Alibaba isn’t a household name in the US, but the e-commerce firm from China is shaping up to hold one of the biggest technology IPOs that the US markets have ever seen.

Some insight into its size was revealed this week with its recent financial results — which were made public via shareholder Yahoo’s recent earnings report — and they are impressive, to say the least, as Tech In Asia reports:

The Chinese ecommerce juggernaut pulled in US$3.06 billion in revenue in Q4 2014, which is up 66 percent on the same period a year before. Alibaba’s Q4 net income hit $1.36 billion in net income in Q4, which has more than doubled (up 110 percent) from the previous year.

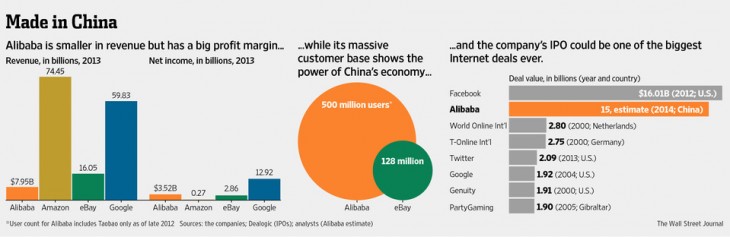

The Wall Street Journal reports that Alibaba’s stock sale could happen as soon this summer, and that the firm could raise as much as $15 billion at a valuation north of $150 billion. That isn’t quite Facebook level, but it is vast and its influence is likely to be felt outside of China too.

There are plenty of major credentials in Alibaba’s lap, for one thing it processes more transactions than eBay and Amazon combined, and takes home larger profits than both combined, while it is said to account for 70 percent of all packages handled by China’s postal service.

Its profits lie in Web commerce, but in addition to its four main e-commerce businesses, Alibaba offers a payments service, cloud storage, a mobile OS, maps, and a mobile messaging app.

The Journal pulled together a bite-sized look at some important and big figures related to Alibaba and its business interests:

But wait, there’s more. Startup founders and investors will be particularly interested in how Alibaba is spending its mountains of money.

This year alone, its deals have included:

- $804 million: A majority stake in TV and film production company ChinaVision Media Group

- $215 million: Lead investor in latest funding round for messaging app Tango

- $692 million: For a 35 percent stake in department store operator Intime

- $1.5 billion: To fully acquire mapping firm Autonavi

- Undisclosed: Part of $250 million funding round for Lyft

- $1 billion: Alibaba-affiliated investment firm bought a 20 percent share in Web TV operator Wasu Media

While, perhaps more interestingly for those in the West, Alibaba has backed US-based e-commerce sites as it looks to dip its toes into the American market. That interest might be indicative that a flurry of acquisitions and investments could happen in the US in the run up to its IPO or after it.

Either way, those in the US that aren’t fully aware of Alibaba need to sit up and take note of the company.

Related reading: 15 tech IPOs from Asia to watch out for in 2014

Also: What Alibaba’s IPO means for e-tailing in the US

Image via Charles Chen / Flickr

Get the TNW newsletter

Get the most important tech news in your inbox each week.