Digital connectivity in APAC reaches 47 percent penetration, as global digital adoption accelerates.

The latest in Kepios’s on-going series of Global Digital Reports reveals that digital connectivity in Asia-Pacific has reached 47 percent in September 2017, and that the pace of global digital adoption may even be accelerating.

The Digital in Asia-Pacific in 2017 report highlights some impressive growth trends around the region, with internet, social media, and mobile user numbers all showing solid increases since the 2016 APAC report.

You can read all 200+ pages of the report in the SlideShare embed above, but read on below to explore our key highlights and insights.

We’ve also produced a short video that outlines the essential findings from this year’s Digital in Asia-Pacific report, which you can watch in the video below:

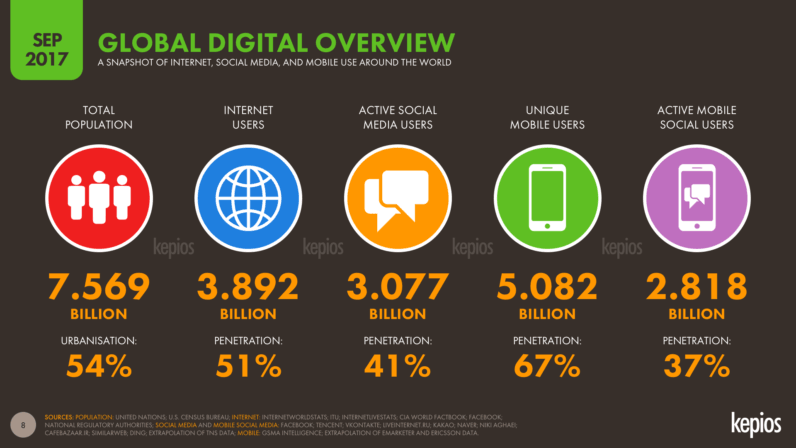

Global overview

Levels of digital connectivity continue to increase all over the world, with some trends even showing signs of accelerating since January’s Global Digital in 2017 reports.

The latest active user numbers for September 2017 are:

- 3.9 billion internet users (51 percent global penetration)

- 3.1 billion active social media users (41 percent global penetration)

- 5.1 billion unique mobile users (67 percent global penetration)

- 2.8 billion active mobile social media users (37 percent global penetration)

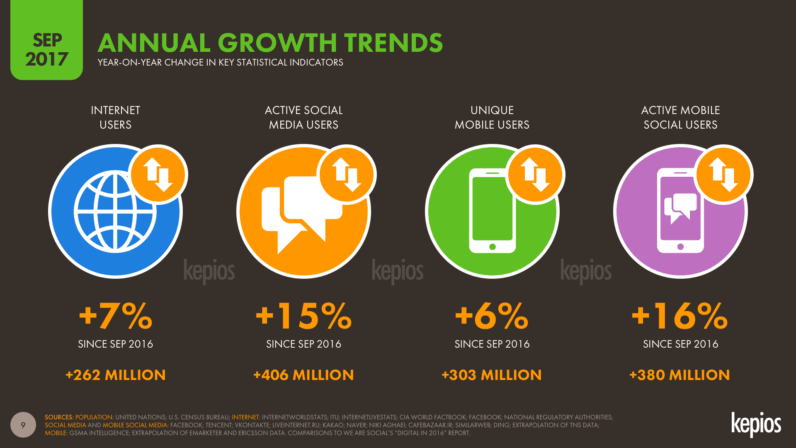

Global growth trends

Mobile users have increased by 6 percent during the same period, with GSMA Intelligence reporting 303 million new mobile users since this time last year.

However, social media posted the strongest user gains over the past 12 months, with overall users up 15 percent year-on-year, and mobile social media users up a healthy 16 percent .

In terms of absolute user growth, 406 million people started using social media in the past year, equating to growth of more than 1.11 million new users every single day — that’s almost 13 new users every second.

The equivalent annual growth rate in the Global Digital in 2017 report from January this year was roughly 12 new users every second, suggesting that social media sign-ups have actually accelerated in the first 8 months of 2017.

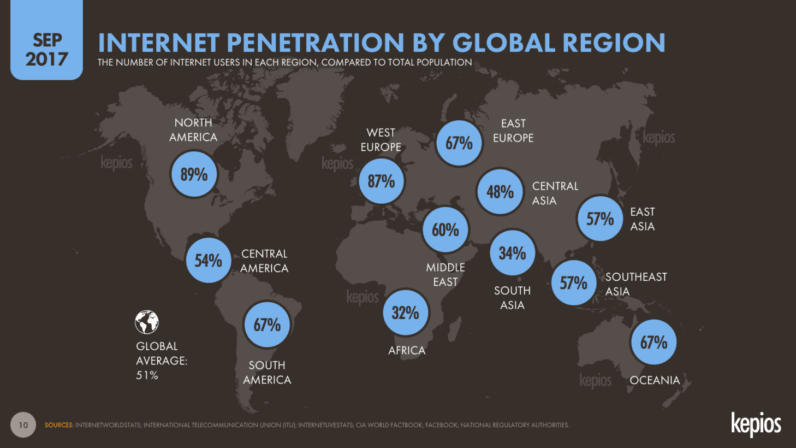

Analysis: the digital divide

Levels of connectivity still aren’t consistent around the world though, and barely one in three people living in Africa and South Asia have access to the internet today.

- Viable infrastructure, especially mobile networks capable of delivering digital data at sufficient speeds;

- Affordable devices and data plans;

- Content that caters to people with lower levels of literacy; and

- Content in local languages that addresses the interests and needs of local communities.

Improving levels of global connectivity remains a priority in the United Nations’ Sustainable Development Goals though, and the UN reiterated its commitment to providing access to these unconnected communities in its recent report on the global State of Broadband.

However, while some parts of Asia-Pacific have some of the lowest levels of digital connectivity in the world, there is still cause for optimism.

Digital use surged around APAC in the past 12 months, with all countries showing meaningful gains across key statistical indicators.

APAC overview

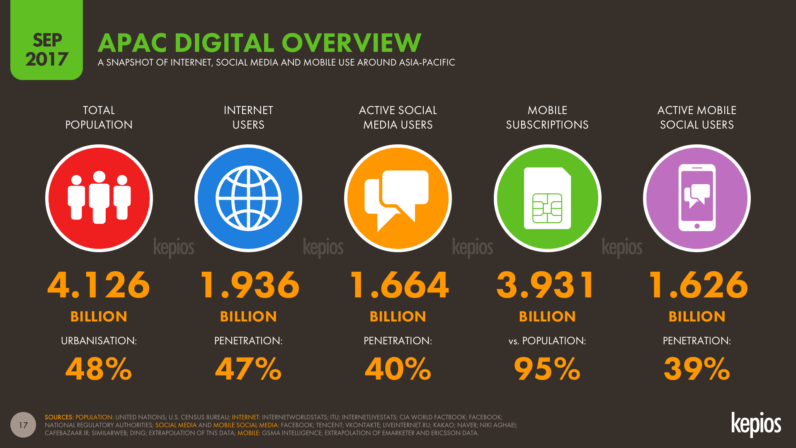

- 1.94 billion internet users, up 8 percent year-on-year to reach 47 percent regional penetration;

- 1.67 billion active social media users, up 17 percent to reach 40 percent regional penetration;

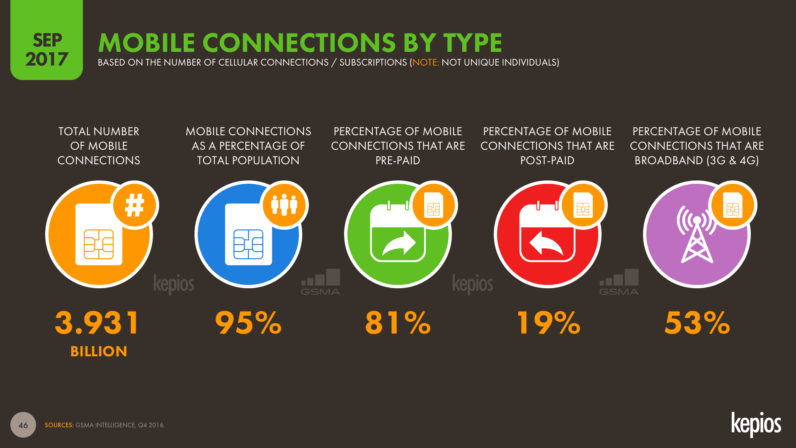

- 3.93 billion mobile connections in the region, up 4 percent year-on-year; and

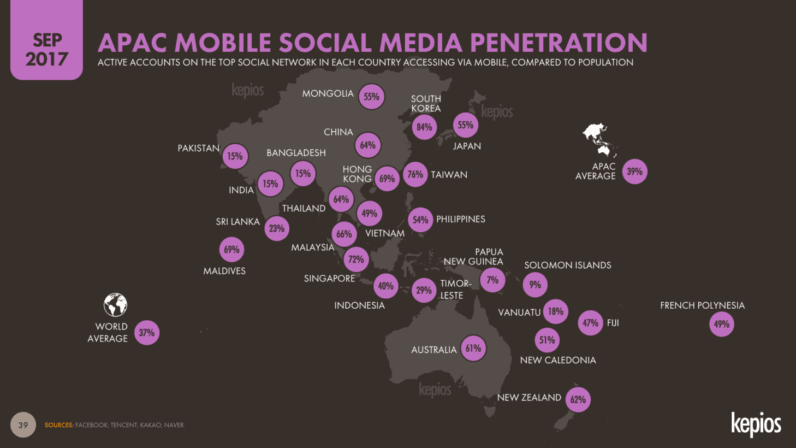

- 1.63 billion mobile social media users, up 20 percent to reach 39 percent regional penetration.

As with the global landscape, it’s those growth figures that give the greatest cause for optimism, and point to some exciting potential for further developments in 2018.

Internet in APAC in 2017

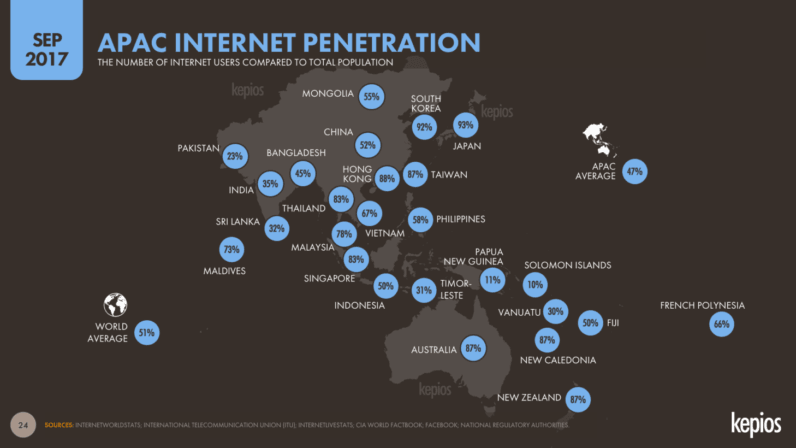

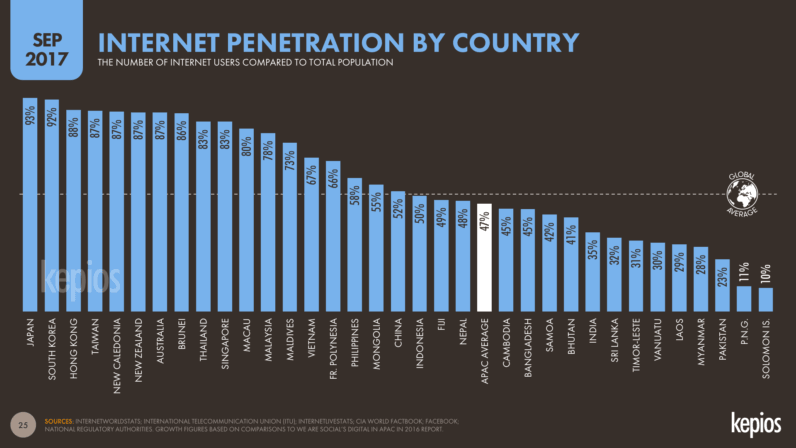

There are now more than 1.9 billion internet users around APAC, equating to a regional penetration rate of 47 percent of the total population.

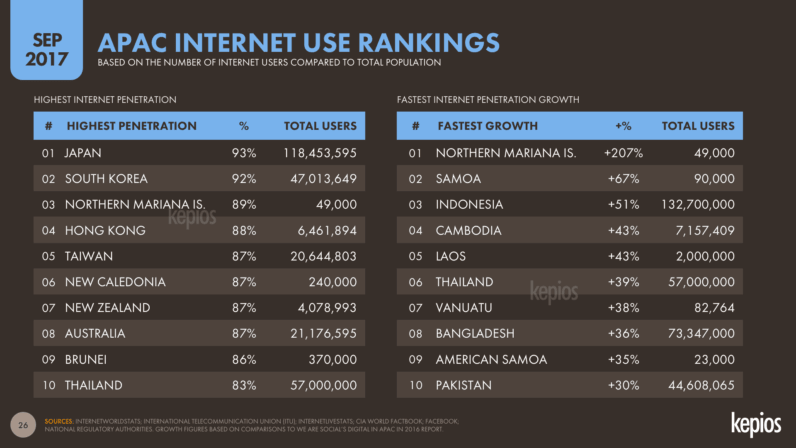

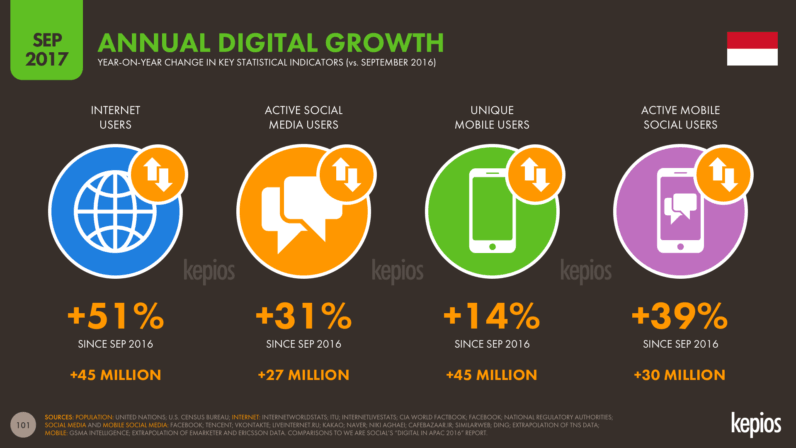

Encouragingly, more than 140 million people came online for the first time around APAC since September 2016, with Indonesia alone accounting for 45 million of these new users.

Japan tops the rankings of countries by internet penetration in this year’s report at 93 percent , closely followed by South Korea with 92 percent .

North Korea has the lowest levels of internet penetration in APAC, with less than 0.1 percent of the country’s total population online in September 2017. Internet penetration levels are also markedly lower in the Solomon Islands, where barely 10 percent of the total population accesses the internet today.

Papua New Guinea, Afghanistan, and Kiribati all have internet penetration levels below 20 percent, whilst more than half of the countries in Asia-Pacific register internet penetration levels below 50 percent.

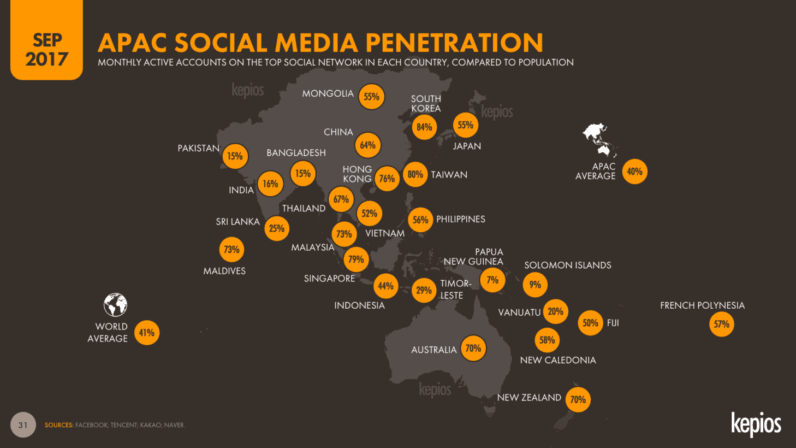

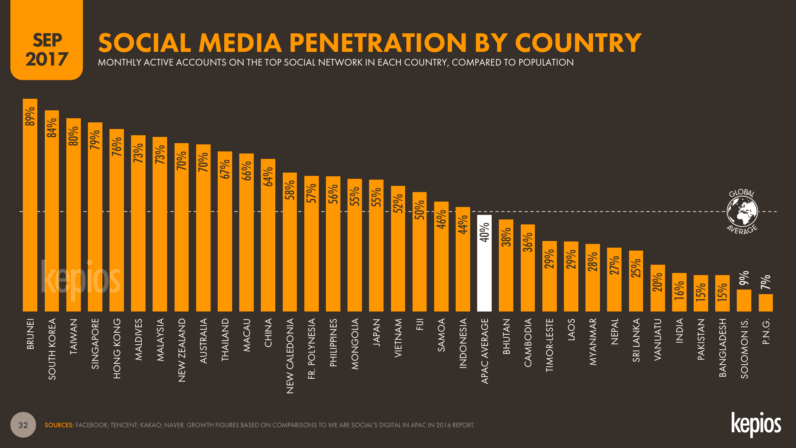

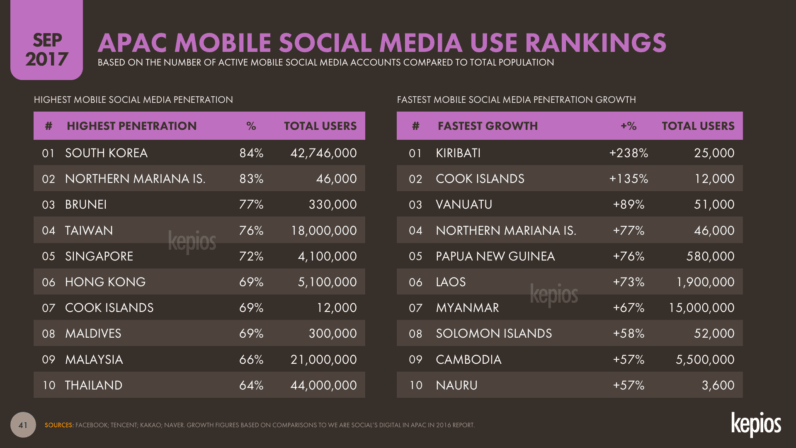

Social Media in APAC in 2017

People throughout Asia-Pacific continue their love affair with social media, with more than 40 percent of the region’s total population using at least one social media platform in the past 30 days.

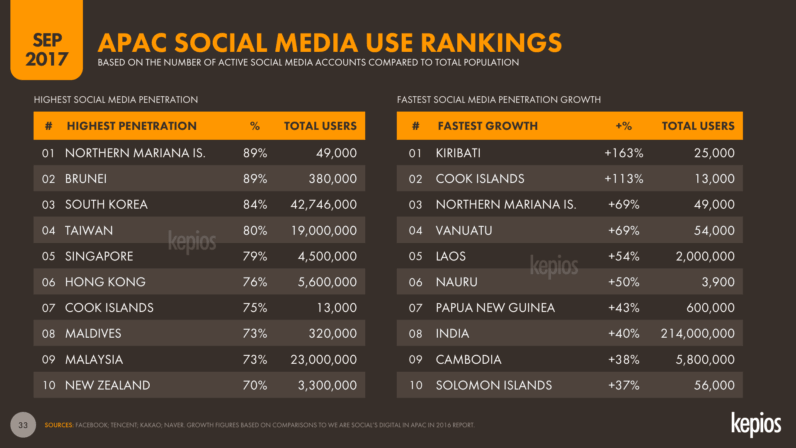

APAC accounted for almost 60 percent of global social media growth in the past year, and current trends show that every minute, more than 450 people in the region sign up to a social platform for the first time.

As with internet user growth, many of the strongest gains in social media users came from Pacific island states, which accounted for many of the fastest-growing user bases.

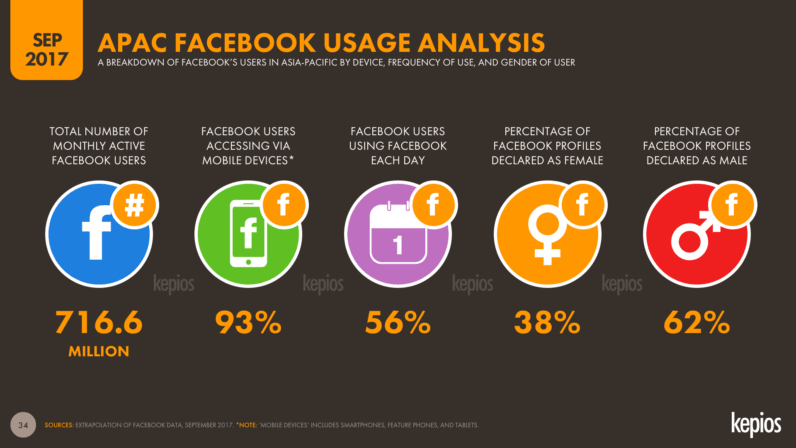

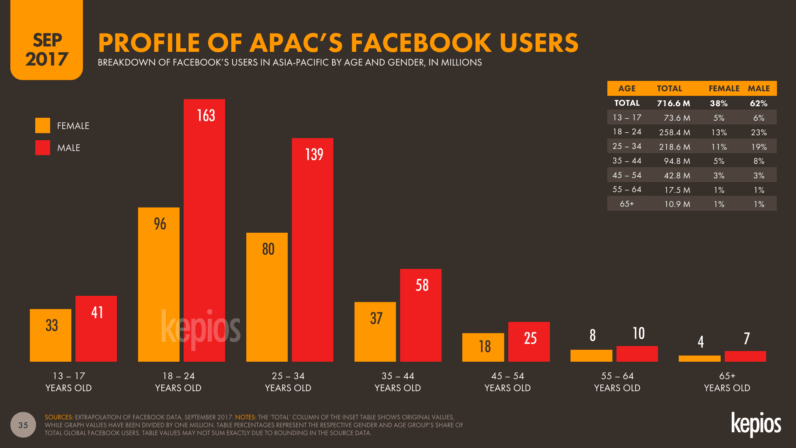

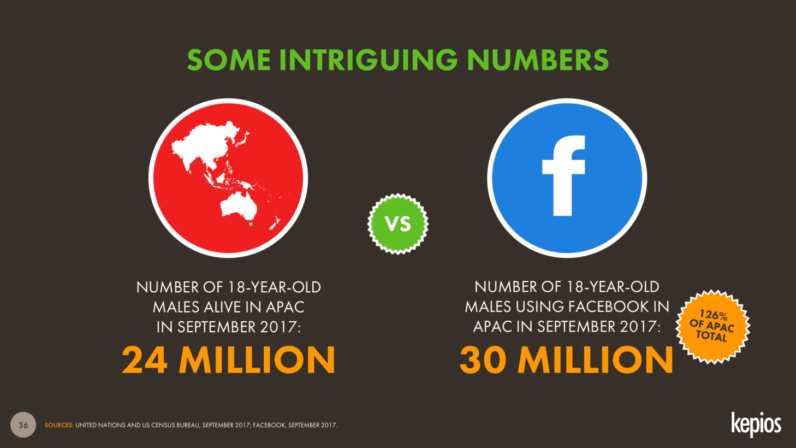

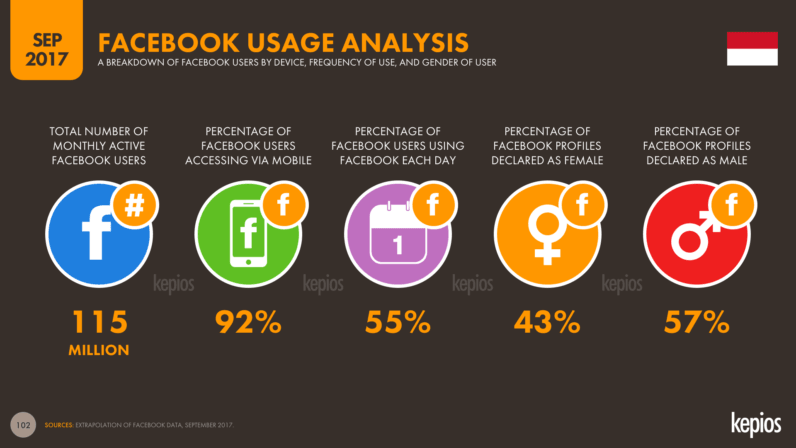

Facebook comes in at second place, with roughly 717 million active users in Asia-Pacific. Gender ratios remain a concern though, with more than 60 percent of the platform’s users in APAC reporting their gender as male.

In some countries in the region — notably Afghanistan (15 percent female), Pakistan (23 percent female), and Bangladesh (24 percent female) — Facebook’s user base remains heavily male-skewed, although this may be because some female users ‘mis-represent’ their gender on Facebook to avoid gender-related harassment.

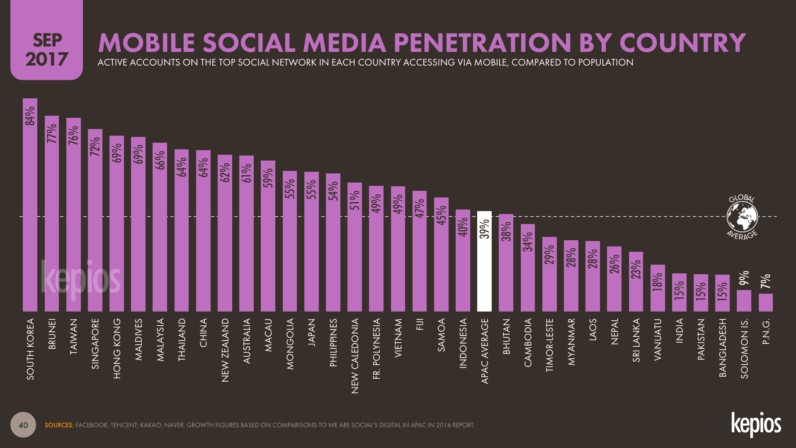

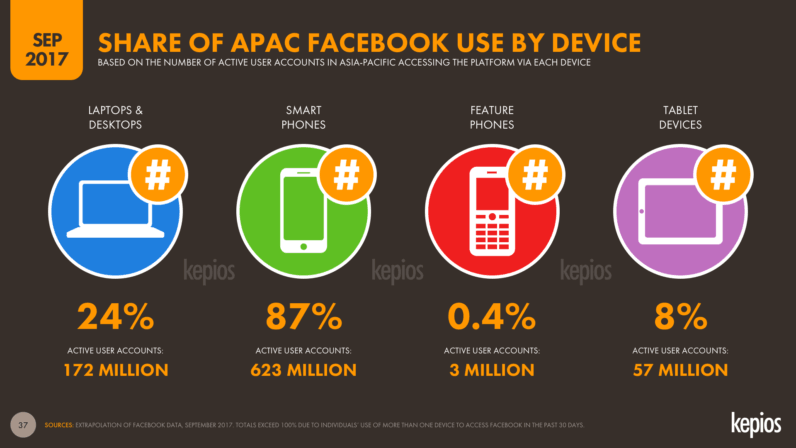

Mobile social media in APAC in 2017

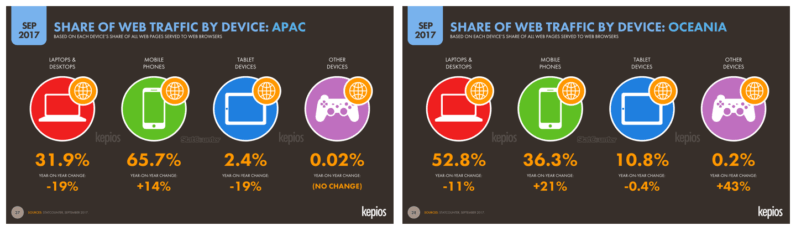

As we’ve reported in many of the previous reports in this ongoing series, mobile remains the primary device for social media access around Asia-Pacific.

98 percent of the region’s social media users access their top platforms via mobile devices, with countries including China, Japan, and South Korea all registering mobile shares of close to 100 percent.

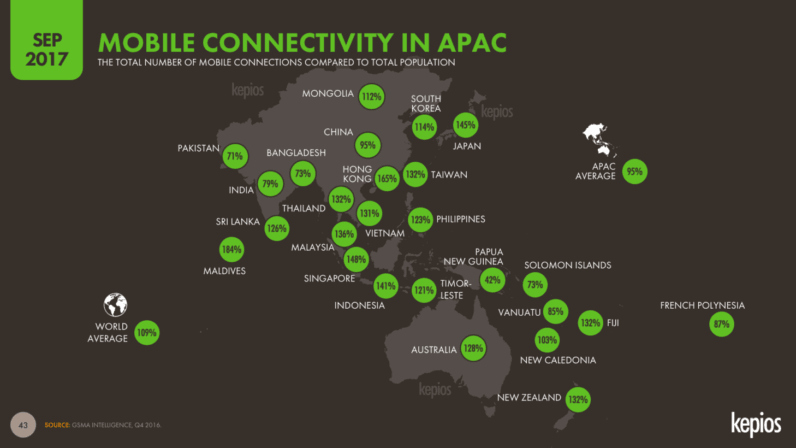

Mobile connectivity in APAC in 2017-

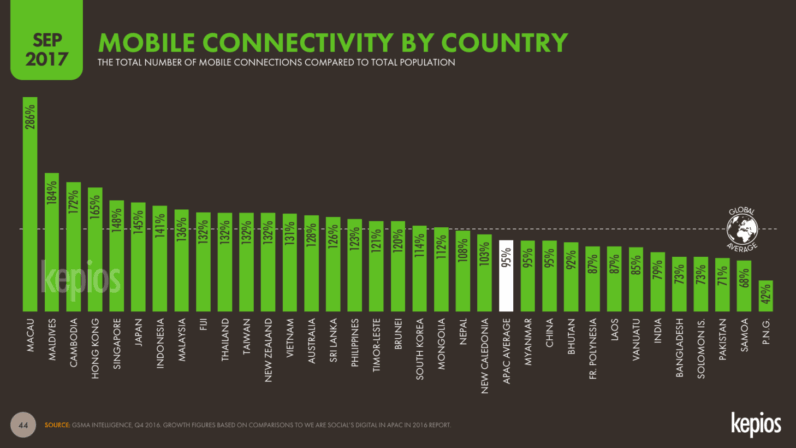

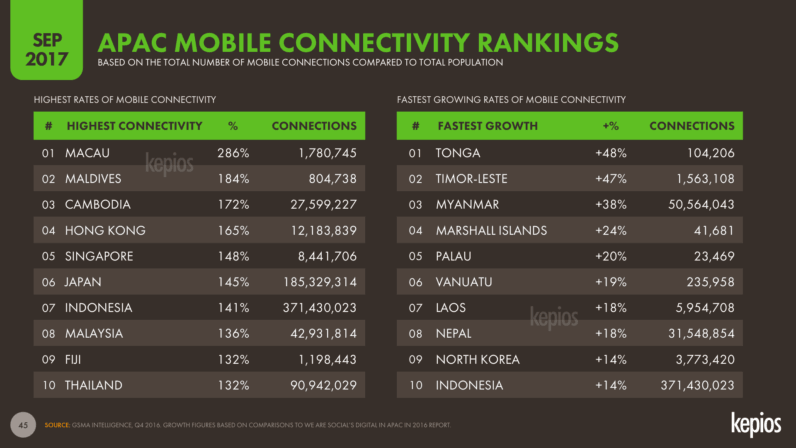

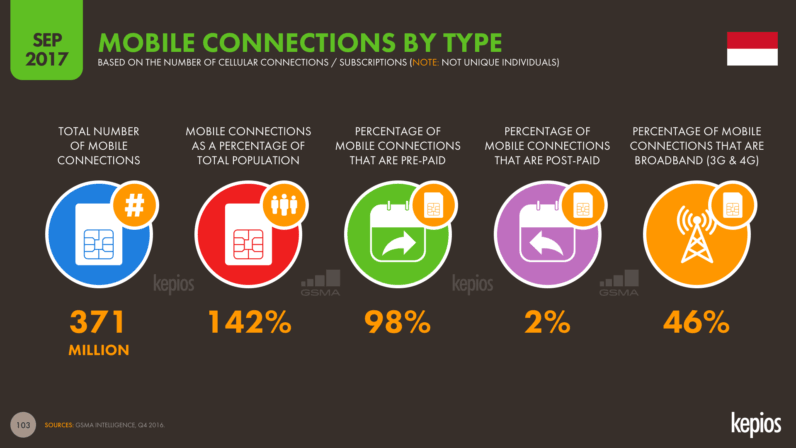

The number of active mobile connections in APAC grew by four percent over the past year, although a number of countries in this year’s study actually registered a year-on-year decline in the total number of connections, as people continue to consolidate the number of mobile devices that they use.

This consolidation is largely driven by access to social communication services such as messenger apps, which remove the need for people to maintain multiple contracts (and handsets) in order to benefit from intra-network pricing deals.

Macau tops the list of active connections compared to population, with the average user in the country now maintaining almost 2.4 active connections.

As recently as five years ago, these two countries had some of the lowest levels of digital connectivity in the world, so it’s particularly encouraging to see them post such strong gains over the past 12 months.

For context, around 400 million people in Asia-Pacific live on less than $1.90 per day, the UN’s global definition of extreme poverty, which puts both connectivity out of reach for most. However, prices continue to fall each year, and there are now a number of Android-powered smartphones available for below US$50, with some costing as little as $20.

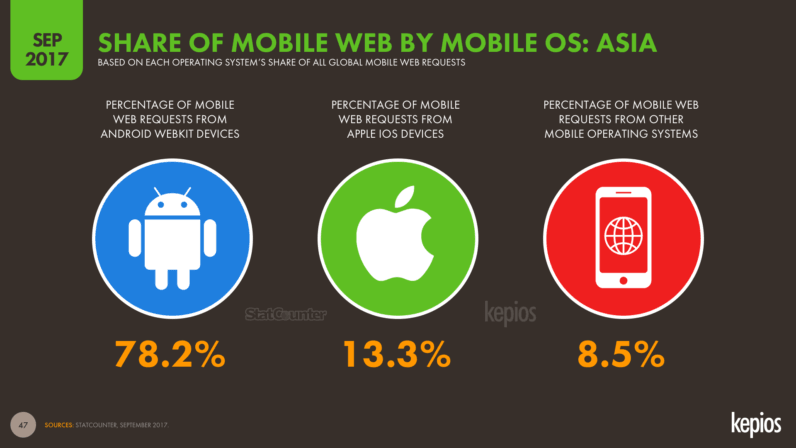

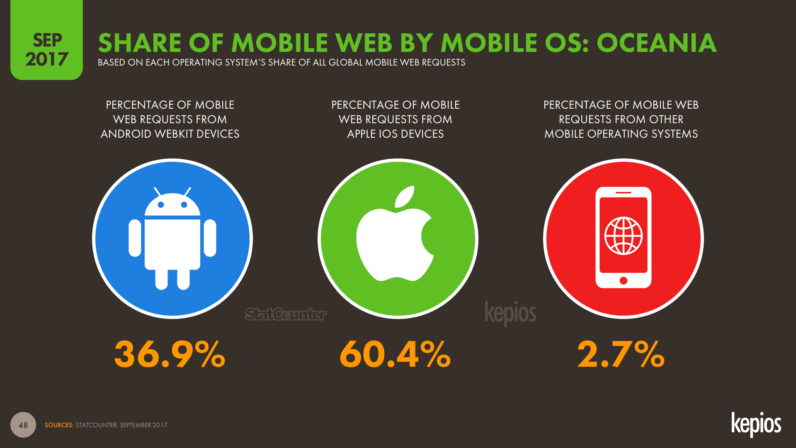

Partly thanks to these cheaper handsets, Android has extended its lead over iOS in Asia, and Alphabet’s platform now enables close to 80 percent of all mobile web traffic in the region.

What to expect in 2018

The accelerating growth we’ve outline above points to the further spread of digital connectivity in APAC and beyond in 2018.

We predict that a number of developments will help accelerate digital access for ‘the next billion’ over the coming months.

In particular, voice control will make it easier for people with lower levels of literacy to interact with devices like smartphones, enabling them access to tools such as web search, but also allowing them to dictate emails and listen to audio versions of informative sites such as news and online encyclopedia.

The steadily falling costs of smartphones and mobile data will also bring mobile connectivity within reach of even more people, especially in countries in South Asia where data prices are becoming increasingly competitive. There’s still a long way to go of course, but with each day that passes, digital connectivity comes within reach for many thousands of new users.

Another important development will be access to faster connectivity. Whilst the UN’s recent Global Broadband report shows that developing economies still struggle with disappointing data speeds, Akamai’s ongoing State of the Internet reports show that the situation is improving steadily, and as more and more users come online, the commercial incentive to offer faster, cheaper data will likely work in favour of the next billion users.

Even without these developments, current growth trends already suggest that we’ll see APAC internet users pass the two billion milestone by mid-2018, so there’s plenty to look forward to over the next 12 months.

If you’re keen to keep track of these changes, look out for our next Global Digital report, which we’ll be publishing in early 2018.

Country by country: the local view around APAC

We’ve increased the number of countries covered in detail in this year’s report to 35:

It’s worth noting here that there are a few numbers in the local-level data that may surprise some readers, especially when comparing internet and social media users. For example, it’s not uncommon for social media users to equal, or even exceed, internet users, and whilst this may seem counterintuitive, there are a number of potential reasons for this discrepancy:

- We collect social media user numbers from single-source commercial entities like Facebook and Tencent, who have a financial incentive to ensure advertisers know the latest size of their platforms’ audiences. In contract, internet user data must be collected using more arduous means such as surveys, because there is no single source for internet user data. As a result, the publicly available data are usually many months older than social media data, and as a result, internet user figures can lower than more recent social media users.

- Where the latest available internet user numbers are either relatively old, or appear to be significantly lower than social media user numbers, we use the latest social media user numbers as a reliable proxy for the number of internet users, meaning that the two figures will be the same.

- Many mobile networks in developing economies offer bundled access to top social media platforms as part of their contract deals, meaning that users can access these services without having access to broader internet services, including the web. Whilst it’s technically true that all of these social platforms are ‘internet powered,’ our research shows that the average person on the street considers ‘internet access’ to mean unfettered web access, so access to one or two social media services alone does not constitute internet access as they define it.

- Some people also choose to restrict their behavior to low-bandwidth social media activities like mobile messaging, in order to limit their data costs. Internet browsing today can be an expensive activity for lower income users relying on pay-as-you-go mobile data, especially with the proliferation of auto-play video and image-intensive web experiences. This self-restricting behavior highlights the potential for businesses and organizations hoping to engage these lower-income audiences though, and companies like Facebook are already catering to their needs with platforms like Facebook lite. However, I expect to see a rise in the number of local internet brands over the coming months who cater specifically to these lower-bandwidth users.

Country-level data for all of the 35 economies that we’ve profiled this year is available for free in the full report (see the SlideShare embed above, or click here to view it or download it on SlideShare), but here’s a sneak peek of the latest data for Indonesia to whet your appetite:

Get the TNW newsletter

Get the most important tech news in your inbox each week.