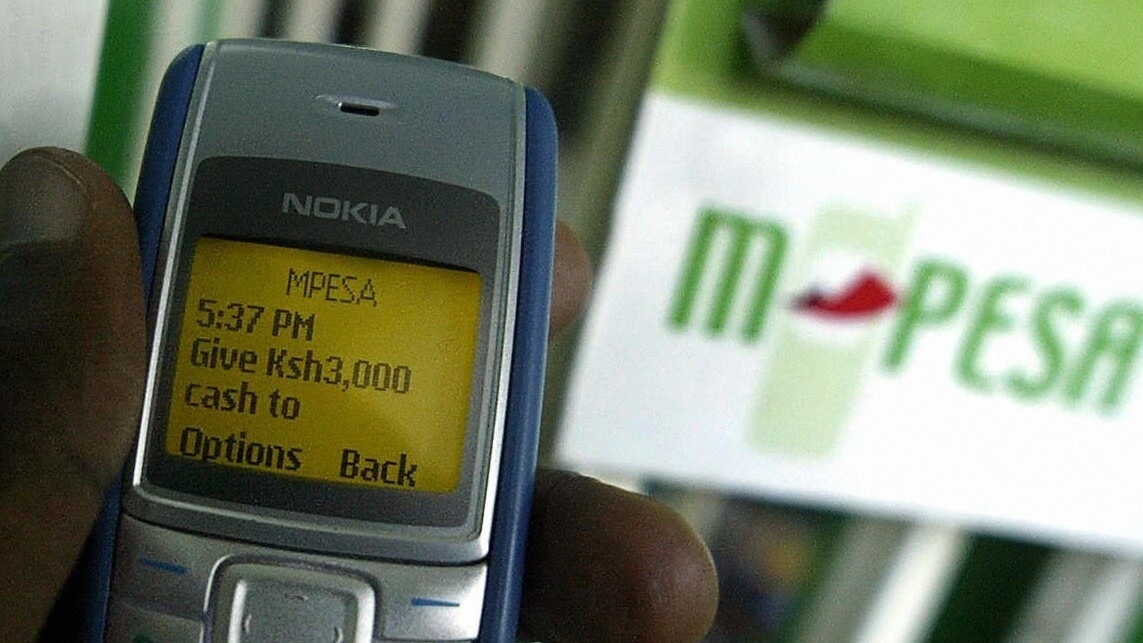

Following the recent strike in Kenya by state-employed teachers, lecturers and doctors, the country’s treasury has said it will cover the approximated $300 million USD cost in wage increases through cost cutting and introduction of new taxes, including on mobile money transfer services such as Safaricom’s M-Pesa.

The tax measures announced by the finance minister Robinson Githae will include a 10 percent excise duty on cash transactions using popular mobile money transfer systems.

M-Pesa is the largest mobile money transfer service provider in Kenya, with more than 14 million subscribers. The mobile money service has proved to be a crucial service for revenue growth for the Vodafone-owned Safaricom. It is estimated that M-Pesa handles some 2 million transactions per day.

This announcement by the finance ministry will surely have caught the mobile service providers by surprise, coming a day after Airtel Kenya removed transfer costs on its mobile money services to allow subscribers to send money through their phone at no cost, in a bid to cut into M-Pesa’s market share.

Airtel’s announcement was seen as enticing new subscribers in a Kenyan market where Safaricom has used M-Pesa to lock down customers from moving to other mobile networks. Airtel reports that it has approximately 4 million subscribers.

Safaricom is definitely going to be hardest hit by this policy as the majority of mobile money transactions have been on their network. Data from the Central Bank of Kenya demonstrates that although new customers grew at a slower pace, the value of money transferred through mobile platforms jumped by 41 per cent in the first six months of 2012.

Githae emphasised that he expected money-transfer service providers to meet the new expenses and not pass them on to consumers by increasing their service fees, though analysts expect the service providers to increase their costs.

According to reports, Safaricom has said it is still investigating the new tax policy stating through their chief executive Bob Collymore adding “the cost will be borne either by the customer or by the shareholder of whom Government is a 35 per cent owner.”

Image credit: AFP / Getty Images

This story originally appeared on HumanIPO.

Get the TNW newsletter

Get the most important tech news in your inbox each week.