The Bitcoin bear market has battered and bruised a multitude of blockchain startups. It’s also rendered terms like “streamlining,” “restructuring,” and “run out of money, shutting down” all too common. But somehow, a Matrix-themed cryptocurrency, NEO, is hiring.

The second iteration of NEO DevCon took place in Seattle over the weekend. The most notable announcement was the opening of a new office in the famously tech-orientated Washington capital.

It’s to be spearheaded by John deVadoss, former director of engineering for Microsoft’s .NET framework. He also served as general manager of Microsoft Digital, and oversaw the majority of its product lifecycle.

A preview of what is being called “NEO 3.0” was also shared in a presentation, which is set to include some neat technical improvements to the platform – but it’s also a little more nuanced than that.

To really nail down these concepts, it’s important we take a step back and define some aspects about this particular blockchain.

NEO uses a delegated consensus style, and it’s not DPoS

NEO is a blockchain that acts as an ecosystem for decentralized apps (dapps), powered by a native cryptocurrency, also called NEO.

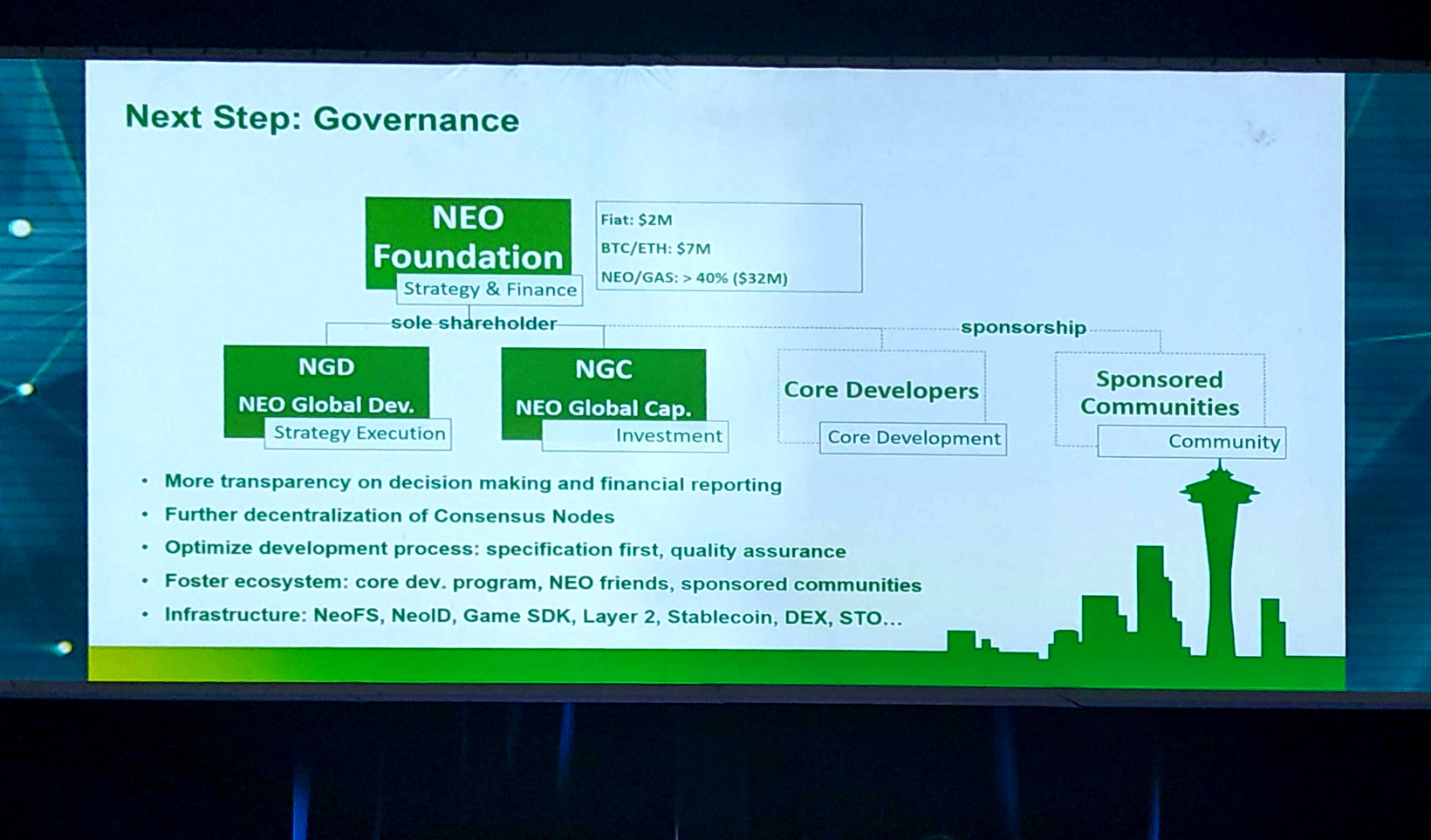

The NEO Foundation maintains its development. It’s a non-profit providing tools for building decentralized platforms, like games, exchanges, and other token-oriented services.

Unlike Bitcoin’s Proof-of-Work (PoW) consensus style, in which anyone with enough resources can participate in validating the network (mining), NEO uses a method called Delegated Byzantine Fault Tolerance (dBFT), where the responsibility of validating transactions is transferred to a much smaller number of parties.

At a high level, dBFT is reminiscent of another consensus model, Delegated Proof-of-Stake (DPoS). It’s employed by rival blockchains EOS and TRON, which have 21 and 27 validating nodes respectively.

Bitcoin currently has more than 10,000 full nodes working on securing its blockchain, while Ethereum has just under 9,000.

In the case of NEO, just seven machines manage that responsibility (an aspect that has attracted quite a bit of criticism, including an indirect dig from Ethereum co-founder Vitalik Buterin). Five validating nodes are directly controlled by the NEO Foundation (again, a non-profit), one is managed by a community known as City of Zion (CoZ), and telecommunications giant KPN was awarded a position most recently.

Trusting delegated validators relies on a mathematic principle in computer science that can be reduced to theoretically believing the network so long as two-thirds (plus one) of all validators can reach consensus.

More generally, if roughly 66 percent of the network agrees, the transactions are treated as legitimate. It also means trusting a very small set of individuals to not get up to any funny business.

But, these methods are considered to provide “absolute finality” to transactions, instead of the “probabilistic finality” afforded by PoW blockchains like Bitcoin and Ethereum.

The differences between DPoS and NEO’s dBFT, though, extend a little further. With DPoS, participants can use their account balance to elect third parties to validate the network. The more tokens held, the more sway can be used to select who should be running the show.

While it’s normally proposed that having a smaller number of validators on a blockchain increases the transaction throughput, it’s long been argued that these quasi-democratic mechanisms are open to being manipulated by cartels of colluding whales who work together to elect who they like.

Despite the intention to brand NEO’s delegation process as a “vote,” the NEO Foundation is really the only one doing the voting. It was the NEO Foundation who “elected” CoZ in July last year, and it also made the call to install KPN in October.

There are more candidates being tested for their reliability in testnet versions of NEO, namely Switzerland’s leading telecom Swisscom, also chosen by the NEO Foundation.

The past two “elections” have involved the NEO Foundation giving up one of its validating spots to the new member. This means that until quite recently, the NEO Foundation were the only ones confirming transactions on its own network.

NEO 3.0 is all about becoming a serious platform

Hard Fork caught up with key players in NEO to find out how the third version of NEO is shaping up, and how decentralization fits in with their philosophy.

John deVadoss, NEO’s new head of development, expressed that NEO is vying to be a serious blockchain for serious business. In that sense, it’s really a question of believing in its founder, Da Hongfei, and his phased approach to decentralization.

“Unlike probably some of the blockchain platforms, NEO has always had this anchor of the smart economy – digitizing assets, a focus on identity, a focus on obvious scenarios like STOs [security token offerings] and so on,” deVadoss explained. “Given that basis, we want to be careful and cautious in terms of our partners, building a trustworthy platform means you take the time.”

But trusting just a handful of parties with such serious transactions is significantly more centralized in comparison to direct competitors like EOS and TRON, let alone Bitcoin or Ethereum.

“I think it would be very easy for [Hongfei] to decide to say, ‘you know what, open the gates [for more validating nodes],'” noted deVadoss. “Speaking for myself, I would say at this point in the evolution, of the maturity of blockchain platforms, I think it would be premature to rely on ‘how many nodes,’ or ‘how many ‘this’ and ‘that.’ I would focus more on the underpinnings of the blockchain.”

“For example, you look at PoW. I think that this notion of probabilistic finality might make sense for Bitcoin. But once you go into the world of dapps, probabilistic finality – it cannot work,” he told Hard Fork. “And so you look at Proof-of-Stake (PoS), this notion of economic finality also has significant challenges, right? I mean, you have to have absolute finality.”

DeVadoss went on to say this gives NEO a unique advantage. He also noted Ethereum was looking to shift consensus styles altogether, and had already faced problems.

“So, you look at, for example, Ethereum. They have to now go from PoW to PoS – they’ve had some hiccups along the way,” he continued. “It’s not easy, because the underpinnings were not probably well-thought through in terms of the long-term goal of building a trustworthy platform.”

For NEO, it’s more about building strong partnerships with key players, and obviously Microsoft is one of them, as it’s native to the Seattle area.

In fact, the attention NEO has paid to Microsoft is no joke. Design choices, which deVadoss described to be tied to the polyglot worldview, have allowed developers to write NEO dapps using Microsoft’s .NET programming language (among other popular languages like C# and Java). This was something he noted the software giant appreciates greatly.

“We want to be seen as a serious platform – trustworthy, developer-friendly and ready. There are things we can learn from the way Microsoft have done with .NET, and obviously Amazon Web Services,” deVadoss added. “That’s kind of the identity that we want to establish for NEO and the NEO community, which I think means that we have to be a little more measured in terms of how we how we venture.”

He then noted NEO would not be changing consensus styles or protocols any time soon.

Seven consensus notes ‘represents the will of the token holders’

While recent efforts to decentralize the network (such as its working relationships with KPN and Swisscom) were certainly lauded at the conference, decentralization at the technical level didn’t seem like an immediate priority.

One panel did seek to assure the audience that the NEO cryptocurrency enjoys rather high levels of distribution, so in that sense, NEO is supposedly decentralized.

It should be noted the NEO Foundation currently controls 40-45 percent of its entire token supply, and this was touted as proof of its financial stability on stage.

When Hard Fork spoke with NEO’s founder directly, Hongfei said NEO 3.0 will be more about improving the standards within the development ecosystem, rather than increasing the number of nodes right away.

“I would say that the seven consensus nodes reflects the will of all the NEO token holders,” Hongfei told Hard Fork. “But, with 3.0, we are exploring new or better governance models. We need to incentivize NEO token holders to take part in the election (or delegation) process.”

When pressed on what some of those incentives might be, Hongfei maintained it was still under discussion. A few different proposals are being considered, but no conclusion has been made as yet.

Until this point, most of the work happening on NEO has been related to coding – increasing reliability, fixing security issues, and generally improving on the current design. It’s still very much of a case of figuring out what is the best development process for a decentralized, open source project.

“In the past, we took the process of ‘code first,’ so there’s no specification. We discuss, we have some idea, we write a white paper and then directly go to coding. But in the future [for 3.0], we will do ‘specification first,’ so it’s more like a formal protocol for building a new foundation,” Hongfei explained.

The need for explicit guidelines is understandably necessary, especially from a software engineering point-of-view. Hongfei went on to describe the primary difference between an open-source blockchain project and traditional software development as the lack of absolute control.

“You cannot say, ‘I want this feature, I want it done by this date.’ You need to have a lot of communication, you need to tell the community and stakeholders why you’re trying to do this, why it’s good for the community,” he said. “But sometimes, it’s not done by yourself. You have to delegate to other core developers, or to a community like City of Zion. It’s a challenge.”

Finding the right blockchain is like finding a suitable date

It’s difficult to prove that NEO’s slow-but-steady market strategy isn’t working. Hongfei told Hard Fork his foundation currently has access to $2 million in fiat, $7 million in Bitcoin and Ethereum, and 40-45 percent of all NEO tokens.

There are 100 million NEO tokens in existence, most-recently priced at around $9 each, but from January to March last year they maintained a value of over $100.

NEO development is also fuelled by NEO Global Capital (NGC), a strategic blockchain investment firm that has funded approximately 80 projects across the ecosystem. Hongfei says it is currently operating at a profit.

“The only revenue we have is from NGC. The investment performance is quite good compared to other cryptocurrency funds,” said Hongfei, before clarifying that NEO Global Development (the software development arm of NEO) was not relying on NGC’s profits.

When asked if it has had to lay off any staff due to the long-term bear market like many other notable blockchain startups, Hongfei stated: “Oh, no, we’re recruiting. We actually have new offices. The number of employees at NEO Global Development grows linearly, very steadily, from four to today’s 45.”

“You know, we’re not being too aggressive, even during the bull market. We’re not hiring 300 developers, then laying off two-thirds of them. We’re not doing that,” he added.

Hongfei, however, highlighted the value of NEO relies heavily on attracting developers to bring utility to the network by issuing tokens. He also urged budding blockchain developers to consider working on NEO’s technology directly, rather than simply pumping another dapp into an already over-saturated market.

“I do think most of the dapps will die in the next few years, as they are not ready for mass adoption,” he said. “So, I will encourage people to devote more of their time to working on infrastructure.”

NEO’s head of global development, John Wang, noted there were not that many decentralized apps completely live on the NEO blockchain. At present, he says roughly 100 dapps are being actively developed across its ecosystem, many of them games (it’s worth adding that gambling platforms were said to be actively discouraged from launching on NEO “for political reasons”).

Personally, my favorite response to the question of whether potential developers are turned off by the fact that NEO’s blockchain is so centralized came rather candidly from Wang.

“It depends on what kind of developer it is. For example, and maybe it’s not a good example, the type of girls you and I like are different. Some [developers] out there will like Ethereum, and some will like NEO,” he suggested. “If you are a C# or .NET developer, you will like NEO.”

“Definitely, developers challenge us over having just seven consensus nodes, ” Wang continued. “We won’t just have seven consensus nodes forever, but currently, we think that seven is maybe the right number for us.”

That’s inevitably what it comes down to: NEO is banking on there being a blockchain out there for everyone. The idea that blockchain developers would be open to trading decentralization for coding flexibility is understandably jarring for some, but it has ultimately led to the fostering of a neat and rather realistic community of builders – and it’s hard to find much fault in that.

Get the TNW newsletter

Get the most important tech news in your inbox each week.