Tonight, before the next financial week begins, I want to take a moment to stare at Groupon, and its marked recent decline. It’s important, as the tech IPO well could be quite poisoned if Groupon is about to suffer even greater losses. Facebook, for example, could experience public-market discomfort when it tries to float, if Groupon’s woes continue.

But let’s not get too ahead of ourselves. What has been going on at Groupon? Two things, roughly. The first, a public statement from its accounts to the effect that the company has ‘material’ weakness in its financial controls. For a freshly public firm, that is a breath of rot.

And secondly, a wave of negative press. TNW, mostly, or completely under my pen has been recently critical about the company. I’ve been joined with voices around the tech writing community, expressing either alarm, or at least worry about how the company is operating. I will say, that for a fully different view, Surya Yalamanchili has an excellent piece on the company that came out this weekend. I recommend that you read it, whatever your perspective.

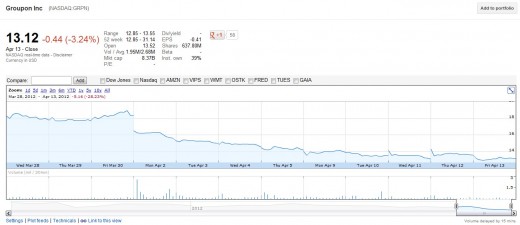

However, let us dispense with that for the moment, the who-is-right-at-the-moment niggling, and let’s allow the charts a chance to speak:

That’s since March 28th, to Friday. The company has apparently found new share price bottom, or floor, which was original impetus for this post; the Groupon slide appears to have lost steam, by my estimation. However, the damage has been done. Groupon is now worth less than $8.5 billion, and is trading below its IPO price.

It’s tough times in Groupon-land. Now, I am rooting for the firm. There is little more that I want for the firm than for it to turn profits, and keep investing in Chicago like it has been. That would be perfect. But I worry. Let’s hope its next quarterly statement is better than expected.

If not, Groupon could inflict more than self-damage; if the company fails to impress, it could dampen market excitement for all tech-related offerings. That means that the larger IPO pipeline, and especially those offerings that relate to tech, could shrivel on the vine. As goes Groupon, in a way, for the moment, so goes the market. Here’s to hoping.

Get the TNW newsletter

Get the most important tech news in your inbox each week.