation and its token sale serves as a way to give users means to both invest and pre-pay for the use of various services.

2. See what the project is about

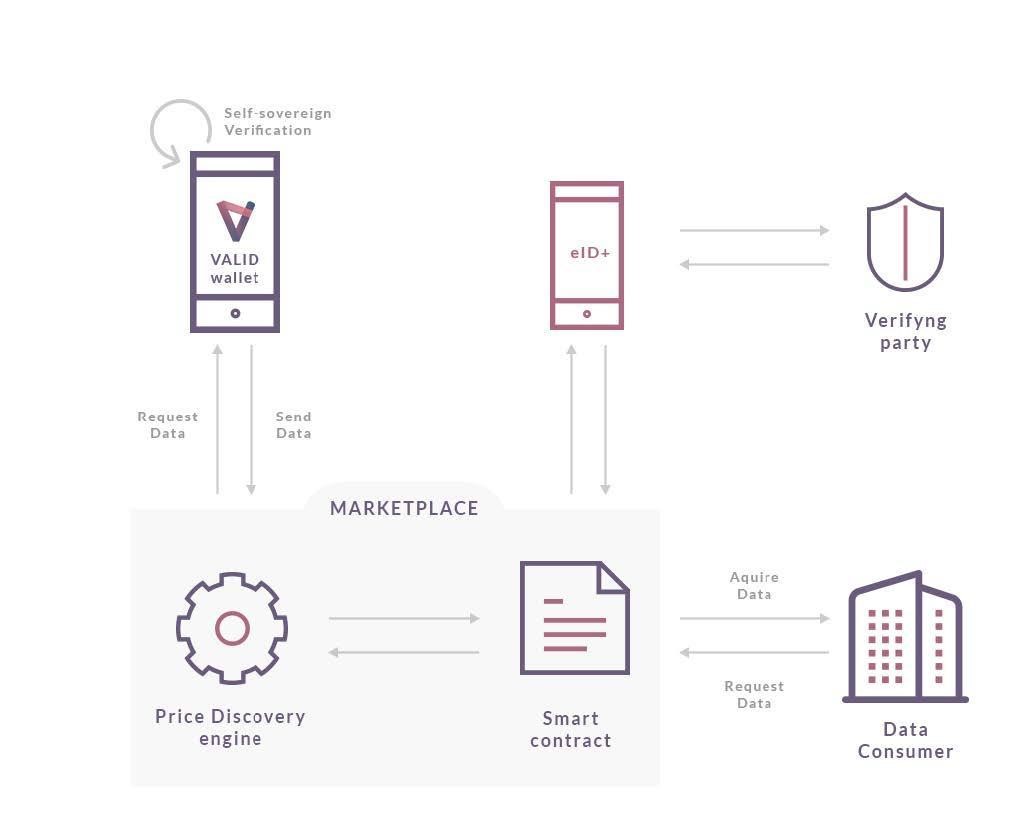

Just like any investment or business opportunity, you should look at the big picture. Review the ICO’s white paper in detail. Analyze if the project’s target market and users could really benefit from blockchain. Does the project offer something unique and useful to the market? Verticals like financial services, real estate, cybersecurity and even healthcare are great fits for blockchain, but this has also led to saturation and competition of services focused on these markets. New entrants should be able to offer new and unique plans of attack or build upon the strengths of existing services. The identity management and data streaming sectors are perfect examples of industries that can benefit from blockchain-powered solutions, due to the security benefits and smart contract usage blockchain offers. These two sectors have been booming with ICOs in the past year, with some well-known companies in the mix, like Civic, which offers identity verification via the blockchain, or Datum, that aims to build a decentralized marketplace for social and IoT data. Even IOTA recently launched their own data marketplace. What Swiss e-government service Procivis has done is to combine identity management with data streaming through its VALID project. VALID allows users to secure and monetize their personal data, giving full control of information back to users – including the ability to determine who profits from the data.

3. Verify the purpose of the tokens

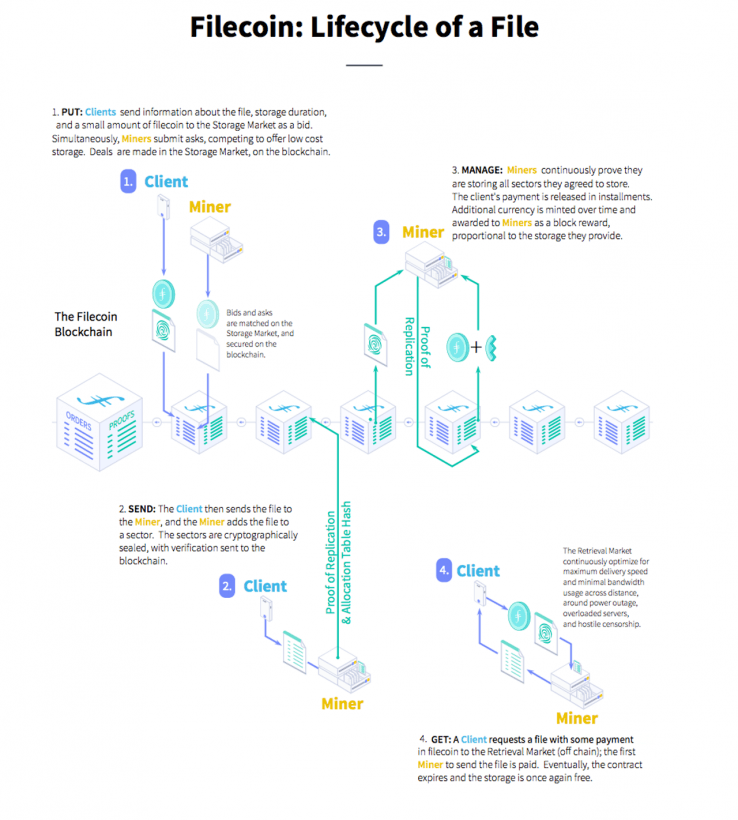

Crypto tokens may serve various purposes. Many of these tokens are “utility tokens” meaning they have specific uses on their respective platforms. For example, Filecoin’s tokens are needed by users to pay for file hosting services and are also used to reward miners who rent out their computer resources to the platform.

4. Understand the sale mechanics

Review the mechanics of the token sale. Details on how you could participate in the token purchase should be clear. There’s no shortage of stories of ICO newbies losing money through mistakes such as sending Bitcoin or Ether to the wrong crypto address. You should also be clear on how you wish to receive your purchased tokens. Some may give you access to an online wallet where your tokens will be stored. Others, like those that use Ethereum’s platform and smart contracts, may automatically credit tokens to the ERC20 wallet that you used to send the investment. Be aware of potential red flags. Typically, not having caps or definite time period to conduct the sale indicate that the company may not have a solid plan on what amount they actually need to get their project up and running. Do the math. The price and the number of available tokens for the sale should be proportionate to their expected development and marketing costs. Needing $100 million to exclusively fund development is quite excessive especially if the service is designed to use distributed resources.

Be smart

Treat ICOs as you would treat any investment opportunity – be calm and use reason. You might be triggered by the fear of missing out (FOMO) on crypto’s recent run. Still, you have to put up a well-thought-out plan. Crypto’s volatility is both its boon and bane. Choose your bets well and only allocate funds that you can stand to lose. Make sure you won’t be using your rent or grocery money just to get into crypto. Even with a lot of analysis, there’s always a chance that you can lose money. This said, investing in crypto assets can be quite exciting and there can be real profit to be made. You just have to be smart about it.

Get the TNW newsletter

Get the most important tech news in your inbox each week.