It’s shaping up to be a day of big money in Korea. First off games giant GungHo teamed up with Japanese operator Softbank to invest $1.5 billion in Supercell, and now reports are suggesting that messaging company Line is preparing for an IPO that could be worth up to $28 billion (30 trillion KRW).

Korea news site MT reports that Line — which has over 230 million registered users of its messaging apps — is looking to list either on the Tokyo Stock Exchange or the NASDAQ.

Suggestion of an IPO chimes with reports from August, when it was reported that the company would wait until the end of the year to list, since it is keen to reach 300 million registered users first. This time, however, the rumors include a prospective valuation, albeit one that seems more than a little on the steep side to us.

See also: How can a mobile messaging service be worth $28 billion?

Questions about profit and spending

For a start, there is a question about profit. Line is scaling fast and generating increasing levels of revenue — it recorded $132 million in revenue for Q2 2013, and it is booking $10 million per month from sales of sticker packs alone — but it is still to reveal its profits publicly.

Given its ambition to grow beyond its strong user base in Japan and a handful of other Asian countries, Line is almost certain to be spending considerably more than it is making.

Korean analysts recently speculated that parent company Naver — which span Line out earlier this year — is investing at least $190 million (200 billion KRW) in Line each year to keep things going, and that’s without considering the figure that Line is reinvesting from its revenue.

Low active user count

Furthermore, and most worryingly, the company deals only in registered users numbers, unlike others in the industry that reveal the number of people who are actively using their services.

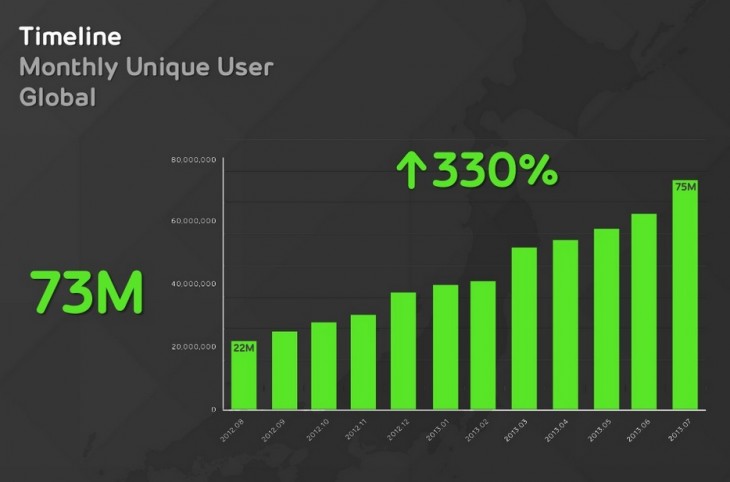

According to Line’s own materials, it has just 73 million monthly active users. That’s someway behind WhatsApp (300 million), which was reportedly an acquisition target for Facebook at a valuation of over $2 billion, and WeChat (235 million) — that throws into question whether Line is worth $28 billion.

Update: Line has clarified that this figure refers to the number of active users of its timeline feature, not the service overall. We have asked the company to clarify exact how many monthly active users that it has and await a response.

Nonetheless, Line is making progress with download figures worldwide. An advertising campaign fronted by tennis star Rafael Nadal helped it gain 15 million downloads in Spain, though it is unclear how many are active. Line also says it is making progress in Latin America and other parts of Asia, and has its eye on Europe among other markets.

Line has struggled to gain significant traction in the US, and it remains unclear whether a listing on the NASDAQ would be aimed at changing that…not to mention whether it actually could.

Already Line and apps of its ilk are more popular than Facebook in some markets in Asia and, with a platform that delivers games, multimedia, marketing messages and more, the aim is clearly to grow into a mobile-first social platform for the world. So that at least explains how Line could be thought of as company that could be worth tens of billions of dollars.

We reached out to Line for comment and will update this post with the company’s response.

Headline image via Thinkstock, others via Line

Get the TNW newsletter

Get the most important tech news in your inbox each week.