Spend any reasonable amount of time delving into cryptocurrencies and sooner or later you’ll read something like: “together it is possible to build history, we are at the technological forefront of the world,” or “today, a cryptocurrency is being born that can take on Superman.”

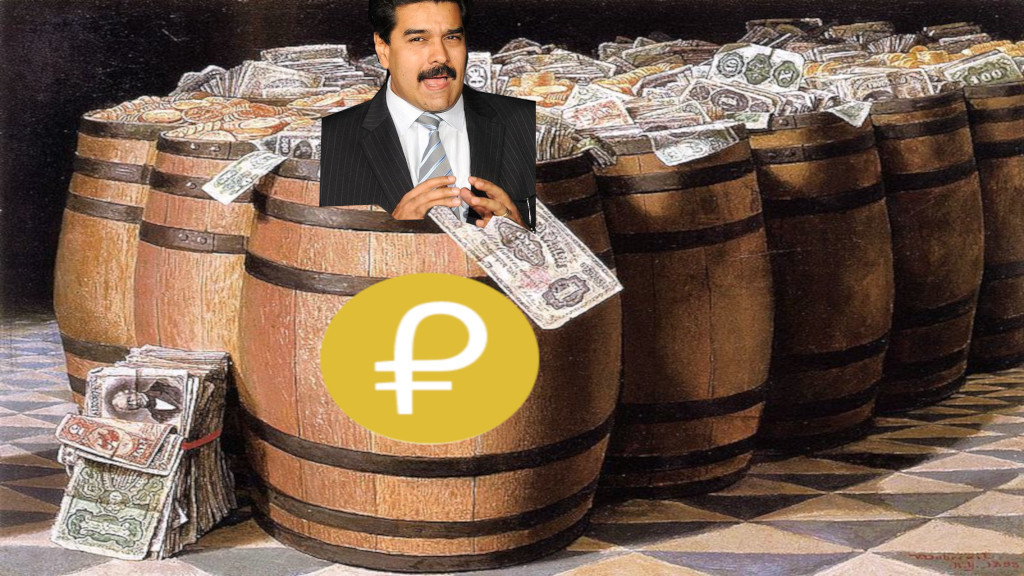

Usually, it’s a fresh-faced, eager team of international software developers and entrepreneurs hyping up their revolutionary tokenizing blockchain set for alpha release in 2022. Those quotes, though, come from Nicolás Maduro – notoriously hardline ruler of Venezuela – who revealed plans to launch the country’s first national cryptocurrency Petro back in February.

Now, in July, Venezuela’s Minister of Habitat and Housing, Ildemaro Villarroel, has revealed that Petro will be used to fund the construction of cost-effective housing for the homeless, in a move that frustratingly proves his inspirational declarations about the possibilities of Petro true.

Telesur notes that 33 businesses are co-ordinating the construction efforts, funded by $750,000 worth of bolivar and 900,900 Petro. Calculated at its ICO price of $60 per barrel, that amount roughly equates to $54 million.

Coincidentally, right around the same time Maduro sanctioned Petro into existence, 40,000 Venezuelans fled to neighboring Roraima, Brazil, seeking refuge from the humanitarian crises plaguing their home.

Today, it was also highlighted that at the time, President Trump had even considered invading in an effort to pull the nation out of turmoil. The situation is expected to only worsen with the International Monetary Fund projecting that hyperinflation will skyrocket to 13,000 percent this year, as reported by Bloomberg.

Petro is a state-issued cryptocurrency which leverages their biggest export, oil, by backing each token with one barrel. Oil makes up around 95 percent of all of Venezuela’s export earnings and the government has reportedly sequestered five billion barrels of oil to ensure token supply is met.

The launch went so well, it seems, that only a few weeks later, Maduro unveiled ‘Petro Gold,’ a variant of Petro backed by gold that will be “even more powerful.”

The establishment of a completely centralized, state-issued cryptocurrency is a rather futuristic way of skirting international sanctions imposed on the trade of securities, most relevantly oil bonds.

The ingenious loophole plays on the hope that trade can be conducted using cryptocurrencies, effectively selling oil and gold while imposed with such stringent sanctions. Despite this, Russia has publicly denied reports that Venezuela would be repaying part of its debts using Petro, while Trump has barred any American business from touching it at all.

In May, the Chicago Tribute reported that prospective investors were directed to Evrofinance Mosnarbank by the official Petro wallet – a bank whose biggest shareholders are two state-controlled Russian companies and Maduro himself. When pressed for comment, the wallet removed all references to the bank, but still allowed purchases.

Given the nature of the Maduro regime, it’s hard to really gauge how much faith to put in figures related to Petro. All reports come through either Maduro himself or state-sanction spokespeople.

But if what they say is to be believed, $735 million was raised on just the first day of pre-sale, and in just one month over $5 billion had been recorded. Whatever the real number is, the nation’s oil industry needs the money, considering their overall output has hit a 28-year low.

Get the TNW newsletter

Get the most important tech news in your inbox each week.