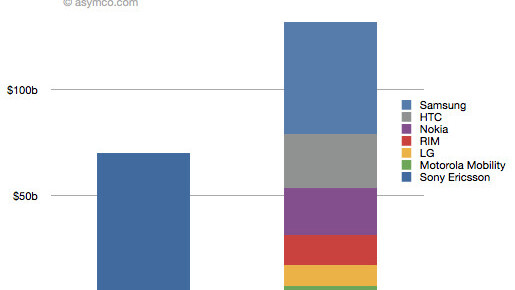

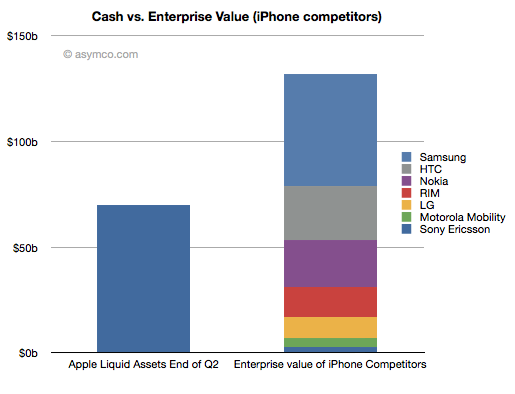

Asymco’s Horace Dediu has done some number crunching, comparing the current enterprise value of Apple’s major mobile competitors against the liquid assets that it has on hand. The results illustrate how dominant of a profit force that Apple’s mobile business has become in just 4 years.

Dediu has compared the four main standalone competitors to Apple but has also made some educated estimations of the mobile divisions of larger companies like Samsung and Sony. At the moment only the inclusion of Samsung prevents Apple from having enough cash to cover a purchase of the whole mobile industry.

- Nokia $22.6b

- RIM $13.8b

- HTC $25.4b

- Motorola Mobility $4.2b

He says that it was more difficult to calculate the value of mobile subsidiaries like Sony Ericsson, Samsung and LG but was able to generate an estimate using multiples of trailing operating profits. Given the troubles that RIM is in right now, its inclusion in this list isn’t too surprising.

Apple currently has estimated liquid assets of $70B, greatly outstripping the enterprise value of all of its competitors combined, excepting Samsung. If Apple’s growth several continues as it has for the past several quarters in a row, even Samsung won’t be a barrier.

Apple could soon have enough cash on hand to purchase all of its major competitors without breaking a sweat.

Get the TNW newsletter

Get the most important tech news in your inbox each week.