Keeping control of your finances can be a challenge at the best of times. Keeping control of your finances as a child is something that probably doesn’t even enter your mind.

Nonetheless, that doesn’t mean that kids shouldn’t have financial tools at their disposal if they are inclined to keep an eye on their spending, or if parents want an alternative to handing over cash. Indeed, it’s this lack of tools that Osper, a mobile-first bank for 8 – 18 year olds in the UK, is hoping to solve.

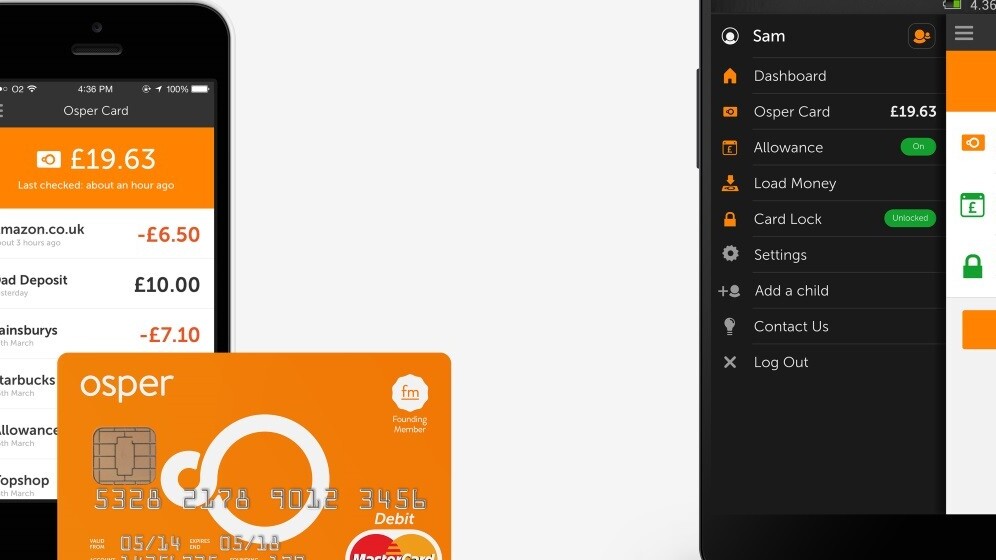

Announced today, Osper is essentially a banking service made up of a prepaid debit card (provided by Mastercard, this is a debit card, not a credit card and there’s no overdraft facility) which links to iOS or Android app.

The child can then, as you might expect, withdraw cash, make online purchases, subscribe to subscription services and everything else you’d do with a normal debit card.

On the app side, rather than simply providing a statement of incomings and outgoings for the user, it also provides a separate login for parents, just so you can keep an eye on things.

The app also allows parents to schedule an an allowance payment directly into the account or make instantly credited emergency deposits, if required.

The dual login for parents and children also means that either party can put a lock on the account if the card is lost or stolen.

Osper’s smartest move, however, is the fact that it has taken a mobile-first approach. Delivering the service through an app rather than a ported desktop experience means that it’s far more likely to reach its intended audience – desktops, like personal finance management, are just so not cool. A slick UI and simple options can go a long way here.

The service is free for the first year and then costs £10 per year after that. To date, it has already attracted more than £10 million of pre-launch investment from the likes of Index Ventures, Horizons Ventures and a number of successful entrepreneurs, which is probably enough to keep Osper’s piggy bank going for a while.

➤ Osper | Google Play | App Store

Get the TNW newsletter

Get the most important tech news in your inbox each week.