We’ve followed the story of Derwent Capital Markets for some time, and today the London-based company has launched its unique stock trading platform, which uses social media data to help traders make moves on the market.

DCM Dealer is a Web-based platform based on technology developed back when London-based Derwent was putting together a Twitter-based hedge fund. While the fund itself was quietly dissolved after one month (a CNBC report today says that it had just $40 million in assets and entered a market that was just too hostile to continue in), the company maintained its faith in the concept behind the fund – that moves in the stock market could be predicted by analysis of social media sentiment.

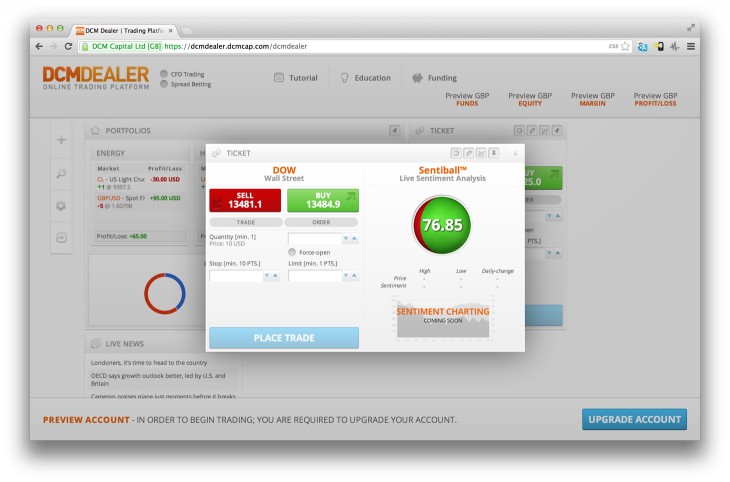

The technology has been repurposed and productized, with Derwent aiming it at day traders. First came an iOS app last year, and now there’s DCM Dealer, which is designed for spread betting and CFD (Contracts For Difference) derivatives trading as opposed to directly buying and selling stock.

While there are a number of features included that traders will find useful, such as built-in news feeds and email alerts when specified events occur, what makes this interesting is that sentiment for stocks, indices, FX and commodities on social media channels such as Twitter and Facebook is measured and displayed as scores between 0 and 100 (where 0 represents a very negative attitude and 100 a very positive attitude). Users will be able to view charts that show how sentiment has changed over time.

While no-one is claiming that sentiment is a 100% perfect guide that will help traders in every case, there’s strong evidence that it’s a useful indicator of future stock performance. We reported last year that Derwent Capital Markets says its short-lived hedge fund returned 1.86% in its sterling shares, ahead of the market and the average hedge fund. This supports academic research into the subject, which formed the basis of DCM’s work. The company has also published case studies that show, for example, how sentiment seemingly ‘predicted’ the future price of Facebook stock.

If this kind of trading interests you, you can sign up for a free DCM Dealer preview account to try it out.

Image credit: AFP / Getty Images

Disclosure: This article contains an affiliate link. While we only ever write about products we think deserve to be on the pages of our site, The Next Web may earn a small commission if you click through and buy the product in question. For more information, please see our Terms of Service.

Get the TNW newsletter

Get the most important tech news in your inbox each week.