Apple has been on a financial tear lately, racking up record quarters one after another. Mac market share is at an all-time high, the iPad has consumed almost the entire market for tablets and the iPhone 4 still sold more units last quarter than any other single phone despite the fact that it’s an 18 month old device.

But now, as the company enters a new era under the reign of freshly minted CEO Tim Cook, it is preparing to expand its markets in the US and abroad with the release of the iPhone 5. One of the areas that is most likely to garner a lot of Apple’s focus in the coming months is the Asia-Pacific region, and more specifically, China.

No other region on the planet is more primed for huge growth in the coming months and Apple is taking advantage in several ways. There are some barriers to growth in China, but some trends in recent months have shown this to be a prime area for customer adoption of Apple products and massive growth for the company in the near future.

Apple breaks the ice in China

In recent quarters, Apple has already seen some success in China. Unlike Japan, which contributes a relatively small amount of Apple’s overall revenue, China has increasingly become a market that is a major factor in Apple’s current financial success.

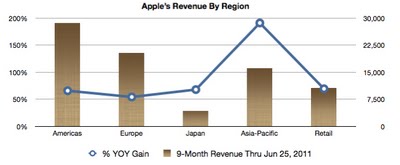

In the first 9 months of this fiscal year, the Asia-Pacific region, excluding Japan, accounted for a whopping 20% of Apple’s reported revenue. That’s 1/5 of all of Apple’s revenue worldwide coming from the region.

This is an increase of 191%, bringing Apple’s reported revenue in the region to just north of $16 billion. The immense year-over-year gain is illustrated in the chart below.

Historically, China isn’t the friendliest market for American brands. Google has found it tough to do business there because of restrictive censorship and retailers like Best Buy and Home Depot have run up against heavy price competition.

Yet, despite the conventional wisdom, Apple’s business in China is booming and is set to get even better over the next year.

China’s economy is having some of its best years ever due to the rising world demand for consumer electronics, much of which is manufactured in China’s monstrous city-factories. The average Chinese citizen is more flush with cash than ever before and ready to spend it on what would previously be deemed as unaffordable luxury.

Paul French of Shanghai-based Access Asia indicates that the increase in middle class affluence is behind the increase in purchasing power. “There is now enough of an urban middle class with enough money to afford Apple products. Five years ago — or even two or three years ago — there weren’t enough of those people.”

In fact, five years ago, Apple didn’t have a retail store in China, now it has four, including a stunning split-level glass and metal flagship store in Sanlitun, an area of Beijing known more for its nightlife than its retail outlets.

Those stores aren’t barely surviving either, with $2.6 billion in revenue this year, four times what we saw last year from Apple’s Retail Stores in China. The two stores already in Shanghai are actually so crowded that Apple plans a third, even larger, store.

This should mean that Apple is fighting the price war well in China, offering its products for less than they can be purchased in the US, but that’s not actually true. In fact, Apple sells a comparatively specced 13-inch Macbook Air for $180 more in China than it does stateside.

Apple’s success flies in the face of conventional wisdom about the region. China’s cost-conscious and knockoff-friendly consumers are somehow finding a way to make room in their budgets for Apple products that are unique and hard to duplicate at the same level of quality.

Presentation and the Chinese concept of face

There is much to be said about the way that Apple presents and sells its products at the retail level and even on a broader marketing scale, but this isn’t the time to discuss it. Suffice to say that Apple’s products hold a certain, almost universal prestige. They’re a premium product, presented in a premium retail environment.

This sort of prestige holds out a type of cachet that drives people to purchase Apple products, not only for their usefulness, but also for the status that they bring to the purchaser.

Almost nowhere in the world is this of more import than in the Chinese culture, where the concept of ‘face’ is an integral part of society.

Apple’s retail stores offer the Chinese consumer a chance to test the products in a beautiful and visually stimulating atmosphere and those efforts are paying off with big sales numbers.

This kind of attention to the senses and emotions of the consumer wasn’t pioneered by Apple of course, but they are one of the first major companies to bring that kind of experience to China’s city centers in a big way.

Complimenting this presentation is the concept of ‘face’. Very, very simply put it is a concept that involves the cultural standing of an individual among his or her peers, but it also carries along other facets that have to do with business and personal relationships and mutual respect. It’s an incredibly complex subject and we won’t be distilling every aspect of it, but there are certain points that are important when it comes to discussing Apple’s business in China.

The primary concept of ‘face’ is that of self-esteem or reputation. This is often referred to as mianzi. The desire to have a positive self-image and to project that image out to other people leads many Chinese people, especially the young and wealthy, to seek out high-end and prestigious products.

Many times this desire to project an aura of wealth and prestige can lead the normally very pragmatic and rational Chinese consumer to make choices based on the appearance of the product and its symbolic value in society.

This difference in the way that the products are presented is doing its job in separating Apple’s products from the rest of the pack almost everywhere that its retail stores are located. Apple is doing no more in China than it does elsewhere to make sure that its products are being seen as objects of desire, but that method is even more effective in the modern Chinese culture of wealth and status.

A country where consumers are hungry for polished products presented in a stimulating atmosphere and finally have the cash to afford them. For more excellent discussion on the concept of face, read this paper by Qiumin Dong and Yu-Feng L. Lee of NMSU.

The second aspect to consider is the concept of guanxi , the interpersonal relationships that cause Chinese consumers to value the recommendations of their friends over advertising and marketing. It also speaks to the complex rules of gift-exchange.

Chinese consumers see the Apple brand as one to be desired and it holds a high satisfaction rating. The word-of-mouth recommendations of consumers in China has done a lot to make the Apple brand a household name, more so than any marketing effort.

I like the way that Doctorate of Science student Li Chen of the Université d’Aix Marseille puts it:

The Chinese consumers tend to regard the brand as part of their social life and their relationships to others. The exchange of gifts is considered as the most direct and most visible to cultivate guanxi. The way a person respects and implements the complex rules of gifts exchange is an essential element in assessing the social position of that person

Apple holds a unique position among foreign brands in China as its products are highly polished, appealing to the young and wealthy elite and valuable as gifts given to those with whom a Chinese consumer might seek a better relationship.

Simply put, Apple’s products are far more valued as status symbols and quality products than other foreign brands in China and their retail presentation is working its magic even better in China than it is in the US.

So now that Apple seems to have cracked the Chinese market in a big way, they need to capitalize on it in a big way. That’s where the iPhone comes in.

China and the iPhone

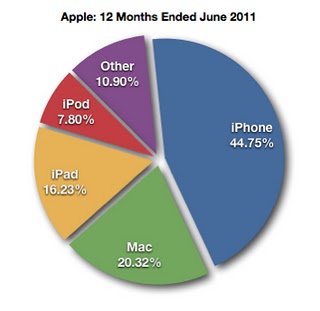

Worldwide, the iPhone makes up a huge percentage of Apple’s business. During the 12-month period that ended with its latest earnings call in June, Apple’s reported revenue exceeded $100 billion for the first time ever. What product made up almost 45% of revenue in that time period? The iPhone.

Together, the iPhone and iPad accounted for 60.98% of Apple’s revenue in the last four quarters.

Numbers like these are why Apple is so hot to get the iPhone launched in a big way in China. Although the company has been selling the iPhone officially on China Unicom since 2009, Unicom is the smallest of the three major Chinese carriers.

Of course, when we say small, we’re talking about 180 million subscribers, more than AT&T or Verizon in the US. That’s how big the potential market for the iPhone is in China.

The big fish is really China Mobile, the 616 million-subscriber juggernaut that is China’s largest mobile carrier. That’s why it’s not surprising that then-COO Tim Cook was seen visiting China Mobile in June. Apple wants to get this deal made.

Even more evidence came in the form of China Mobile’s chairman Wang Jianzhou stating during an earnings call last month that then-CEO Steve Jobs had met with him several times already about the deal.

Despite the fact that China Mobile’s network is incompatible with the 3G radios in the current-model iPhones, there are still 7.44 million unlocked phones running on the network with pre-paid SIMs. This speaks to the desire that the Chinese public has for the iPhone.

Jianzhou said that an official agreement to carry the iPhone is something both parties want, “All I can say is, it’s a common wish of China Mobile and Apple to come to an agreement as soon as possible.”

Of course, even if a deal is reached, this doesn’t mean that Apple would gain all 616 million of those subscribers, there is the matter of competing brands like Android and the newly launched Android fork Yi, by search engine Baidu.

In addition, only a fraction of the phones in China are currently smartphones, the vast majority of devices in China are featurephones at best. These challenges represent roadblocks to the iPhone’s continued growth in China.

There is also potential competition from China Telecom, China’s state-run mobile provider, who has been rumored to carry the iPhone before the end of this year.

But if Apple manages to broker a deal for China Mobile to carry the iPhone 5, or a cheaper iPhone 4, in time for their release next month, it seems clear that there will be a growth spurt like Apple has never seen in China.

The iPad and halo effects

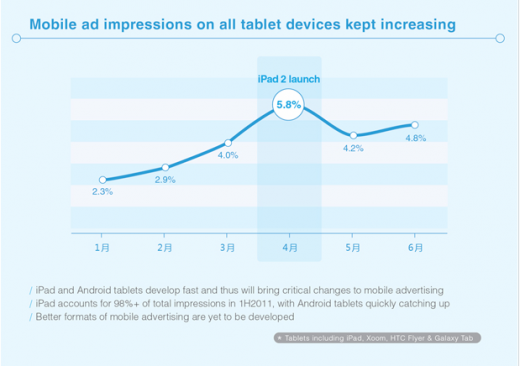

The iPad isn’t a small part of Apple’s growth in China either, and the market for the device seems strong. The iPad currently accounted for 98% of all ad impressions on tablets in the first half of 2011, displaying its dominance even in the Chinese market.

“The desire for this brand has already broadened out from the trendy urban demographic to just about everyone,” Chiang Jeong-wen, a professor at China Europe International Business School in Shanghai, told the Financial Times.

In keeping with the gift-giving guangxi mentality, the iPad has also come to be a prime way to bribe officials or business partners. “I give away 20 iPads in a good month,” a marketing executive at a cosmetics company told FT. He has a trunk full of iPads and iPhones that he uses as ‘gifts’ to encourage retailers to put his company’s products onto their shelves.

This cachet has carried over to other devices besides the iPhone and the iPad as well. More evidence of the ‘halo effect’ that Apple’s portable devices are having on consumers. This effect causes those who purchase an iPhone or iPad to regard other Apple products in a better light and, perhaps, to transition to a Mac from a PC when making their next computer purchase.

This halo effect was part of the reason that Apple overtook Lenovo in sales in greater China for the first time ever this year.

iPhones cheap!

Without a doubt, one of the primary factors that will determine Apple’s success in China and other emerging markets is its ability to offer a lower-cost pre-paid alternative to a subscription-based and subsidized iPhone.

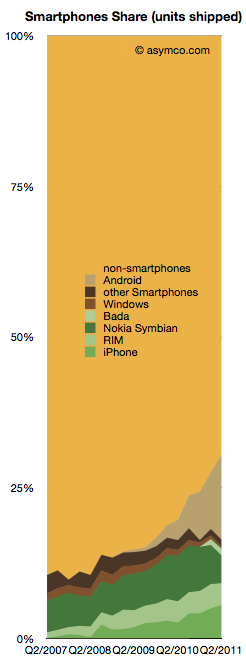

Such a device would allow Apple to penetrate into the massive non-smartphone market not only in China, but globally as well. As Horace Dedieu of Asymco points out, while the non-smartphone market has shown a sequential decline of 6%, it still represents nearly 75% of the global market for mobile devices. This means that manufacturers that are only making smartphones, like Apple, are fighting for their share of only 25% of the market.

It only makes sense from a market-share standpoint for Apple to make a low-cost iPhone that can convince some of these customers to move up to more capable device, while not incurring the expense of a lengthy contract.

Of course, if Apple were to make a move into this market, it would attempt to do it in an Apple way. Tim Cook and Apple CFO Peter Oppenheimer recently told RBC analyst Mike Abramsky that Apple would only launch a low-end device if it would provide an “innovative, category killer experience.”

But that doesn’t mean that it hasn’t been on their mind either, as they acknowledged that there is a massive and significantly untapped opportunity left in China, despite all that Apple has achieved there already.

The future of Apple in China

In January of 2010, Tim Cook had choice words about Apple’s focus on China, saying, “if you look at greater China last quarter, which is China, Hong Kong and Taiwan, our revenues tripled year-over-year in that geography which is I think phenomenal by any measure. We have a tremendous focus on it.”

The past year of growth for Apple in China has borne out those words and it appears that its efforts have been rewarded. But that doesn’t mean that this isn’t just the beginning for Apple.

It has laid its foundation well, with products that appeal to the newly enriched and status-conscious Chinese consumers and has benefited from its skill in presenting its products as objects of desire and quality with its Retail Stores.

It has been rewarded with six-fold growth in the market and a high level of acceptance of the iPad. But with all of this, it still seems that Apple is just beginning to build a track record of success in the region.

Cook shares those sentiments, saying “I firmly believe that we are just scratching the surface right now, think there is an incredible opportunity for Apple [in China].”

Get the TNW newsletter

Get the most important tech news in your inbox each week.