Crowdfunding is gradually creeping into every walk of life. The latest evidence? LexShares is a new platform that lets you invest in US litigation.

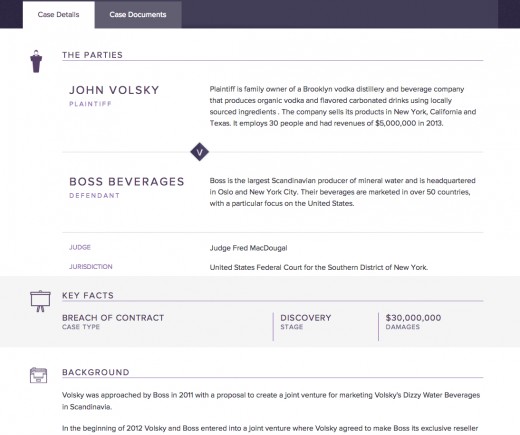

Accredited investors around the world can use the site to browse lawsuits that require funding, and then put a minimum stake of $2,500 into any that appeal to them.

LexShares was founded by Jay Greenberg, ex of Deutsche Bank’s technology investment group, and Max Volsky, an attourney and expert in lawsuit funding. While the idea of investing in lawsuits may seem odd, Volsky points out that there are already three publicly-traded funds (two in the UK and one in Australia) that do just that, along with some US hedgefund activity too. However, these funds generally only touch cases that require upwards of $3 million.

Conversely, LexShares is targeting smaller cases that require backing of between $100,000 and $1 million. The startup wants to “even the playing field” between well-resourced corporations and smaller organizations and individuals, who often lack the backing needed to win, even if they have a good case.

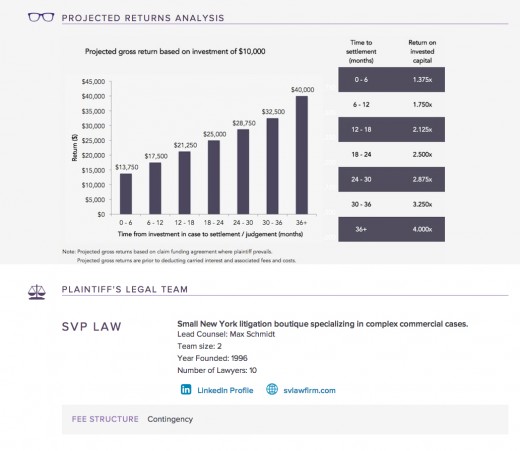

Before you invest, you’ll get a chance to see details of the plaintiff’s legal team and an estimated time for a return on the investment, assuming the plaintiff wins.

Lawsuits must reach their full funding target before they receive the money, and investors will get progress reports as a case proceeds, including PDF copies of court documents. If the plaintiff wins, investors receive a portion of the proceeds. If the plaintiff loses, the investor forfeits their stake.

Greenberg says the market for investment in lawsuits is similar to the private equity market in the 1980s, with plenty of opportunity but not enough capital. LexShares sees an ‘education gap’ here that it hopes to bridge for potential investors.

If it makes an impact, LexShares could really shake up litigation in the USA.

Get the TNW newsletter

Get the most important tech news in your inbox each week.