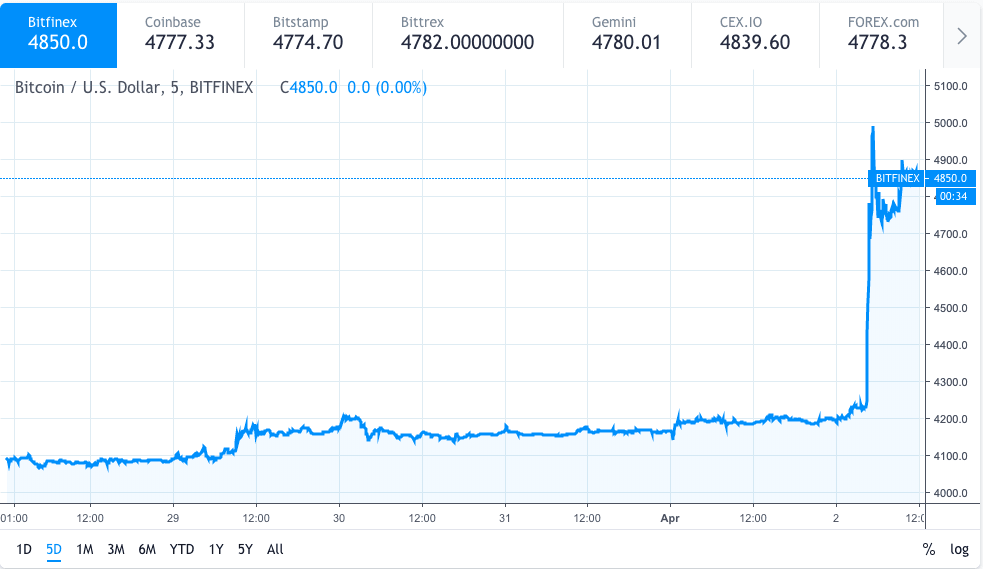

Bitcoin has been pumping. Over the past six hours, its value has jumped as much as 20 percent, and a recent report has claimed a “mystery buyer” is responsible.

During Asian trade, Bitcoin’s value broke $5,000 for the first time since November last year, marking the biggest one-day gain in the past year, Reuters reports.

Trade has since calmed, with the price remaining steady at around $4,700 across major exchanges. The last time Bitcoin was over $4,500 was back in November 2018, around five months ago.

Oliver von Landsberg-Sadie, head of a cryptocurrency brokerage firm, told Reuters the movement was likely the result of a single buyer, who used a computer algorithm to trigger the purchase of $100 million worth of Bitcoin spread across a number of exchanges.

“There has been a single order that has been algorithmically-managed across these three venues, of around 20,000 BTC,” he told Reuters, noting the orders were spread between cryptocurrency exchanges Coinbase, Kraken, and Bitstamp.

“If you look at the volumes on each of those three exchanges – there were in-concert, synchronized, units of volume of around 7,000 BTC in an hour,” he added.

Another industry insider told Reuters there were 6 million trades over an hour during the price rise, mostly concentrated on Asia-based exchanges. This is three to four times the usual trading volume.

“You trigger other order books to play catch up, and that creates a buying frenzy,” he commented.

Bitcoin’s price famously almost hit $20,000 in December 2017 and had been gradually falling ever since. By February this year, we had entered the longest Bitcoin bear market in history.

Curiously, Hard Fork reported back in January that cryptocurrency analysts had determined some time in Q1 2019 to be the end of Bitcoin’s cold streak. We are now in Q2.

So far so good, I guess.

Did you know? Hard Fork has its own stage at TNW2019, our tech conference in Amsterdam. Check it out.

Get the TNW newsletter

Get the most important tech news in your inbox each week.