YouTube introduced professional channels — an initiative to add original content to the Web’s top video site — back in December 2011, after an investment of $100 million, and now it is preparing its a second push for the program but far fewer partners can expect to see upfront cash investments.

Ad Age reports that the company is readying a second round of funding but the fresh money will only be seen by 30 to 40 percent of its 100 plus channel partners, which were recruited to make the service more TV-like and competitive against video-on-demand (VoD) services.

“Our biggest objective was to kick-start the ecosystem, to bring in great creators, to deepen our relationships with advertisers and to grow viewership,” Jamie Byrne, global head of content, told Ad Age.

The original line-up of professional channels mixed celebrities and entertainers — including Madonna, Jay-Z, Deepak Chopra, Tony Hawk and Rainn Wilson — with “authentic, real and accessible” partners to compliment the better known names on the service. It seems, however, that the channels backed by celebs and obvious names are not guaranteed to be part of the influx of fresh cash.

“We looked at viewership they’ve been able to achieve, the cost of the content, and from that we are able to determine the channels that are delivering the best return on our investnent,” Byrne says.

YouTube says it is still a few weeks away from contacting the partners that are in line for money and, as before, it has not given precise details of exactly how much channel owners can expect. Ad Age, however, speculates that most will see $1-5 million.

The money is, as it was last year, not a free lunch since it is essentially an upfront payment of one year of advertising revenues. Each producer must earn the money back via ads attached to their content before they can make additional revenue from the service. For example, $1 million comes it at 50 million views on a $20 CPM (cost per mil/thousand) – fairly high stakes.

YouTube says that its top 25 channels average more than a million views per week and that the top 33 have racked up more than 100,000 subscribers – each of whom is more likely to visit the channel, view its content and make advertising dollars. The service has also gone international, and the coming few months will see it launch in the UK, Germany and France.

Those stats, added to the 4 billion monthly hours of play it was seeing as of August, are impressive but the second round of money raises some questions too.

YouTube is positioning the move as a narrowing of focus on its best performers but, by the same token, the decision to abandon upfront payments to two-thirds of the channels could be seen as an indicator that it does not believe it will see a return on its investment from the others. Are they are failing to generate sufficient viewer and ad engagement numbers?

The video site has, according to Ad Age, thus far not provided ongoing performance statistics to a large number of channel owners which, again, can be taken positively or negatively.

Certainly, it will be interesting to see which channels and niches get the second round of investment as that will give us an indication of where YouTube has seen growth and the content areas where it is focused on accelerating.

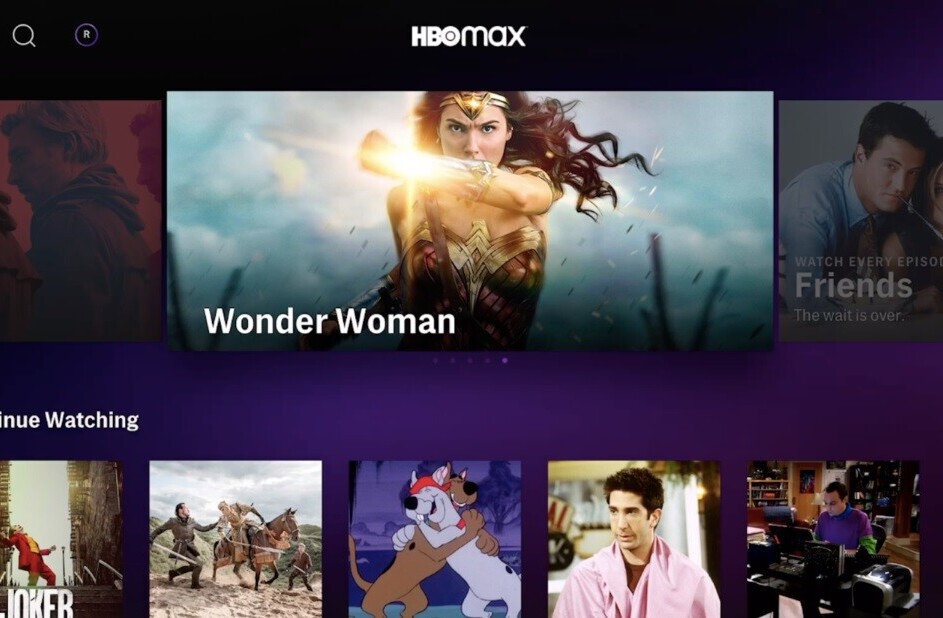

The Channels program was introduced to help YouTube — far and away the Web’s most used video platform — evolve beyond being a repository of videos. Hulu and Netflix are among the VoD services that are revolutionizing the way Internet users watch and interact with TV and other broadcast content.

Netflix recently announced Q3 revenues of $905 million and the US firm expects to make $400 million of operating income this year after covering its global operating expenses. Amazon, which owns UK Netflix competitor LoveFilm, is also in the game and is trialing an $8 per month subscription for its Prime service.

Image via Rego Korosi / Flickr

Get the TNW newsletter

Get the most important tech news in your inbox each week.